SMEs still experiencing rate rises

(24 June 2013 – Australia) More than four out of ten Small and Medium Sized Enterprises (SMEs) have had interest rate hikes on their loans over the last six months, according to the latest research on this critical business segment from industry analysts East & Partners.

East’s SME Transaction Banking Markets report interviewed a structured, national sample of 1, 491 businesses with annual turnover of between $1-20 million in April and found that despite a historical low of 2.75 percent in the Reserve Bank of Australia’s Overnight Cash Rate, SMEs are still experiencing rate rises on their secured borrowings.

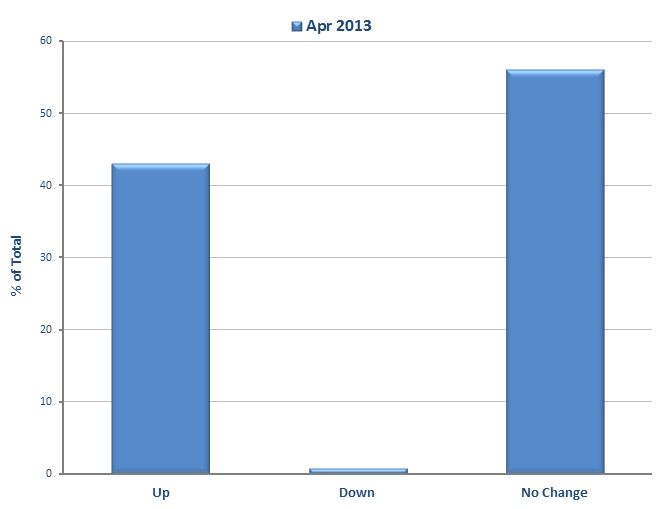

The research shows that 43.1 percent of SMEs reported an increase in the interest rate on their loans, with an average increase of 5.3 percent.

In contrast, only 0.8 percent reported their rates had dropped – by an average of only 0.8 percent – while 56.1 percent reported no change.

Lending is a key to the SME relationship with 68.7 percent perceiving their primary banking relationship to be with their lender, rather than their transaction banker (30.5 percent).

Despite this, SMEs are still having difficult credit experiences with their banks. Separate research conducted by East earlier this year found that 23.2 percent of SMEs applied for new or credit lines over 2012, with 56 percent successful and 44 percent unsuccessful.

Of those who were unsuccessful, the SME walked away in a majority of cases because the pricing was too high (18.2 percent), the terms and conditions were unacceptable (21.8 percent) or the credit application process took too long (14.6 percent).

Although they are frustrated, SMEs are still comparatively loyal to their banks, with only 4.8 percent of SMEs interviewed in the Transaction Banking report indicating they would "definitely" be changing banks, while 14.6 percent said it was "highly probable." 32.5 percent said they would "definitely not" be changing their transaction bank.

Lachlan Colquhoun, Head of Markets Analysis at East & Partners, said the SME segment was starting to re-leverage in 2013, and lending was becoming more important.

"Many SMEs have been in survival mode in the aftermath of the Global Financial Crisis, but now we see that many are wanting to grow and are showing signs of renewed credit demand," said Colquhoun.

"The research, however, underlines how difficult it is for the SME sector as a result of credit requirements banks are now seeking in this low growth, cautious environment.

"East sees a major opportunity for a bank to become the SME champion and that we have a moment in the market right now for a provider to make such an "ownership" move."

Interest Rate Change in Last Six Months – Loans

For more information or for further interview based insights from East & Partners, please contact:

Sian Dowling

Marcomms & Client Services

East & Partners

t: 02 9004 7848

m: 0420 583 553

e: sian.d@eastandpartners.com

Subscribe

Subscribe