Some Banks Winning in COVID Pandemic While Others Struggle

(27 January 2021 – Australia) How Banks must support CFOs through the coronavirus pandemic has been accurately quantified in newly released research by East & Partners, with startling implications for corporate and institutional banking (CIB) customer coverage teams.

The COVID-19 pandemic has had an ultra-transformative impact on the business of banking, in particular relationship management. Long held views of best practice service models have been shattered as social distancing, lock downs and remote work have placed immense pressure on customer coverage teams.

East & Partners latest Global Insights analysis delves deeper into relationship manager (RM) characteristics since the onset of the crisis. With an uncertain recovery timeframe and ongoing risk of plunging deeper into the crisis in the absence of a rapidly distributed wide scale vaccine, institutional banking teams are tasked with adapting their service offering to the prevailing ‘new normal’ to prevent damaging customer churn and wallet share deterioration.

Key decision makers are faced with overwhelming, competing challenges. The path ahead is uncertain as CFOs and corporate treasurers continue to comprehend the full scale and scope of the COVID-19 pandemic impact on long term operations and customer behaviour.

Unlike the global financial crisis (GFC), liquidity is not the most pressing concern amid an abundance of fiscal and monetary stimulus. Reduced revenue and supply chain disruptions may in fact be a more sinister and difficult legacy from the pandemic, however. The only guarantee is that business practices and customer expectations have been irrevocably altered, leaving many major enterprises unprepared and scrambling to bring forward long overdue digitisation or key processes. Corporates are turning to their bank to support them in becoming more digital savvy and data-driven with cloud-based functionality enabling lower cost through automation.

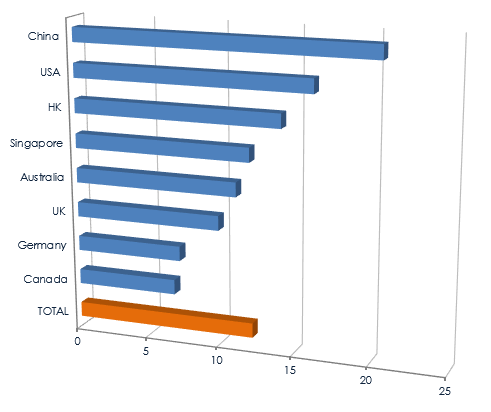

Borrowing appetite varies significantly by country, with Chinese corporates outstripping their European and Canadian counterparts two to one. 94 percent of institutional enterprises are increasing borrowings, on average by 12.2 percent through H1 2021. Unsurprisingly credit growth forecasts align closely with predictions of when a full recovery will be achieved. A complete recovery is expected by May 2021 from interview in Q3 2020, however as with credit forecasts, confidence varies significantly by country.

Forecast H1 2021 Credit Demand

Average % Change Forecast

Source: East & Partners H1 2021 Global Insight Report - COVID’s Shake Up of Relationship Banking (N: 748)

The expert nature of major bank’s response to the crisis by deploying relationship specialists to consult on COVID-19 related enhancements to corporate balance sheets and liquidity management is rated exceptionally highly by major corporates at 1.95 on a scale where 1 = high and 5 = low, especially those based in Asia where attention to detail has been critically important. How prepared would corporates be to pay for specialised balance sheet and liquidity management support from their bank? The majority would pay a premium for this offering, a high number unsure and a minority unprepared to pay.

|

"If they are (offering specialised advice), we haven’t seen it. We’d quite happily pay a service fee if they brought this kind of value to the table." - Group Treasurer, US$20Bn UA Manufacturer The report also presents which global bank is setting the benchmark for COVID-19 advice, relationship management and confidence across all eight markets among heavy weights including Citigroup, HSBC, JPMorgan, Standard Chartered, Bank of America, Bank of China, Barclays, DBS, CBA and many others. Over 50 banking institutions were individually nominated yet only one institution ranked in the top ten banks in every country. Of greatest concern for incumbent global IB majors is the high proportion of corporates who failed to nominate any provider excelling for COVID advice and support. An astoundingly high 15 percent of corporates globally were at a loss as to who they would prefer to turn to for guidance, particularly apparent among German (26 percent) and US corporates (26 percent). |

Contact East & Partners now for research access to tap into valuable ‘voice of the customer’ insights to help navigate uncertain market dynamics as the COVID crisis extends into 2021 and possibly beyond.

About the research

East & Partners Global Insight reports explore key issues identified by institutional banking (IB) customers as part of the group’s long running core research programs covering Transaction Banking, Credit, Trade Finance, Business FX, Equipment Finance, Merchant Payments and Customer Sentiment. The latest report provides timely insight into rapidly changing IB relationship management (RM) as a result of the COVID-19 crisis. This exclusive analysis follows the H2 2019 Onboarding and H1 2020 RFP editions, providing valuable ‘voice of the customer’ insights.

The purpose of the report is to identify and guide East & Partners clients including Banks, financial service providers, regulators and legislators of areas of opportunity within the global IB market. Direct interviews were conducted with the Top 100 revenue ranked corporates in each of eight countries including Australia, China, Hong Kong, Singapore, Germany, the United Kingdom, Canada and the USA.

About East & Partners

East & Partners is a leading specialist business banking market research and analysis firm. The firm’s core expertise is in the provision of analysis and advisory services tailored for the commercial, business and institutional banking markets across Asia Pacific, Australasia, Europe and North America.

For more information about this report, or East & Partners’ research, please contact:

Head of Markets Analysis

Martin Smith

t: +61 2 9004 7848

e: martin.s@eastandpartners.com

Subscribe

Subscribe