Super Steering Term Deposit Tenor Turnaround

(27 August 2015 – Sydney) The flow of retail deposit volumes from On Call accounts to Term Deposits is accelerating, new research by East & Partners (E&P) shows.

E&P’s Deposit Funding and Debt Index (DFDI) tracks deposit taking and lending ratios by bank and segment. The program is based on data sourced from and reported by the Australian Prudential Regulatory Authority (APRA) each month, itself based on data inputs from Authorised Deposit Taking Institutions (ADI).

Released monthly, E&P’s demand-side segmentation is used to overlay APRA’s monthly banking statistics to produce proprietary segmentation cuts of deposit volumes.

“The shift in retail deposits from On Call to Term has been taking place over an extended period of time. The trending relationship is suggested to be in response to a combination of factors, including rising risk aversion by Superfunds and falling investor confidence.” said E&P’s Head of Markets Analysis, Martin Smith.

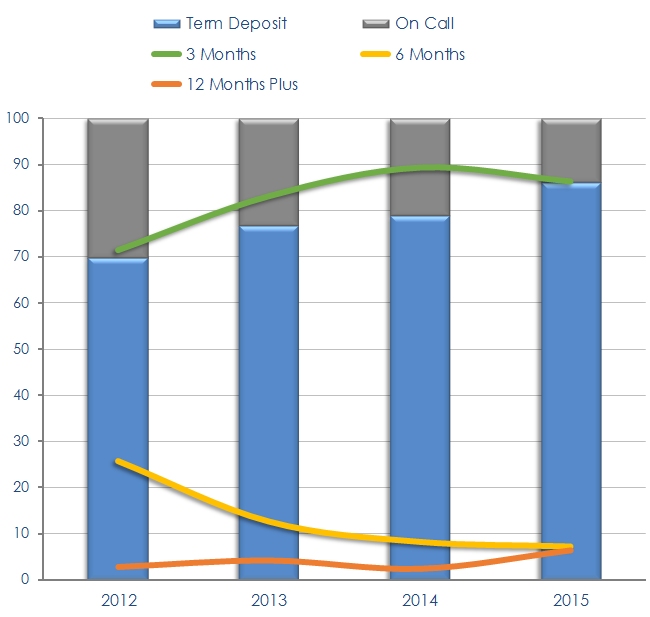

Term Deposit volumes currently represent 86.2 percent of total retail deposit volume, increasing steadily over the last three years from as low as 69.8 percent.

The increase in Term Deposit volumes is reflected in lower On Call balances, halving from a proportion of 30.2 percent in 2012 to 13.8 percent currently.

The official cash rate of 2.00 percent is expected to remain at record lows in the short term amidst falling commodity prices and uncertain Chinese economic growth.

Yet despite historically low rates of return on Term Deposits, Term Deposits pay higher interest rates than other forms of deposits and the relative safe haven status of the conservative investment class is appealing given the higher certainty of future value and a predictable income stream.

Partial withdrawal conditions and the ability to allocate interest to linked accounts is also a key attraction.

The share of shorter dated retail three month term deposits is steadily declining, replaced with renewed demand for longer tenured 12 month plus term deposit accounts. Competition remains relatively high given Term Deposits are considered very ‘sticky’ by the banks, with customers commonly rolling over the balance at maturity. In contrast, On Call deposits exhibit a high level of churn.

Fully 56.6 percent of retail customers plan to switch their on call deposit provider in the coming month, with the rate differential required to switch falling to a mere +0.007 percent.

“Term deposits remain an essential element in the growth of bank deposits and are of particular importance with the push for Banks to hold higher amounts of high quality liquid assets.” said Smith.

“Longer tenured TDs will increase in prominence as Banks offer relatively attractive rates for depositors and the preference over investments in other riskier assets gains in precedence, particularly relevant with the broad based sell-off in equity markets this month. Managed funds and Superannuation will also continue to contribute to higher Term volumes” he added.

Retail Deposit Segmentations

% of Total Retail Deposit Volume

Source: E&P Deposit Funding & Debt Index

About the East & Partners Deposit Funding & Debt Index

East & Partners Deposit Funding and Debt Index (DFDI) provides insightful research supporting the implementation of bank funding strategies within a highly competitive business and retail credit market. Released each month based on the Australian Prudential Regulation Authority (ARPA) monthly banking statistics, the industry generated benchmarks capture trending data across core deposit funding and lending metrics. Overlaying East’s demand side segmentation allows unique inferences to be derived by bank and segment, including business to retail deposit volume ratios, deposit and lending market share, rate triggers for deposit switching, deposit churn levels and term deposit tenors.

Business Depositor Segments:

| › | Institutional – A$725 million plus |

| › | Corporate – A$20-725 million |

| › | SME – A$5-20 million |

| › | Micro – A$1-5 million |

For more information or for further interview based insights from East & Partners, please contact:

| Media Relations Nehad Kenanie t: 02 9004 7848 m: 0402 271 142 e: nehad.k@eastandpartners.com |

Client Services and Development Sian Dowling t: 02 9004 7848 m: 0420 583 553 e: sian.d@eastandpartners.com |

|

|

| www.eastandpartners.com | |||

Subscribe

Subscribe