Non-bank cross-border payments providers in Asia: who to look out for in 2019

(29 March 2019 – Asia) Non-bank providers are making headway in the cross-border payments space in Asia, as evidenced by almost all (98.9 percent) of the region’s businesses having at least one alternative provider on their radar.

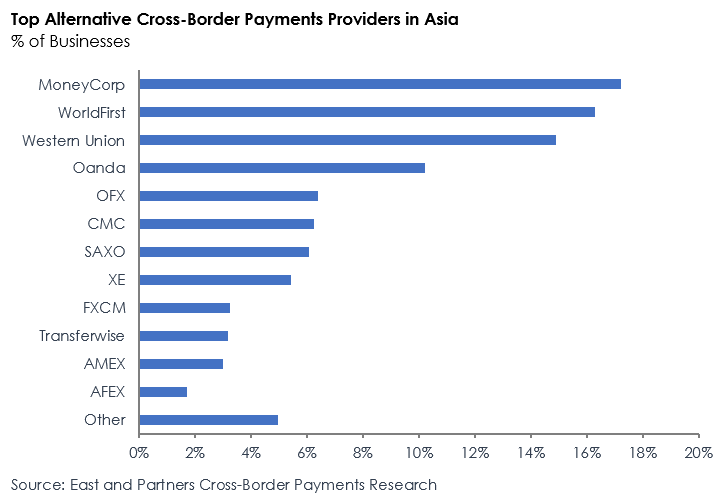

The top four non-bank providers CFOs have their eyes on are MoneyCorp, WorldFirst, Western Union and Oanda. Together, these four groups are nominated by more than half (58.7 percent) of the businesses. Other cross-border payments providers high on treasurer watch lists include OFX (6.4 percent), CMC (6.2 percent), SAXO (6.1 percent) and XE (5.4 percent).

What offerings would tempt businesses in Asia to make the switch to these alternative providers? To discover what these customers value the most, contact inkai.khor@eastandpartners.asia

Methodology

In total 1,858 enterprises across Hong Kong, Malaysia, the Philippines and Singapore from the Micro, SME and Lower Corporate segments were interviewed directly in February 2019. Interviews were conducted with the Business Owner, CFO, Finance Manager or Corporate Treasurer using a structured questionnaire.

The Micro segment comprises businesses with annual turnover of US$1–5 million, while the turnover band for SME is US$5–20 million and Lower Corporate US$20–100million. The sector distribution in each country market reflects a natural sample of the population distribution.

Subscribe

Subscribe