Royal Commission to Scrutinise SME Lending - CFOs Most Pressing Concerns

(17 May 2018 - Australia) The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry moves its spotlight from consumer lending and financial advice to small business lending from May 21. Public hearings will be held into topics including responsible lending, approach of banks to enforcement, management and monitoring of loans to businesses, product and account administration and extension of unfair contract terms legislation to small business contracts.

The hearings will also explore the current legal and regulatory regimes as well as self-regulation under the Code of Banking Practice, referencing case studies from the Big Four majors, BoQ, Suncorp, BankWest, ASIC and the Australian Banking Association. Evidence will also be given by business owners and customers of their particular experiences together with other witnesses providing context for the case studies.

The provision of credit facilities commonly utilised by small businesses such as overdrafts, property mortgages, secured and unsecured term loans will be scrutinised, as will the range of options available to small-to-medium sized enterprises (SMEs). East & Partners SME research, based on interviews with 1,497 SMEs (A$1 – 20 million turnover), confirms 84.4 percent of SMEs nominate a Big Four or subsidiary as their primary lender, rising to 86.3 percent for transaction banking needs such as cash management, internet banking and payment processing.

Both the July 1 2019 phased implementation of the Open Banking mandate set to liberalise access to valuable customer data for trusted external providers and introduction of mandatory comprehensive credit reporting (CCR) are anticipated to drive significantly greater competition between bank and non-bank providers. Ultimately customers benefit as more competitive options emerge however small businesses have traditionally been reluctant to ‘shop around’ for better deals. Despite opting to bank in a holistic way with their primary bank regardless of declining satisfaction and negative advocacy, this trend is now slowly beginning to change.

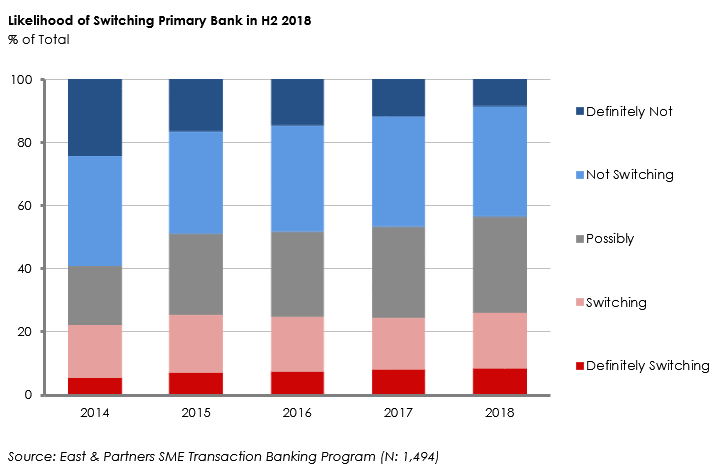

East & Partners research reveals the proportion of small businesses considering switching primary bank in the next six months lifted from 41 percent to 56 percent since 2014, consisting of one in ten SMEs ‘definitely switching’, 17 percent ‘likely switching’ and one in three ‘possibly’ switching. 44 percent of the SME segment is not planning to switch bank in the next six months, expressing high levels of satisfaction with selected bank’s transaction processing speed and improving internet banking platform functionality in particular.

Subscribe

Subscribe