Rising Expectations: Small Businesses Voting with their Feet

(19 May 2014 – Australia) Small businesses want more from their bank, however who is winning the race to deliver more?

Research from East & Partners indicates that failing to consider small business’s most pressing concerns has resulted in in a severe deterioration in wallet share and customer retention for several prominent banks.

East’s SME Transaction Banking program presents customer satisfaction rankings across key product, service, operational and relationship manager metrics.

Structured by bank, state and industry, the results allow for the precise identification of which bank is disbursing its product and service proposition most successfully.

Based upon 853 direct interviews with SME’s turning over A$5 – 20 million per annum, it is clear that small businesses are more than happy to transfer a portion or the entirety of their transaction banking wallet to another provider following a small decline in satisfaction.

Banks are being forced to offer an enhanced transaction banking product and service offering to the most populous SME business segment.

Despite a low interest rate environment, Term Cash Deposits present as the product most commonly increasing in terms of customer need. 29.5 percent of SME’s require more focus in this area, significantly greater than Cross Border Payments products, reaching 15.5 percent.

Term Cash Deposits remain an area of strength for regional and international banks, most notably ING and BankWest, while two Big Four banks have suffered significant satisfaction rating slides in this product line.

“SME’s nominate quality transaction execution and superior value for money of highest importance to them” said Senior Markets Analyst Martin Smith.

“Overall satisfaction of these key service issues continues to fall however. Higher wallet share ratings achieved by the regionals mirror significantly higher relationship manager satisfaction scores”.

“Forecasts of future market share and customer satisfaction ratings are provided within the report, drawing upon over a decade of trending data. These predictions indicate which banks are set to suffer the most from declining customer satisfaction and wallet share within the SME segment.”

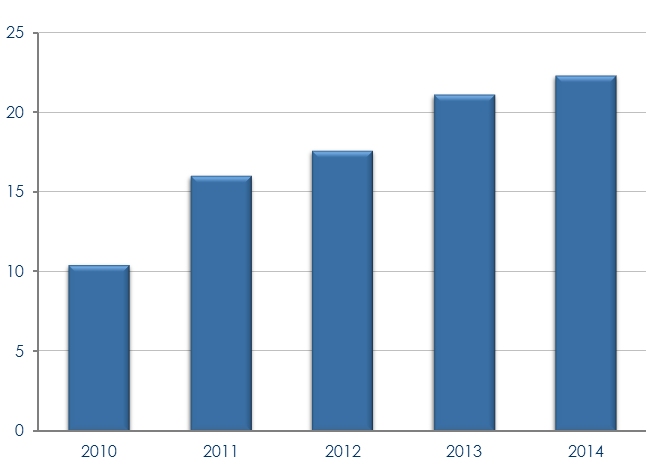

Likely Change Primary Bank in Next Six Months

% of Total

Source: SME Transaction Banking Program – April 2014

About East & Partners SME Transaction Banking Program

A detailed analysis of product usage, market share, share of customer wallet, bank by bank customer satisfaction performance, share of mind, account churn and purchasing characteristics of small to medium sized enterprises in the A$1–20 million turnover segment. Cash, Payments, Deposits, Desktop Banking, Internet Banking, Cross Border Payments and Remittance Processing products are examined in detail, providing market wide transaction banking customer dynamics and analysis.

For more information or for further interview based insights from East & Partners, please contact:

Sian Dowling

Marcomms & Client Services

East & Partners

t: 02 9004 7848

m: 0420 583 553

e: sian.d@eastandpartners.com

Subscribe

Subscribe