Corporate Transaction Banking Needs Changing

(13 April 2015 – Australia) Middle market transaction banking engagement is increasingly driven by CFO’s focus on their core business offering, newly released research by banking analysts East & Partners (E&P) reveals.

Of 893 corporates directly surveyed for E&P’s Corporate Transaction Banking Program, 46.2 percent report that their most important transaction banking improvement is for their bank to better understand their needs.

“For many enterprises in the A$20 – 725 million turnover segment, this translates to their business bank providing the support and expertise they need to better take advantage of offshore markets, either now or in the future” E&P’s Head of Markets Analysis Martin Smith stated.

“Middle market cross border payment usage has jumped from 27.4 percent to 44.0 percent since 2008 as global markets shift closer.”

Rising cross border payment usage is not surprising given Australian businesses’ pivot towards Asia, yet the fact that average wallet share remains critically low at 50.3 percent is significant.

Average cash management and payment processing wallet share in comparison is as high as 96.1 percent and 96.9 percent respectively.

Cross border payments and international transaction banking reflect where the greatest incidence of ‘multibanking’ takes place. These products are being targeted successfully by international banks such as Citigroup and HSBC seeking to complement their prominent trade finance offerings.

Although banks are delivering well in terms of overall product, service and operational expectations, their individual performances vary considerably. This is especially prevalent among the majors and reflects not just where a bank is placed in terms of system upgrades but more so how their service offering is supporting it.

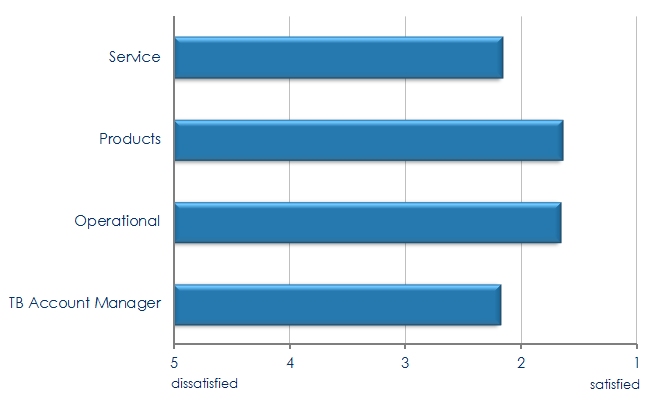

The top ranked transaction bank achieves an overall service satisfaction rating of 1.96, compared to a rating of 2.17 for the lowest ranked major (where 1 = satisfied and 5 = dissatisfied). Average market wide service satisfaction has declined to 2.14.

“A quarter of corporates currently do not use a secondary transaction banking provider however as cross border payment demand increases Australian banks will be challenged to replicate their service offering across all products in order to focus on businesses particular needs” said Smith.

Corporate Transaction Banking Satisfaction

Overall Satisfaction Ratings

Source: East & Partners Corporate Transaction Banking Program

About the East & Partners Corporate Transaction Banking Program

The Corporate Transaction Banking Markets program delivers core industry insights from CFOs and treasurers for one of the most competitive business banking segments, increasingly allocated greater industry investment and resource allocation.

The success banks are having in understanding underlying business needs and transaction banking requirements are evaluated against competitive Market Share, Payments, Internet Banking, Trade and Cash Management key performance indicators. Product and operational importance and satisfaction ratings are directly comparable and interdependent upon customer churn, futures and definable mind share.

Corporate Segment: Annual turnover A$20 – 725 million

Released: February and August

For more information or further interview based insights please contact:

Sian Dowling

Head Client Services

East & Partners

t: +61 2 9004 7848

m: +61 420 583 553

e: sian.d@eastandpartners.com

Subscribe

Subscribe