Queensland Businesses Have Sunny Outlook on Banks

(22 June 2015 – Australia) Queensland businesses are more than twice as happy with their bank relative to interstate businesses according to East & Partners latest Business Banking Index (BBI).

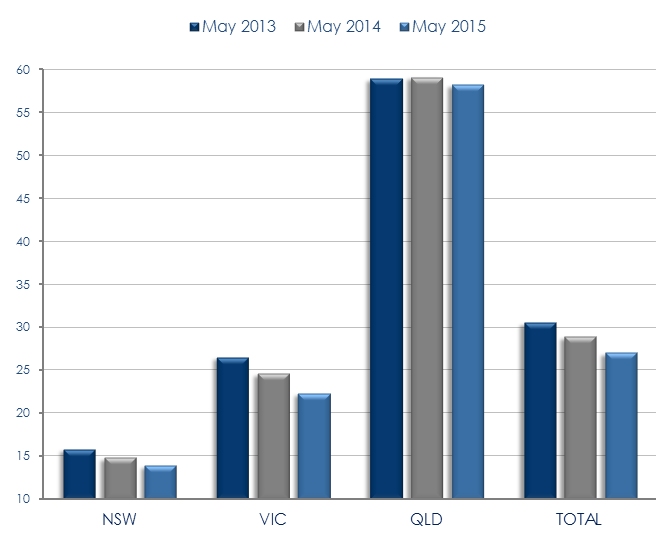

The Index, derived from 6,150 interviews with businesses across Australia annually, found that while overall sentiment has slipped to 27.0 (where 10 = low and 100 = high), Queensland businesses achieved a score of 58.2.

Business banking sentiment exhibited by the ‘Sunshine State’ is more than four times higher than NSW (13.9) and two and a half times higher than Victoria (22.3).

“Small businesses display a distinctly antagonistic relationship with their bank,” said Jessica Gao, East & Partners Senior Analyst.

“This poses a significant risk for banks, particularly the Big Four who are already experiencing customer churn. A continued decline in sentiment will undoubtedly result in customer’s acting on their intention to switch provider, especially when one in four corporates are actively looking for alternative primary banking providers.” she said.

While national business banking sentiment on average is generally pessimistic, the BBI uncovers significant variance by state. Queensland based enterprises outperform all other states by a considerable margin across the four criteria measured: Empathy, Satisfaction, Loyalty and Advocacy.

Readiness to advocate is a leading indicator of future market and mind share change, particularly with increasing demand for additional banking services. With an overall Advocacy score of 47.0, businesses based in Queensland are the most positive about their banking relationship, more than four times higher than NSW (10.9) and Victoria (11.0).

Peer advocacy is the most valued source of advice for business customers. Nearly 80.0 percent of Australia’s Top 500 enterprises acquire advice on banking matters from business colleagues and associates. Peer advocacy is nine times more popular than specialist consultants, acting as a powerful driver of product engagement.

Advocacy scores by state indicate Queensland based CFOs and treasurers are more likely to speak positively about their bank than their cross-border counterparts, developing a strong footing for further engagement in terms of associated business banking products and services.

Queensland businesses expect additional banking demand to increase by 35.7 percent in the near term. NSW enterprises on the other hand expect demand to increase by 24.9 percent, while Victoria forecasts a relatively conservative 16.1 percent increase.

“Content customers tend to generate higher wallet share because they are actively engaged with their service provider. Queensland’s high levels of positive advocacy and additional business demand sets an exceptional standard for business banking.” said Gao.

Business Banking Index Score by State

10 (low) to 100 (high)

Source: East & Partners Business Banking Index – May 2015

About the East & Partners Business Banking Index

The East & Partners Business Banking Index is a bi-monthly Index of business customer behaviour towards banks. The Index provides a monitor of several key drivers of customer engagement behaviour with their banks including advocacy, empathy, satisfaction, loyalty, detraction and mind share.

The BBI has proven clear predictive correlations based on customer engagement behaviour and intentions with key bank performance outcomes both in aggregate and by individual bank. Its leading predictors are strongly connected with measures such as market share, customer retention, wallet share, product cross-sell and bank margins.

Business Segments:

| › | Institutional – A$725 million plus |

| › | Corporate – A$20-725 million |

| › | SME – A$5-20 million |

| › | Micro – A$1-5 million |

For more information or for further interview based insights from East & Partners, please contact:

| Media Relations Nehad Kenanie t: 02 9004 7848 m: 0402 271 142 e: nehad.k@eastandpartners.com |

Client Services and Development Sian Dowling t: 02 9004 7848 m: 0420 583 553 e: sian.d@eastandpartners.com |

|

|

| www.eastandpartners.com | |||

Subscribe

Subscribe