Spotlight on cross-border payments in Asia

(8 November 2018 – Asia) Cross-border payments hold immense opportunity for financial institutions in Asia, as evidenced by over three-quarters of the region’s total financial supply chain for businesses being exposed to foreign exchange risk.

Blockchain: A Game Changer for Supply Chain Management

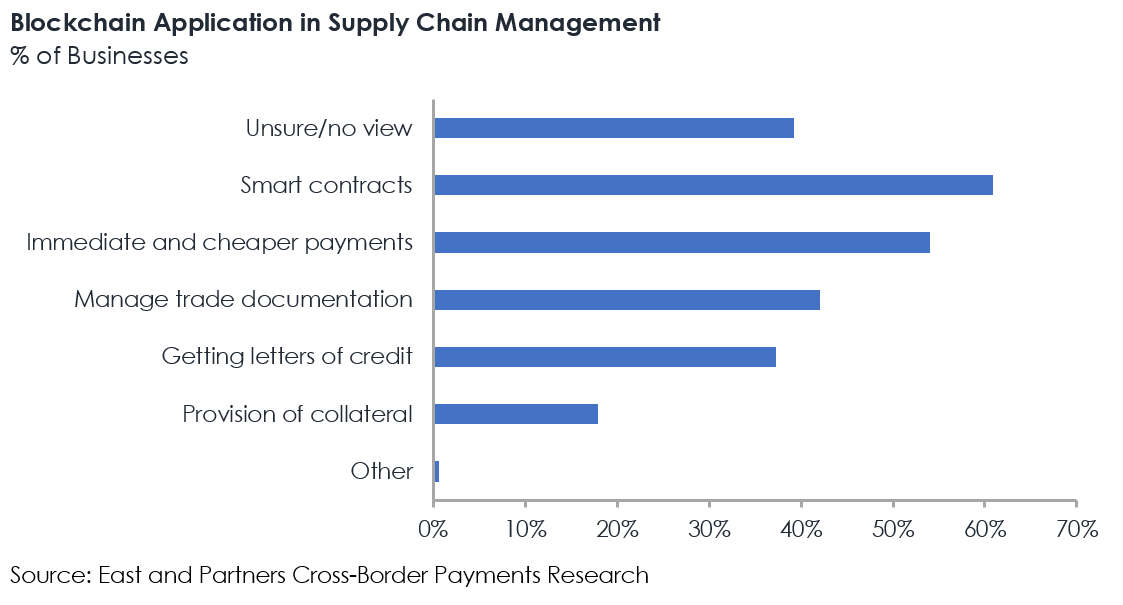

Nearly two in five businesses are still unsure about how blockchain would enhance their supply chain management, highlighting the confusion around what the technology really is. As for the remaining 60.8 percent, all see value in using smart contracts.

A majority (54.1 percent) of businesses also noted the potential of blockchain for immediate and cheaper payments, ahead of managing trade documentation (42.1 percent) and getting letters of credit (37.2 percent).

Methodology

In total 1,853 enterprises across Hong Kong, Malaysia, the Philippines and Singapore from the Micro, SME and Lower Corporate segments were interviewed directly in August 2019. Interviews were conducted with the Business Owner, CFO, Finance Manager or Corporate Treasurer using a structured questionnaire.

The Micro segment comprises businesses with annual turnover of US$1–5 million, while the turnover band for SME is US$5–20 million and Lower Corporate US$20–100million. The sector distribution in each country market reflects a natural sample of the population distribution.

About East & Partners

East & Partners is a leading specialist business banking market research and analysis firm. The firm’s core expertise is in the provision of analysis and advisory services tailored for the commercial, business and institutional banking markets across Asia Pacific, Australasia, Europe and North America.

Subscribe

Subscribe