Capex growth disappoints despite mining strength

(27 November 2019 – Australia) Australian private business investment unexpectedly declined in Q3 2019 according to the latest data from the Australian Bureau of Statistics (ABS).

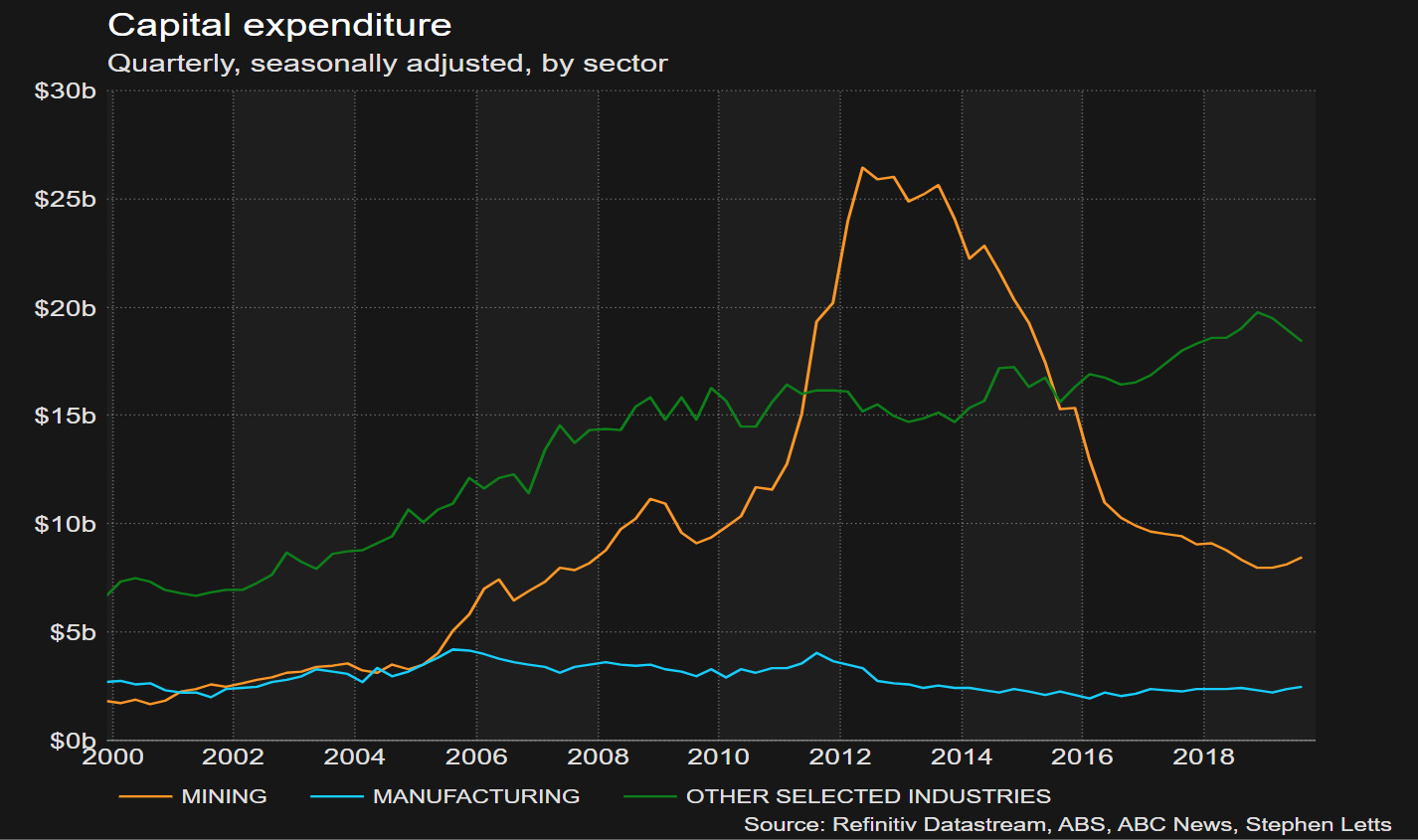

A promising uplift in capital expenditure (capex) in the mining sector of 15.7 percent year-on-year was offset by weakness in plant and equipment (P&E) investment. Spending expectations remained relatively flat in manufacturing and decreased for services. Positive private sector investment softened in the September quarter, marking a 1.5 percent slide year-on-year. The weak investment data was compounded by ongoing construction and retail spending falls, raising concern towards upcoming official GDP data for Q3 2019.

Capex decreased by 0.2 percent from Q2 2019 seasonally adjusted, marking the third consecutive quarterly decline after economists forecasted capex to remain steady. Despite borrowing costs at generational lows and interest rate setting ‘lower for longer’, Australian corporates continue to display a reluctance to invest for new growth. Although it is important to note the data does not fully incorporate capex for from health and education industry verticals, or the entirety of the SME segment, the ABS has been including experimental estimates in the Appendix section for Education and Training (Division P) and Health Care (Division Q) from Q2 2018. The ABS data excludes Agriculture, Public Administration and Superannuation Funds.

While the fourth estimate for capex for the current 2019/20 financial year was 2.5 percent higher at A$116.7 billion compared to the fourth estimate for 2018/19, and up 3.4 percent on the third estimate from the Q2 2019 release, it was under the A$120 billion mark most stakeholders had predicted. The result compares to East & Partners upcoming Asset & Equipment Finance growth forecast, based on direct interviews with 1,294 Australian enterprises financing P&E across ten asset types. Forecasts have been trending steadily higher each year since 2013.

“The softer-than-expected capex result was driven by a pullback in machinery and equipment spending, centred in the services sector. There were some modest revisions higher in the capex spend in the fourth estimate, the estimate was taken in October/November. It seems clear that it is too early for business to respond to lower rates, if they intend to all" stated IFM Economist Alex Joiner

“The survey was weak well beyond the headline figure and likely cause a downward revision to GDP forecasts. Headline spending came in at -0.2 percent, with the weakness concentrated in plant and equipment (-3.5 percent) which is the component that maps best to a key component of business investment in GDP due this Wednesday" commented RBC Vice President, Macro Rates Strategist, Robert Thomson.

"Overall, the weak investment cycle continues, reflecting a multitude of factors - tepid demand, weak confidence amid heightened global trade concerns - and in line with the global capex cycle” Mr Thomson added.

"The RBA are likely to be disappointed with this report. If the cut to investment plans eventuates, it will weigh on the recovery in growth, eventually flowing through to a weaker labour market. While mining firms remain fairly positive, non-mining firms have lowered their expectations and now plan to reduce investment by 3 percent in the current financial year compared to expectations of a six percent rise last quarter” ANZ Senior Economist Felicity Emmett stated.

“This is a disappointing outcome and likely reflects weak business confidence amidst global uncertainty. If the downgraded expectations materialise, it will weigh on the recovery in growth, eventually flowing through to a weaker labour market” Ms Emmett added.

Subscribe

Subscribe