Reshaping the Future of Supply Chains in Asia

(22 September 2020 – Asia) Against the backdrop of the global pandemic, businesses in Asia are looking at how they can better structure, finance and manage their supply chains.

The business environment of 2020 presents an extraordinary range of challenges that did not exist a year ago. This is especially true for companies that manage complex supply chains that have been disrupted by the COVID-19 pandemic. There is a realisation that as the coronavirus is brought under control, the world will not return to how it was once, but instead enter a new normal where supply chains are influenced by an altered range of concerns and imperatives.

HSBC recently commissioned a survey of supply chain financial professionals. It gives an in-depth picture how treasurers are thinking during this extremely challenging time, while pointing towards how supply chains will be organised in the future.

Sources of concern – COVID-19 and its impact on global trade

It should be no surprise that the COVID-19 pandemic is the most troubling issue facing supply chains. In addition to the broad negative impact that coronavirus is having on the global economy, the survey’s respondents pointed to the border controls that have been implemented, which impede the movement of goods and services. Transaction sizes are 10-15 per cent lower, this stems from caution in terms of committing to new orders, as well as the increased possibility of delayed payments. Beyond the pandemic, there are concerns about risks that could emerge due to geopolitical considerations.

Looking forward, treasurer concerns are firmly economic, with macro uncertainties and fears of a global slowdown at the front of mind. From a trade perspective, there were also fears of increased regulatory pressure and currency volatility. The need to digitise the supply chain was also brought up as a challenge by many of the survey’s respondents.

The changing structure of supply chains

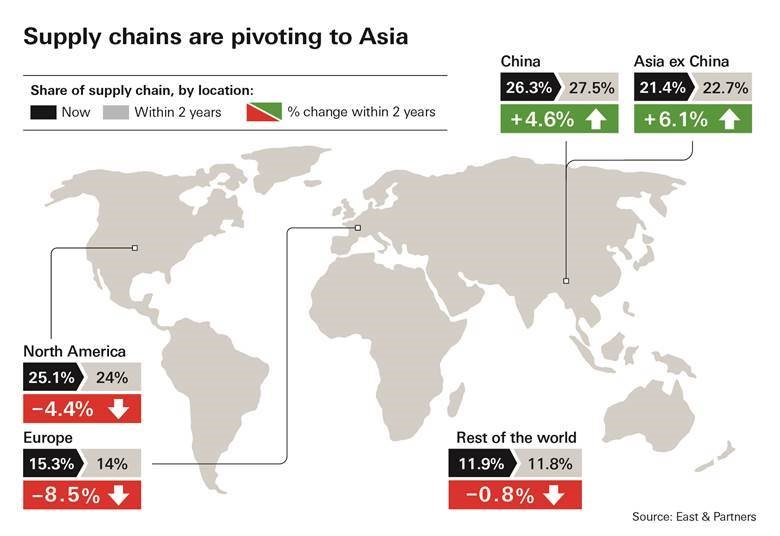

How can the concerns of today influence the supply chains of tomorrow? In short, the survey reveals an expectation for concentrated supply chains that are even more embedded in Asia.

The pivot towards Asia is a long-term process that will play out gradually over the coming years. The results of the survey go against those who think that China is on track to decouple from the global economy, as respondents expect their supply chains to be even more embedded in the world’s second largest economy over the next 12 to 24 months.

The underlying dynamics however are more complicated, since the expected gains for other Asian countries are partially due to companies shifting from China to new markets – such as Thailand and Vietnam. The explanation for this shift can explained by wages, as some Southeast Asian countries have a more attractive cost of labour than China, while there is also a trend of companies diversifying into a wider range of markets to reduce their reliance on a single country. China however, remains the top choice for a wide range of mid to high-end industries where it is the centre of excellence.

The structure of supply chains will also evolve, as businesses are clearly looking to de-risk by cutting the number of companies that they deal with. This means closer relationships with strategic partners, such as end suppliers, and a move away from a reliance on intermediaries.

Financing the chain

Adequate financing is essential to ensure that each link of the supply chain connects smoothly with the next – all the way from raw materials to the end consumer. As a result, there is a growing realisation that treasury should be involved in the strategic decisions relating to supply chain decision making, with more than half of the survey respondents saying that treasurers play a leading role.

By far the most popular funding programmes for supply chains are pre-existing working capital and traditional trade finance. The problem with using working capital in the current challenging environment is that it has become a strategic resource that companies want to protect. Companies are therefore looking for alternative supply chain funding such as inventory financing, pre-shipment financing, receivables and payables financing.

Receivables financing for example, is a popular supply chain finance product that allows the company to borrow money against an expected payment. Purchase order finance provides funding for businesses with purchase orders to pay their suppliers and smooth out cash flow. While distributor finance is when a treasurer is able to extend finance to local distributors to cover the liquidity gap that arises after goods are sold and receivables are not yet paid.

All of these products are well-suited to the current environment, as they are forms of finance that provide the necessary funding to ensure that each link in the supply chain smoothly proceeds to the next. And they all do so in way that does not negatively affect cash reserves, which have taken an extra level of importance during the pandemic.

A global bank with a long history financing global trade is able to offer these specialist supply chain services, because it will understand the specific needs of treasurers who are managing complex supply chains that spread across multiple geographies. Industry knowledge like this means that banking is more than about financing, it also a way for a treasurer to get actionable information that informs their choices.

New priorities gaining ground

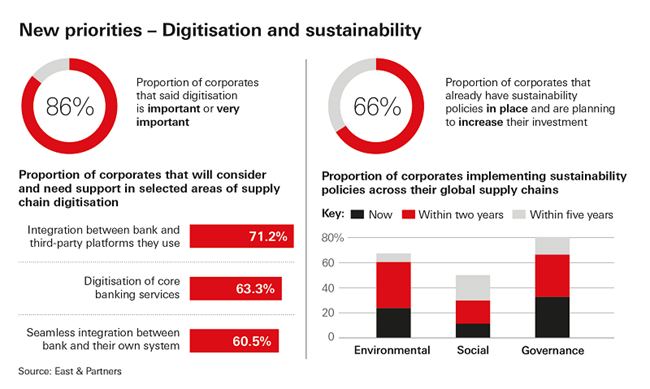

Another way we can see the broadening scope of banking is how it relates to priorities that are growing among treasurers. The survey found that both digitisation and sustainability are no longer optional considerations, but rather mission critical for the future of supply chain management.

Treasurers expressed that they need support from their banks in their digitisation journey. In particular, they are looking for systems integration – ensuring that third party platforms merge seamlessly with their own. There is also demand for tools that automate supply chain management

Sustainability is the other up-and-coming area, which in Asia has typically focused on the governance part of ESG, at the expense of the social and environmental efforts. The survey not only found an intention among the majority of participants to increase investment across the entire ESG spectrum, it also found that there are hardly any barriers to supply chain sustainability.

Time for change

In conclusion, our survey shows that although there is little doubt that 2020 is an extremely tough year for international trade, pro-active businesses can take advantage of a period of flux to drive through changes to their supply chain at a speed that would have been unimaginable a year ago. The positive message is that businesses that can look beyond the current challenges will be in a stronger position in the new normal that emerges after the pandemic.

Source:

The survey was sponsored by HSBC and conducted by East & Partners to understand the trends of future supply chains in Asia. The study was carried out between June and July 2020 and 177 large corporates were interviewed, representing 45 per cent North Asia (China, Hong Kong, Japan, South Korea) and 55 per cent South Asia (Australia, India, Indonesia, Malaysia, Singapore) with an average annual turnover size of USD1000M+. More than 70 per cent of respondents were corporate treasurers and remainders were CFOs, corporate trade heads or finance directors.

Read the original article on https://www.gbm.hsbc.com/insights/growth/reshaping-the-future-of-supply-chains-in-asia

Subscribe

Subscribe