|

It’s been slightly over a year

since the UK embarked on its Open Banking reforms,

mandating banks to share their data with regulated

third parties. And in two months’ time, all major

banks in Australia will need to open their customer

data on credit and debit cards, deposit as well as

transaction accounts. Open Banking appears to be

gaining traction globally.

So, how is this new landscape

playing out in Asia Pacific, especially in the

corporate space?

Current Level of

Awareness Among Corporates: Medium

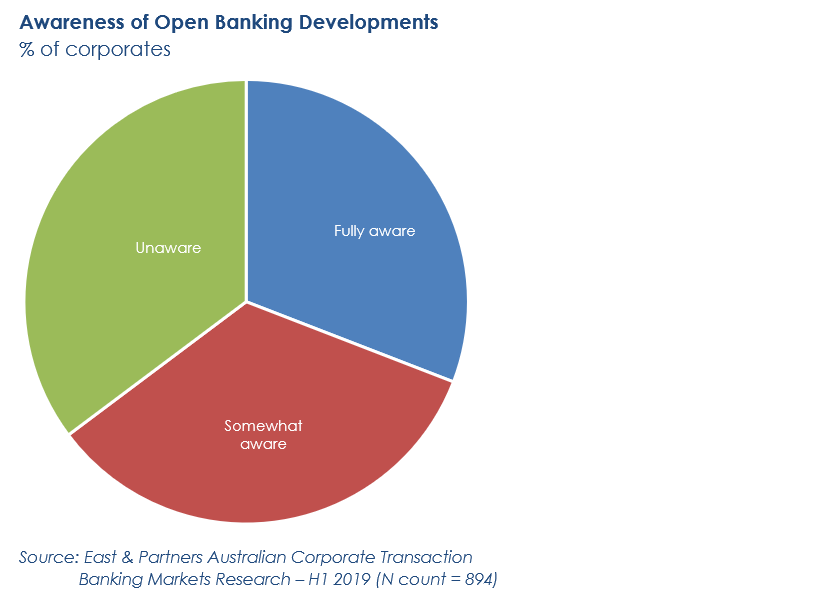

The developments around Open

Banking have yet to gain full awareness among

corporates. In Australia, for example, when CFOs and

corporate treasurers are asked whether they are

familiar with the latest Open Banking developments,

there seems to be a nearly equal split between those

who are fully aware (30.9 percent) vis-à-vis those

somewhat aware (33.9 percent) and entirely unaware

(35.2 percent).

Encouragingly, however, the

very fact that all large businesses surveyed in Asia

have at least an idea of how they want Open Banking

to improve their payments services signals that they

somewhat understand what it entails.

Opportunities with

Transaction Banking and Payments

Transaction banking and payments has been singled

out as the most likely area to reap the rewards of

Open Banking with more than one in three (35.2

percent) large corporates in Australia nominating

it, ahead of cash management (28.3 percent),

treasury (23.0 percent) and finance (12.1 percent).

Key Focal Points: Pricing Transparency and Real

Time Visibility

While there are ample opportunities for Open Banking

to remake business payment solutions, the highest

priorities are to improve price transparency and

enhance real time visibility of payment status,

cited by over four in five businesses in Asia.

Other areas where Open Banking can play a key role

in upgrading the payments process include achieving

real time cross border payment processing (73.5

percent), improving multi-account management (54.0

percent) and furnishing transaction data in formats

compatible with businesses’ existing systems (48.4

percent).

|