UK High Street Banks Fighting Back in FX Risk

(04 February 2021 – United Kingdom) Suppressed market confidence and extreme currency market volatility have combined to become increasingly problematic for British corporates conducting foreign trade, new research by industry analysts East & Partners shows.

|

|

Much of the adverse market conditions have been spurred on by prolonged Brexit deliberations and uncertainty, in addition to the ongoing COVID-19 pandemic and stringent lockdown measures. According to research just released by East & Partners (East), 80.3 percent of corporates in the United Kingdom (UK) with revenues between US$1 million to US$100 million experienced currency losses in the last six months of trading. With such a high proportion of corporates suffering losses trading foreign exchange (FX), it is no surprise that enterprises across the UK rely heavily on risk management services to help guide their execution and strategic planning. The real question is whether FX providers are satisfying this market demand? “It has become increasingly difficult for businesses to predict future exchange rates in the current global economic climate. Businesses need the expertise of banks and currency specialists to help them manage expectations and future foreign cash flows” commented East & Partners Markets Analyst, Pierre Sokoya East & Partners’ Business FX program, which tracks competitive positioning of al FX providers and corporates’ satisfaction for various FX services on a bi-annual basis, reveals lackluster customer experience. |

|

Source: East & Partners UK Business FX Program (N = 2,212) |

|

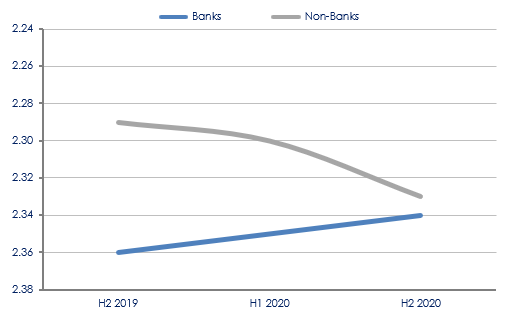

East interviewed 2,212 corporates with revenues from £$1 million up to £100 million and who rated their primary FX risk management service provider (using an inverse rating scale from 1 to 5, where 1 = satisfied and 5 = not satisfied). The results show that satisfaction scores have fallen by seven points from 2.33 to 2.40 across the whole market since June 2014.

However, since the pandemic FX providers have placed additional effort in enhancing their risk management advisory services to meet the surge in demand. As a result, the fall in satisfaction scores has decelerated and, in fact, improved for high street banks.

When we dissect the market into banks and non-banks, we can clearly see incumbent bank major’s competitive performance. CFOs and Corporate Treasurers have been increasingly satisfied with bank-provided risk management services, particularly since H2 2019.

The opposite holds true for non-banks where satisfaction scores have plummeted in risk management performance year-on-year. Interestingly, although non-banks in aggregate are still generally performing better in the provision of FX risk mitigation services, we see an inflection point approaching in early 2021 with high street banks surpassing non-bank satisfaction ratings amongst UK corporates.

FX Risk Management Customer Satisfaction

Average Rating (1 = satisfied to 5 = dissatisfied)

Source: East & Partners UK Business FX Program (N = 2,212)

Two questions arise as a result. Why are non-banks failing to maintain their historically strong satisfaction ratings for risk management services in a time of urgent need? What can non-banks do to reverse the current trend?

One driver appears to be the lack of personal consultation with their corporate clients. In other words, non-banks tend to focus more on platform delivery, which works well in times of low or moderate risk. However, in todays’ unprecedented circumstances, corporates are looking for all the support they can get, and high street banks are stepping up to help with enhanced risk advisory services. Recently banks have also been investing significant capital in fintech acquisition and partnerships to match their risk management expertise with digital platforms in response to the pandemic.

In order for non-banks to reverse the current trend they need to start investing more resources in providing bespoke advisory services if they are to remain competitive with domestic and international banks.

Find out how banks and non-banks compared in other key FX services such as FX platform, pricing and deal execution through East & Partners Business FX Program.

About the research

East & Partners’ Business Foreign Exchange (BFX) program tracks the relative competitive positioning performance of domestic banks, international banks, and non-bank providers. The analysis provides an accurate monitor of relationship share, wallet share, customer satisfaction, customer advocacy and mind share across spot, options, and forwards.

Based on direct interviews with a large representative sample of 2,212 UK importers and exporters – the research closely monitors all BFX providers as nominated by the randomised sample of CFOs and corporate treasurers included in each round’s sample. The analysis conducted continuously since 2014, also provides and delivers strategic insights based on key drivers of BFX customer needs and forms part of a broader, ten country analysis program.

Released Biannually: June and December

Business Segments:

Lower Corporates – £20 -100 million

SME – £5 - 20 million

Micro – £1 - 5 million

About East & Partners

East & Partners is a leading specialist business banking market research and analysis firm. The firm’s core expertise is in the provision of analysis and advisory services tailored for the commercial, business and institutional banking markets across Asia Pacific, Australasia, Europe and North America. Further information about us at eastandpartners.com

For more information or further voice-of-the-customer insights from East & Partners on global Business FX markets, please contact:

East & Partners Europe

Lead Markets Analyst, Europe & US

Pierre Sokoya

t: +44 203 889 4281

e: pierre.s@eastandpartners.com

Subscribe

Subscribe