Businesses to Banks: “Raise Rates and We Walk”

(9 February 2016 – Australia) One in two Australian businesses would switch banks if interest rates on business loans increased by more than half a percent, new research from East & Partners (E&P) reveals.

As part of the firm’s Business Banking Index, a closely watched monitor of customer sentiment towards banks, 976 CFOs and corporate treasurers were asked to what extent their business would absorb higher costs resulting from the need for banks to hold more capital against their loan books.

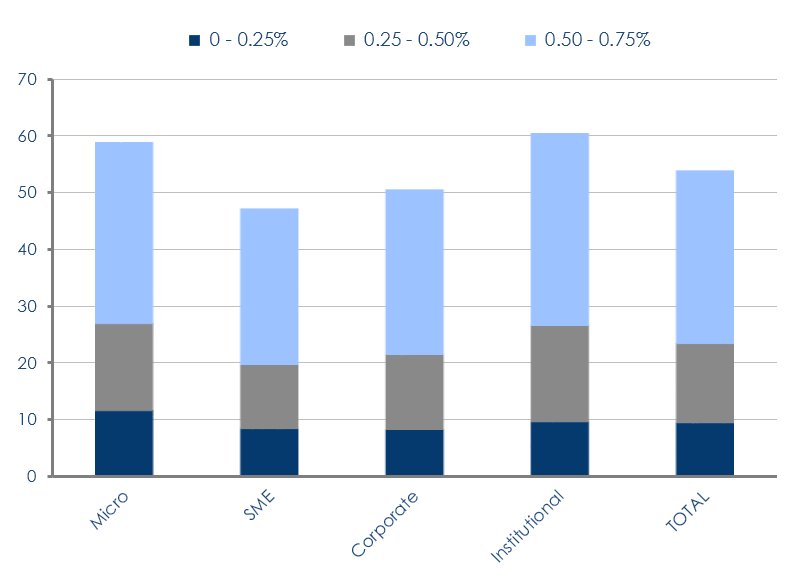

Thirty percent of respondents indicated that they would switch banks if rates rose by more than 0.50 percent. Nearly 14 percent of Australian enterprises would switch banks if interest rates rose by 0.25 to 0.50 percent, while a further 10 percent would churn if rates rose by 0.25 percent.

“NAB may be one of the first to raise rates on short-term business borrowing by up to 0.29 percentage points, but undoubtedly won’t be the last due to higher capital requirements and wholesale borrowing costs,” said Martin Smith, E&P’s Head of Markets Analysis.

“Despite interest rates at generational lows, the business community has drawn a line in the sand should rates lift. This is despite the fact variable rates on business financing remains below six percent and discounted rates are available as low as 4.5 percent,” he said.

Over a third of institutional enterprises indicated that they would switch banks if interest rates on business loans increased by over 50 basis points. In comparison, 28 percent of SMEs reported that they would change lender if rates on overdrafts or lines of credit rose by the same margin.

Commenting on the results, Smith pointed to the fact that larger enterprises were more adamant in their decision making relative to small business owners.

“The difference in willingness to shop around for a better rate is interesting, however it is clear any increase in business loan rates would be difficult for businesses to absorb at a time of uncertainty towards domestic and international trading conditions”, he said.

Businesses reacted even less favourably to the prospect of banks building up their capital buffers by raising loan collateral requirements.

An upward adjustment in loan-to-value ratios would result in 58 percent of enterprises changing banks.

Small businesses are affected more adversely than corporates by changes to loan covenants. In response to increased covenant calls, 64 percent of Micro businesses would change banks, compared to 54 percent of Corporates.

With business credit demand tracking strongly higher, particularly within the corporate segment, competition is increasing rapidly. Non-bank lenders such as Prospa, Kikka and Spotcap are targeting new opportunities by utilising advancements in digital platforms to deepen customer engagements, extending credit based cash flow and slashing application turnaround times.

“E&P’s figures show that the biggest driver of customer advocacy continues to be service levels experienced, reflected by the 46 percent of businesses that would opt to stay with their provider despite higher interest rates,” said Smith.

“This clearly emphasises the importance of delivering on new technology expectations but also improving satisfaction in every interaction and rewarding customer loyalty“.

Extent Businesses Would Absorb Higher Interest Rate before Switching

% Enterprises Who Would Switch (N: 976)

Source: E&P Business Banking Index – November 2015

About the East & Partners Business Banking Index

East & Partners Business Banking Index (BBI) is the foremost predictor of business banking sentiment towards Australian banks, based on bi-monthly interviews conducted with a nationwide structured sample of up to 1,025 enterprises. Representing Micro, SME, Corporate and Institutional segments, the survey sweep presents the findings of over 6,150 direct interviews with business banking customers annually. The Index provides a monitor of several key drivers of customer engagement with their business bank, including advocacy, empathy, satisfaction and loyalty.

The index delivers proven clear predictive correlations based on customer engagement behaviour with key bank performance outcomes both in aggregate and by individual bank. The BBI’s leading predictors are strongly connected with important customer dynamics such as market share, customer satisfaction, wallet share, product cross-sell and market wide bank margins. The BBI is a stand-alone initiative and is not related to East’s other research programs.

For more information or for further interview based insights from East & Partners, please contact:

| Media Relations Nehad Kenanie t: 02 9004 7848 m: 0402 271 142 e: nehad.k@eastandpartners.com |

Client Services and Development Sian Dowling t: 02 9004 7848 m: 0420 583 553 e: sian.d@eastandpartners.com |

|

|

| www.eastandpartners.com | |||

Subscribe

Subscribe