Is Payments Innovation Hitting the Mark?

(26 July 2022 – Global) Digitisation and technology adoption has been forcefully thrust forward by the pandemic and supply chain disruption, but how quickly are long overdue cross border payments functionality enhancements, improved transparency benefits and lower costs proliferating according to corporates themselves?

Functionality Enhancements Long Overdue

As they say, “necessity is the mother of invention” and innovation in cross border payments has accelerated by as much as five years by some estimates. The drastically increased rate of innovation has brought forward conceptual applications from years to months. Open Banking is a key pillar of moves afoot to provide greater functionality for CFOs and corporate treasurers.

The benefits of Open Banking include giving customers access to their own data, greater competition and accelerated innovation.

Electronic Service Delivery Divergence

Incumbent Bank majors are tasked with responding to the challenge posed by nimble non-bank challenger banks and Fintech providers targeting the space. At the centre of the digital shift is application programming interfaces (APIs). While Banks are implementing a range of APIs to satisfy new Open Banking regulations, many are failing to link customer expectations with service delivery.

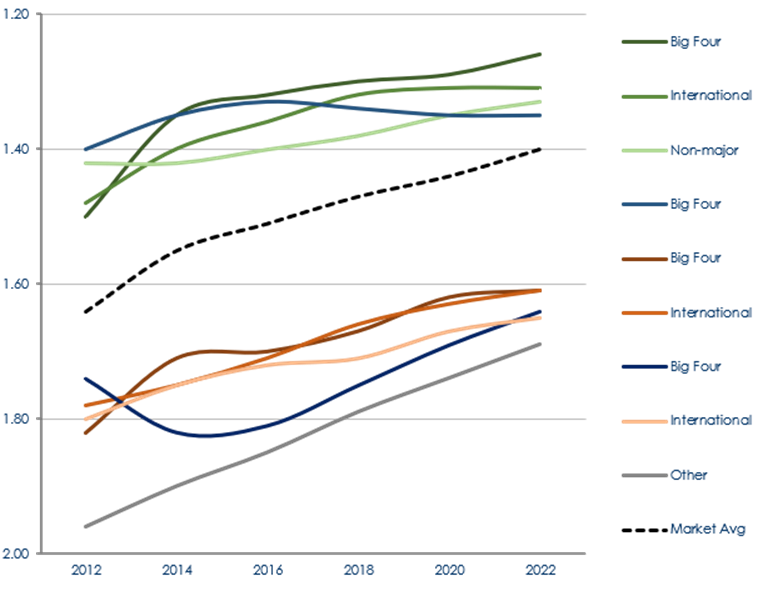

Electronic Service Delivery satisfaction ratings reveal leading Banks are actively responding to the test (Exhibit A), in particular in Australia CBA (1.28) and HSBC (1.31) rating well above the market average of 1.41. Average market wide satisfaction jumped three points year-on-year from 1.44 to 1.41, marking the biggest single year improvement in the last decade.

Over one in ten corporates are seeking further cloud technology and software-as-a-service (SaaS) support (14 percent). One in ten need to link up eDocumentation capability, particularly in trade finance (11 percent), fraud protection (10 percent) and AI (9 percent). Crucially the human touch remains an integral factor to corporate and institutional banking (CIB) success, in that customer expectations towards relationship management are racing ahead of Banks product and service delivery.

“Mission critical for us, RMs have become a lot more responsive over this year. Getting learnings from them about what other big customers have done or are doing would be very valuable”

- Treasurer, US$15Bn Australian Resources Corporate

East & Partners Global Insight Report COVID’s Shake Up of Relationship Banking confirms a high proportion of large corporates are crying out for digital functionality that they do not yet have access to but urgently need. In most instances they are voting with their feet in the event their primary transaction bank is found wanting as East & Partners research confirms customer switching intentions are running at record highs across multiple product lines.

Is Crypto the Answer?

Using digital currencies for cross border payments is rapidly shifting from theory to execution as reserve banks in Australia, South Africa, Singapore and Malaysia progress their “Project Dunbar” prototype platform for processing sovereign virtual assets.

The project seeks to streamline the number of financial institutions touching each transaction, reduce time and cut costs for international transfers, effectively making settlement as straight forward as domestic transactions.

The prototype is addressing key regulation and governance hurdles in addition to which stakeholders should gain direct access to the platform.

East & Partners upcoming “Opportunities and Upsides in the Digital Payment Revolution” report in partnership with PCM is also set to provide a detailed breakdown of receptiveness to Blockchain treasury transformation at a pivotal point in time where the concept of cryptocurrencies as an asset are under question while the use cases of the technology are more than compelling and soon to realise tangible benefits.

Exhibit A

Electronic Service Delivery Satisfaction Rating Average Rating Reported (1 = satisfied to 5 = dissatisfied)

Source: East & Partners Commercial Transaction Banking Program – February 2022 (N: 901)

Subscribe

Subscribe