Business Banking Sentiment Dips Further

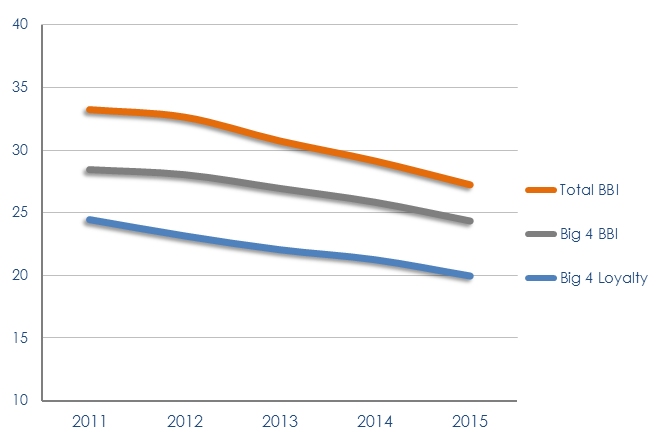

(27 April 2015 – Australia) Business banking sentiment has fallen to its lowest level in nine years, results from the latest East & Partners Business Banking Index (BBI) show.

The BBI, which monitors business customer behaviour towards Australian banks, found the Big Four achieved an average score of 24.4 (where 10 = low and 100 = high), 10 percent below the market average and nearly three times lower than the best performing bank - BOQ.

“The Big Four’s relatively lower aggregate score reflects persistent dissatisfaction, compounding over an extended period of time.” said East & Partners analyst Jessica Gao.

Since March 2012, sentiment towards three out of the four majors has fallen by almost 20 percent.

The BBI confirms that poor business banking relationships are more prominent among small businesses. The Micro business segment, with an indicative BBI score of 11.4, is more than five times less satisfied than the well serviced corporate segment which has a BBI score of 60.6.

Overall business banking sentiment is collected from CFO’s and treasurer’s collective survey responses to empathy, loyalty, satisfaction and advocacy. Loyalty and advocacy perennially weight the index negatively and the lowest ranking is consistently attributed to a Big Four bank.

Almost no business customers currently advocate their Big Four bank to friends or colleagues.

On the BBI scale of 10 (would not recommend) to 100 (would recommend), three out of the four Big Four banks rate below 13.

“The Big Four’s business customers are clearly disengaged. Advocacy and loyalty are now practically non-existent. This is excellent news for competitors outside of the Big Four, with business owners actively seeking alternative solutions across the full product suite.” quoted Gao

Small businesses in particular are exploring working capital and cash flow relief options outside of traditional channels. BOQ, Suncorp and St George consistently score above average across all four contributing metrics and are set to benefit from business owners exasperation when it comes to dealing with their relationship bank.

BOQ achieves the highest overall BBI score of 65.9, trending higher over the last two years and representing the most highly satisfied business banking customers market wide.

“BOQ is an attractive alternative to the Big Four in terms of their business banking service proposition. Greater numbers of customers nominate BOQ first when prompted “who do they think of first for business banking”. Generating greater ‘mind share’ requires more than broad based advertising and BOQ has considerably increased its prominence as a viable Big Four alternative as a direct result of customer advocacy and loyalty”

Business Banking Index Score

10 (low) to 100 (high)

Source: East & Partners Business Banking Index

About the East & Partners Business Banking Index

The East & Partners Business Banking Index is a bi-monthly Index of business customer behaviour towards banks. The Index provides a monitor of several key drivers of customer engagement behaviour with their banks including advocacy, empathy, satisfaction, loyalty, detraction and mind share.

The BBI has proven clear predictive correlations based on customer engagement behaviour and intentions with key bank performance outcomes both in aggregate and by individual bank. Its leading predictors are strongly connected with measures such as market share, customer retention, wallet share, product cross-sell and bank margins.

Business Segments:

Institutional – A$725 million plus

Corporate – A$20-725 million

SME – A$5-20 million

Micro – A$1-5 million

For more information or for further interview based insights from East & Partners on this DFDI, please contact:

Nehad Kenanie

Marketing Communications

East & Partners

t: 02 9004 7848

m: 0402 271 142

e: nehad.k@eastandpartners.com

Sian Dowling

Client Services and Development

East & Partners

t: 02 9004 7848

m: 0420 583 553

e: sian.d@eastandpartners.com

To keep up with East & Partners

please follow our Twitter and LinkedIn pages

Subscribe

Subscribe