Asian enterprises bullish on euro and pound into 2018

(11 September 2017 - Asia) The research is derived from direct interviews with 1,571 importers and exporters with annual turnover of US$1 – 100 million based across Hong Kong, Singapore, Malaysia and the Philippines.

The analysis forms part of E&P’s global research program into the Business FX markets, providing insights on pivotal industry benchmarks and FX provider satisfaction ratings.

For this ninth consecutive round of research forward dated currency forecasts were captured from CFOs and small business owners that currently manage their FX exposure actively.

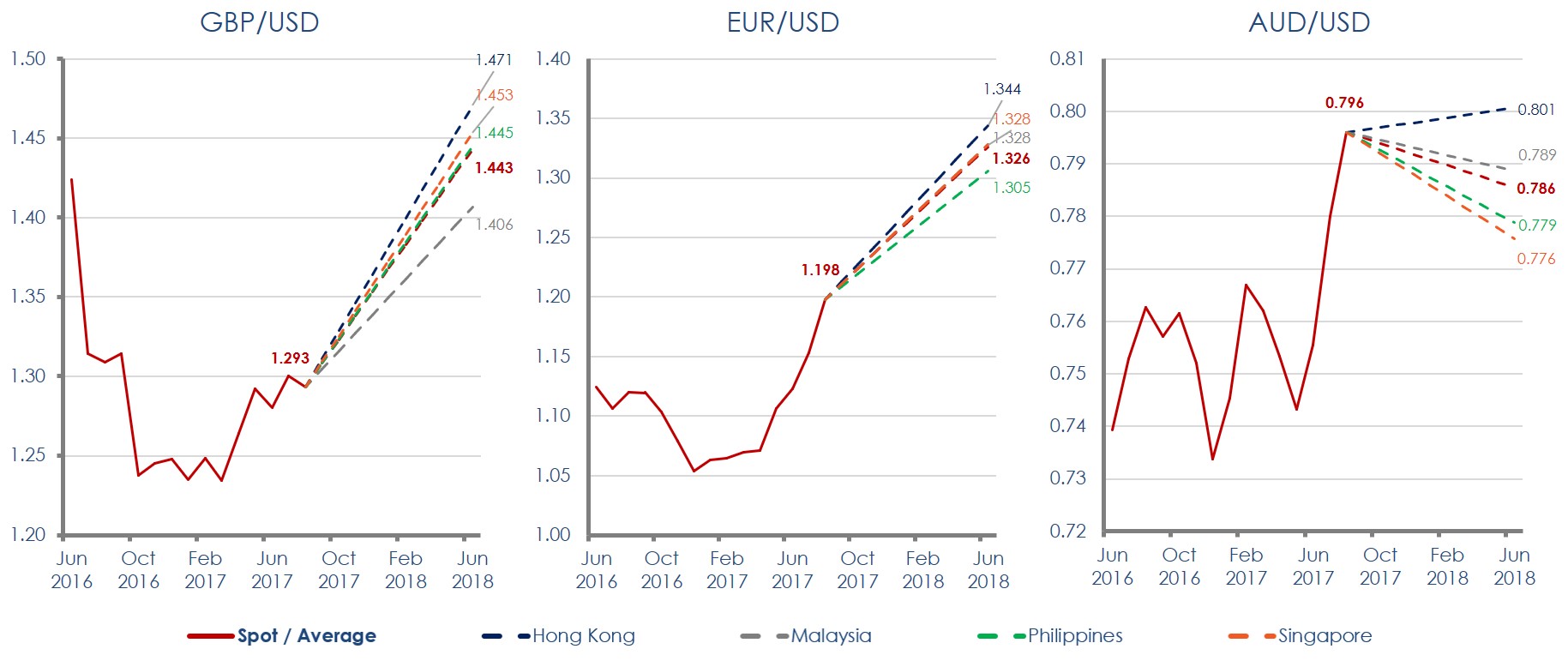

Businesses expect the pound and euro to continue their strong performance in 2017 against the greenback, having already appreciated by up to 12 percent and 5 percent respectively since the start of the year. The GBPUSD and EURUSD are expected by Asian businesses to settle at 1.443 and 1.326 respectively, an increase of 10 to 15 percent from current trading levels through to mid-2018.

High conviction bullishness on the pound and the euro contrasts against anticipated weakness for the Australian dollar. After recording single digit gains since the start of 2017, Asian firms expect the AUDUSD currency pair to remain range bound over the next three-quarters, with only Hong Kong firms forecasting mild appreciation in the single digits in the first half of 2018.

Hong Kong enterprises were consistently the most bearish on US dollar performance over the coming year, however, variability of under five percent for currency forecasts from companies in Hong Kong, Malaysia, Philippines, and Singapore indicated a forecast consensus in each respective market.

E&P Analyst Sangiita Yoong views the results as reflective of a broad-based market turnaround in eurozone sentiment and growth prospects, however warns that forecasts may reflect complacency relating to unpredictable Brexit negotiations which could precipitate a decoupling of the pound from the euro.

“The significant disparity in enterprise FX forecasts regionally demonstrates the inherent difficulty importers and exporters face absorbing the impact of rising FX volatility on their bottom line,” said Yoong.

“Despite the evident need for risk management advice and direction, businesses are instead opting to ‘shop around’ for their business FX needs more than ever, creating an extremely competitive environment for banks and stand-alone FX providers”

Asian Enterprise Currency Forecast

Historical monthly current rates and enterprise forecasts through to June 2018

Source: East & Partners’ Asia Business FX Program

About the East & Partners Business FX Program

E&P conducts research with around 13,400 enterprises across Australia, New Zealand, Asia, Europe and the Americas in the Institutional, Corporate, SME and Micro turnover segments on a quarterly basis.

Key insights include Business FX provider benchmarks on market share, the amount of business allocated to each provider, brand recollection and business satisfaction. Industry insights track ongoing trend towards ‘multi-banking’ and uptake of hedging utilisation in the lower market.

For more information or for further interview based insights from East & Partners, please contact:

| Media Relations Nehad Kenanie t: 02 9004 7848 m: 0402 271 142 e: nehad.k@eastandpartners.com |

Regional Insight Market Analyst Sian Dowling t: 02 9004 7848 m: 0420 583 553 e: sian.d@eastandpartners.com |

|

|

| www.eastandpartners.com | |||

Subscribe

Subscribe