Global Business Foreign Exchange Markets Program

East & Partners’ Business Foreign Exchange (FX) Markets Program delivers demand-side assessments of the Micro, SME and Lower Corporate markets of Australia, Canada, Hong Kong Malaysia, the Philippines, Singapore, United Kingdom and the United States of America.

Designed to monitor competitive performance in these high growth but highly competitive markets, East’s Business FX Markets Program supplies industry wide performance measures across pivotal industry benchmarks. The six-monthly programs monitor industry specific metrics on:

- Spot FX Market: Market Share, Wallet Share, Share of FX Customer Mind

- FX Options Market: Market Share, Wallet Share, Share of FX Customer Mind

- Forward FX Market: Market Share, Wallet Share, Share of FX Customer Mind

- Product Customer Satisfaction Ratings

- FX Customer Service Satisfaction

With primary research based on direct interviews with a combined total of over 10,000 businesses based on a structured sample frame across the geographies, this program provides a powerful set of measures for providers seeking to heighten their global or local reach and positioning every six months.

The recent additions of the Canadian, UK and US markets mirror sister services that have been running for a number of years in the South East Asian and Australian business FX markets.

For more information on this program or to request a report profile, please contact:

| Hong Kong Office Perpetua Ngo Head Client Advisory Services |

t: +852 3175 1966 e: perpetua.n@eastandpartners.com |

| Singapore Office In Kai Khor Head Client Services |

t: +65 6224 6101 e: inkai.khor@eastandpartners.com |

| Australia Office Sian Dowling Client Services & Development |

t: +61 2 9004 7848 e: sian.d@eastandpartners.com |

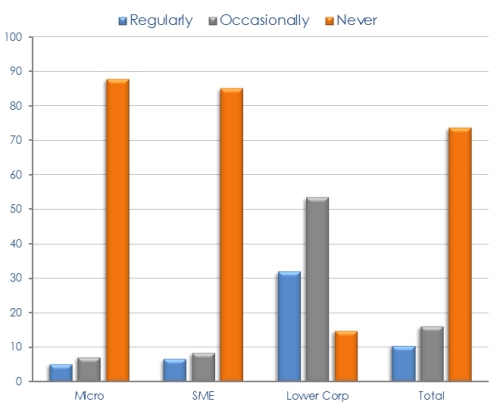

Penetration of FX Options

% of FX Customers Using Options

Subscribe

Subscribe