Positive growth forecast for Australian trade finance

(7 May 2018 – Australia) Trade Finance markets are bracing for transformative change in 2018 as renewed trade protectionism, increased tariffs and geopolitical tensions impact the trade of international goods and services and consequently global trade finance volumes.

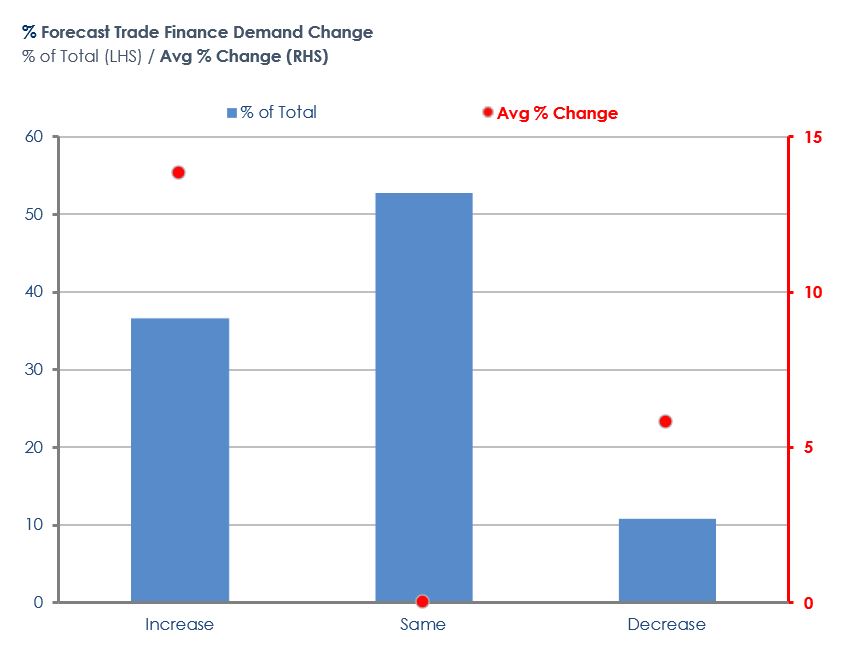

Despite major headwinds facing the sector, East & Partners latest Australian Trade Finance program highlights positive underlying growth sentiment. Direct interviews with 1,881 enterprises reveals that over one in three enterprises expect trade finance demand to increase in the coming year (36.6 percent). This is a significant vote of confidence in sentiment and forward dated trade outlooks given mounting macro and regulatory concerns.

Regional growth sentiment is primarily driven by activity associated with the trillion-dollar Belt and Road Initiative linking maritime and overland routes between Europe and China. Increased uptake of innovative eTrade solutions and ongoing digitisation of traditionally ‘paper heavy’ trade finance documentation processes are also supporting high confidence levels expressed by Australian CFOs ‘despite everything’.

Australia is excellently positioned to take advantage of surging hard and soft commodity markets. LNG exports in particular are a major standout for the mining and energy sector, reaching a record A$230 billion in energy exports in 2018 alone. LNG is tracking to surpass iron ore to become Australia’s most valuable resources export within the next five years.

Despite growing climate change concerns, Agritech is also underpinning farmers exports of beef, grains, fruit, seafood, and processed food products. These combined factors coupled with unchanged import volumes resulted in a sharply improved trade balance in Q1 2018 following a decline in Q4 2017 as both volumes and export prices increased.

Trade customers are bracing for a long-awaited increase in financing rates from historic lows, set to place further pressure on pricing competitiveness and margins at a time when banks are already experiencing wallet share erosion and difficulty retaining customer trade volumes. Export finance risk remains extremely low despite a slight uptick in defaults as reported by the International Chamber of Commerce (ICC).

“Pricing competitiveness continues to increase as margins come under pressure, evidenced by higher customer churn intentions as middle market enterprises in particular plan to switch some or all of their trade financing business to another bank, be it a Big Four, international or non-bank offering” Martin Smith, East & Partners Head of Markets Analysis said.

“Interestingly unlike Business FX where churn is higher among larger enterprises, relatively fewer institutional enterprises are looking to switch provider (38.0 percent) compared to SMEs (47.9 percent), emphasising the crucial importance of relationship management, professional competence and industry knowledge plays in achieving best of breed customer satisfaction and retention outcomes,” Mr Smith added.

About East & Partners Trade Finance Markets Program

East & Partners (E&P) Australia Trade Finance program provides a detailed monitor of bank’s performance across key performance indicators including market share, wallet share, customer satisfaction and mind share. The demand side analysis, based on direct interviews with a representative sample of importers and exporters, tracks the relative competitive positioning performance of all trade finance providers as nominated by selected CFOs and corporate treasurers included into each round’s sample.

About East & Partners

East & Partners is a leading specialist business banking market research and analysis firm. The firm’s core expertise is in the provision of analysis and advisory services tailored for the commercial, business and institutional banking markets across Asia Pacific, Australasia, Europe and North America

For more information about this report, or East & Partners’ research, please contact:

Regional Insights Manager

Sian Dowling

e: sian.d@eastandpartners.com

t: +61 2 9004 7848

Subscribe

Subscribe