No End in Sight for Global Supply Chain Chaos – Global Treasurer

(19 September 2022 – Global) Corporates have concluded supply chain upheaval is not going away anytime soon and are scrambling to find ways of mitigating its impact.

The Global Treasurer reports the latest findings from East & Partners Digitising and Greening Global Supply Chains Report based on direct interviews with treasurers and CFOs in over 750 large corporates across eight leading economies. They expect supply chain disruption to negatively impact their businesses for another two years on average, with some reckoning it will cause them serious problems until at least 2025.

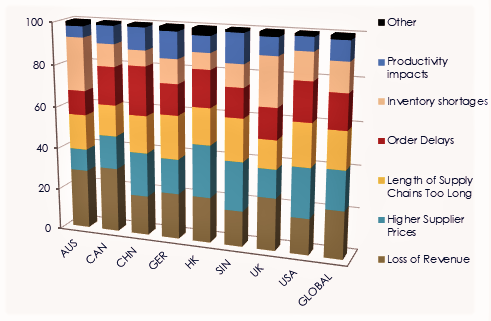

The research also reveals that the biggest, most distinct impacts of supply chain disruption on corporates are an outright hit to their revenue (23 percent of respondents); raised supplier prices (19 percent), overly complex and difficult to manage supply chains (18 percent); and order delays (16 percent).

The research involved direct interviews with large corporates across eight countries – Australia, Canada, China, Germany, Hong Kong, Singapore, the United Kingdom, and the United States.

Martin Smith, East & Partners Global Head of Markets Analysis at, states it is clear from the study that corporates have come to the conclusion that supply chain disruption will be a significant drag for them for the foreseeable future

“There is clearly a high level of consternation amongst them that the confluence of multiple geopolitical, macroeconomic and pandemic-related factors will continue to prevent global logistics players, shipping companies and port operators to clear the growing backlog and at the same time keep up with sharply increasing consumer and business supply chain demands,” says Smith.

Surprisingly, the study found that the recent supply shock from the pandemic did not encourage corporates around the world to build comprehensive domestic supply chains.

Smith says that even for corporates in China and Australia where more than half of their supply chains are located within their domestic borders, the tendency towards offshoring is expected to continue into 2023.

“The reasons behind corporates switching their primary suppliers from one geography to another are fundamentally more complex than simply addressing supply chain vulnerabilities uncovered as a result of the COVID-19 pandemic,” Smith explains, noting that the top two factors driving these changes are macro in nature – geopolitical concerns and rising tariffs.

Most Significant Supply Chain Disruption Impact Experienced

% of Total

Source: Digitising and Greening Global Supply Chains, East & Partners

Green supply chains

With ESG a high priority for corporates, many firms will be looking to their banks to advise and provide intelligence on sustainable supply chain financing, according to the survey. However, almost one in three of the large corporates surveyed failed to nominate any bank as a leader in the space.

Similarly, one in five corporates could not recall any bank or financial services provider as a stand-out pacesetter for digital innovation in areas such as cloud, Internet of Things (IoT), artificial intelligence (AI), distributed ledger technology (DLT), automation or other technology solutions.

The demand for digital solutions, however, is running very high, with only two percent of firms stating that they are not in the process of implementing digitisation projects across their supply chain.

Meanwhile, 72 percent of those surveyed have implemented or plan to implement cloud computing. In fact, cloud adoption dominates all other areas of digital technology investment, the most significant being IoT (24 percent) and blockchain/DLT (16 percent).

Despite the survey revealing there is a set of banks – HSBC, Standard Chartered, Citi and BNP Paribas – that are highly regarded by treasurers for both sustainability and digital innovation – “the grouping is so tight it can be said no single provider definitely stands out from the pack by exceeding customer expectations outright exceptionally in any circumstances,” adds Smith.

As for supply chain partners themselves, the survey found that the most important digital functionalities they are requesting from corporates include order tracking and tracing, ERP integration, risk management monitoring and legacy system upgrades.

Subscribe

Subscribe