Memo to banks: lift your game on Short Term Debt and Liquidity Management

(1 July 2015 – Asia) The CFOs of Asia’s Top 1000 corporates are increasingly dissatisfied with the Short Term Debt and Liquidity Management solutions offered by their banking providers, according to new research by East & Partners Asia (E&P Asia).

Now in its 27th round, the Asian Institutional Transaction Banking Markets (ATB) report is derived from interviews with the top 1000 corporates by revenue size in ten countries across Asia (ex-Japan), a sample of organisations with average annual revenue of over US$1 billion.

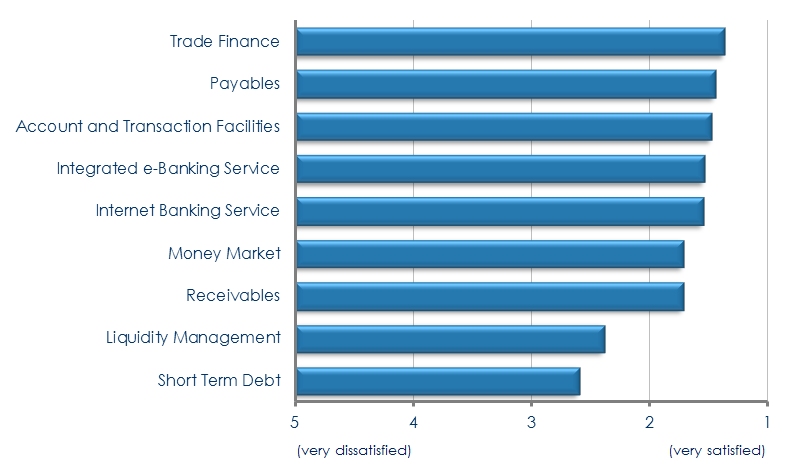

The ATB report found that Short Term Debt and Liquidity Management were rated as the most important products by CFOs and Corporate Treasures out of nine products rated.

Despite their high importance to corporate customers, satisfaction levels for both products are the lowest out of the nine surveyed, and by some distance.

The two satisfaction ratings were the lowest of nine products in the previous survey, in November 2014, and have declined even further this round.

Lachlan Colquhoun, chief executive of East & Partners Asia, said the ATB research showed that while banks were delivering well on some – largely commoditised - products, they were falling down in areas rated as most important by their customers.

This was translating into higher churn rates, with the May ATB report showing that a change in primary transaction banker was either “definite” or “highly likely” for 25.3 percent of Asia’s Top 1000.

“The ‘coat hanger’ product solutions of Payables, for example, has a healthy rating but these products’ integration with debt and liquidity for a full working capital relationship seems well broken,” said Colquhoun.

“Both products are key components of an integrated working capital solution but it is clear that, across the board, banks are not delivering to their clients.

“This presents as a major opportunity for a bank which gets this even half-right in Asia.”

Total Satisfaction Ratings of Products

Source: Asia Transaction Banking Report – May 2015

About The Asian Institutional Transaction Banking Markets Program

East & Partners' bi-annual Asian Institutional Banking Markets Program delivers a full analysis of transaction banking products and services across Asia’s Top 1,000 Institutional businesses in 10 countries in the Asia Pacific (ex-Japan). These countries include China, Taiwan, Hong Kong, Singapore, Indonesia, Malaysia, the Philippines, India, Thailand and South Korea.

Released every May and November, detailed data analysis includes:

| › | Primary and Secondary Market Share |

| › | Primary and Secondary Wallet Share |

| › | 9 Product importance and satisfaction ratings |

| › | 26 Service Attributes importance and satisfaction ratings |

| › | Customer Churn index and analysis |

| › | Product-Brand Mindshare index |

For more information or for further interview based insights from East & Partners, please contact:

| Media Relations Nehad Kenanie t: 02 9004 7848 m: 0402 271 142 e: nehad.k@eastandpartners.com |

Head Client Advisory Services Perpetua Ngo t: +852 3175 1966 e: perpetua.n@eastandpartners.com |

|

|

| www.eastandpartners.com | |||

Subscribe

Subscribe