Asian Institutional Transaction Banking Markets Program

East & Partners' bi-annual Asian Institutional Banking Markets Program delivers a full analysis of transaction banking products and services across Asia’s Top 1,000 Institutional businesses in 10 countries in the Asia Pacific (ex-Japan). These countries include China, Taiwan, Hong Kong, Singapore, Indonesia, Malaysia, the Philippines, India, Thailand and South Korea.

For over 10 years, the research program has consistently delivered insights and detailed analytics of market share, wallet share and key satisfaction metrics on banks jostling to position themselves among the region’s top corporates. The program scope includes commentaries on product and services which overlap with the Investment Banking and Treasury markets.

East & Partners recognizes that quality market intelligence and insightful thought leadership are highly critical in account management, business development and market strategy formulation. In addition to the core multi-client content of the program, subscribers are able to place proprietary questions in the interview sweeps as a means of developing bespoke and private research insights.

Released every May and November, detailed data analysis includes:

- Primary and Secondary Market Share

- Primary and Secondary Wallet Share

- 9 Product importance and satisfaction ratings

- 26 Service Attributes importance and satisfaction ratings

- Customer Churn index and analysis

- Product-Brand Mindshare index

For more information on this report, or to request a full report profile please contact:

| Hong Kong Office Perpetua Ngo Head Client Advisory Services t: +852 3175 1966 e: perpetua.n@eastandpartners.com |

Singapore Office In Kai Khor Head Client Services t: +65 6579 0533 e: inkai.khor@eastandpartners.com |

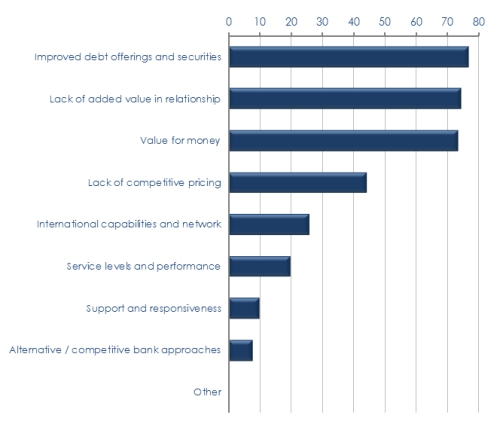

Main Reasons for Institutions Changing Bank

% of Reasons Reported

Subscribe

Subscribe