A “Back To The Future” Moment For Western Union Business Solutions

(23 August 2021 – Global) Finally, this long-standing brand with a deep pedigree in cross border payments has new owners and suddenly, perhaps, a brighter future.

As a relatively smallish part of a global currency remittance behemoth, Western Union Business Solution (WUBS) showed spectacular growth during a decade of acquisitions and accelerated market coverage. Growth which started fracturing, however, five years ago with the deployment of a new transactional platform, WU Edge. Having recognised the power of a self-serve model for business FX payments way ahead of its time, some key issues tripped the business up

- Significant customer recruitment onto the platform but very slow volume conversion, with users holding on to the old WUBS high-touch engagement model.

- Recognised for its competitive pricing and straight-through execution of trades, the platform couldn’t maintain these differentiating competitive attributes.

- The quick arrival of a convoy of Fintech start-ups targeting not only cross border payments but specifically WUBS as the market’s leading non-bank brand holding considerable market share.

- Designed to support the cross sell of risk solutions to Spot FX businesses, who proved reluctant buyers of Forwards and Options (and still are)

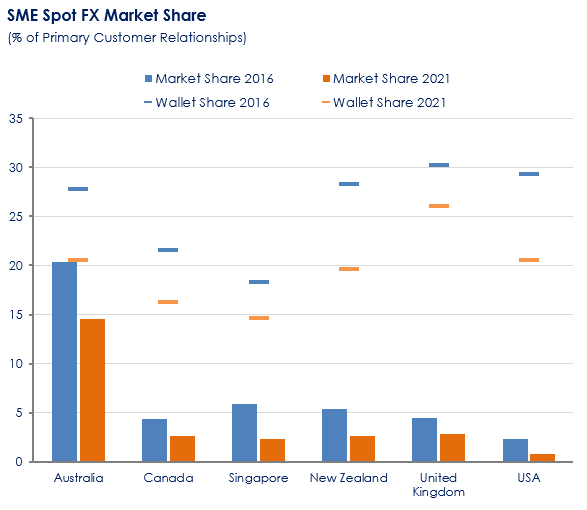

The business began to falter under these pressures with East’s numbers having witnessed continual attrition in market share over the past five years.

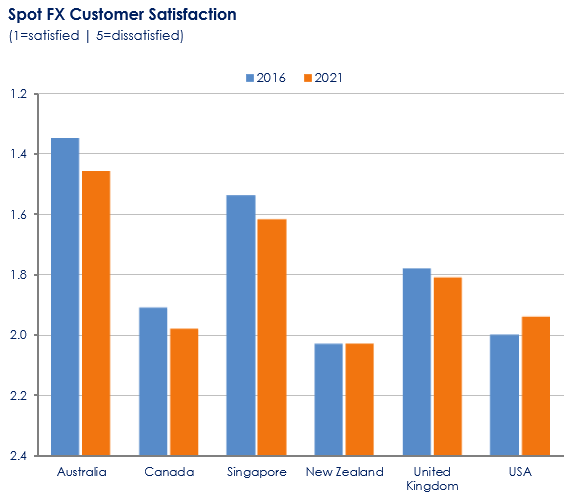

The same decline has taken place across customer satisfaction ratings, a key driver of revenue retention.

There remains real brand value however in WUBS, providing its new owners with powerful levers to re-energise the business

- Although falling, WUBS is still recording a “top 5” customer satisfaction reading in all its core markets.

- A still-significant SME customer base and share of market.

- Stable to growing share of secondary relationships in business Spot FX, a particularly effective jumping off point if leveraged effectively.

- Stable, albeit small, positioning in the Forwards market.

- Strong mind share and brand recognition, supporting its market share positioning and potential customer acquisition.

Separate ownership away from Western Union’s retail remittance business and a refreshed focus on its core business will help such a revitalisation.

Are we going to see a “back to the future” moment for WUBS and a return to being a challenger brand and scourge of the high street banks? Real light at the end of a dark tunnel is dawning.

Subscribe

Subscribe