Asian corporates double receivable financing engagement

(3 August 2015 – Hong Kong) Banks have an opportunity to exploit the trade finance needs of top Asian corporates according to new research from East & Partners Asia (E&P Asia).

E&P Asia’s bi-annual Asian Institutional Trade Finance report, created from interviews with the region’s top 1000 corporates by revenue across 10 markets (ex-Japan), shows that although full supply chain finance is rated as ‘highly important’ by customers, their satisfaction rating for this product area has fallen significantly.

The research asks customers to rate the importance of a product and then their level of satisfaction and in the most recent round of the trade report – completed in July – the gap between importance and satisfaction for supply chain financing continues to widen.

Although some “best of breed” banks (both international and regional) record good satisfaction ratings for supply chain finance, a large number of highly rated banks with significant market share as trade financiers are punished with the lowest satisfaction ratings.

Average satisfaction ratings across the market for supply chain financing have declined in every round of Trade Finance report since January 2014.

At the same time, engagement with supply chain financing is increasing, with strong traction for receivables in particular.

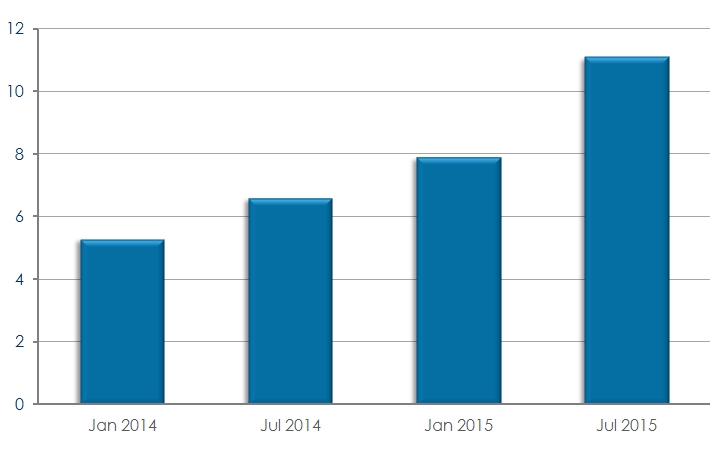

The report has found that Asian corporates are increasingly engaging with receivables financing. The number of corporates utilising the product has more than doubled over the last 18 months, from 5.3 percent in January 2014 to 11.1 percent in June 2015.

Over the same period, the percentage using inventory financing has also increased from 11.9 to 12.4 percent.

The focus on supply chain financing comes in the context of higher forecast churn intentions, with better than three in ten corporates saying that a change in trade financier is either “very likely” or “possible.”

Lachlan Colquhoun, chief executive of East & Partners Asia, said supply chain presented as a growing opportunity for trade financiers.

“Many banks have traditionally only financed small parts of the supply chain,” said Colquhoun.

“What we are seeing is that corporates are becoming more involved with their supply chain partners at the financial level, and they want their banks to follow them.

“Intra-Asian trade is in growth mode and supply chain connectivity is increasingly important.

“We believe the research shows that banks which deliver in this area can expect to grow the traction of their trade finance business.”

The Rise of Receivables

Percentage of corporates engaging with Receivables Financing

Source: East & Partners Asia ‘Asian Trade Finance Markets Program’

Asian Trade Finance Markets Program

East & Partners’ Asian Trade Finance Markets Program delivers leading market research and analysis of strategic product and service deliver across Asia’s Top 1,000 Institutional businesses operating in 10 countries in the Asia Pacific including China, Taiwan, Hong Kong, Singapore Indonesia, Malaysia, the Philippines, India, Thailand and South Korea.

Released every June and December, detailed data analysis includes:

| › | Primary and Secondary Market Share |

| › | Primary and Secondary Wallet Share |

| › | Importance and satisfaction rating indexes for 19 Key Service Factors |

| › | Customer Churn index and analysis |

| › | Product-Brand Mind share index |

For more information or for further interview based insights from East & Partners, please contact:

| Media Relations Nehad Kenanie t: 02 9004 7848 m: 0402 271 142 e: nehad.k@eastandpartners.com |

Head Client Advisory Services Perpetua Ngo t: +852 3175 1966 e: perpetua.n@eastandpartners.com |

|

|

| www.eastandpartners.com | |||

Subscribe

Subscribe