Chinese Yuan engagement being sustained in Asia

(23 April 2018 - Singapore) The Chinese Yuan is expected to stay flat against the US dollar over the coming year as the currency’s appreciation pace comes to a halt, new research from East and Partners has found.

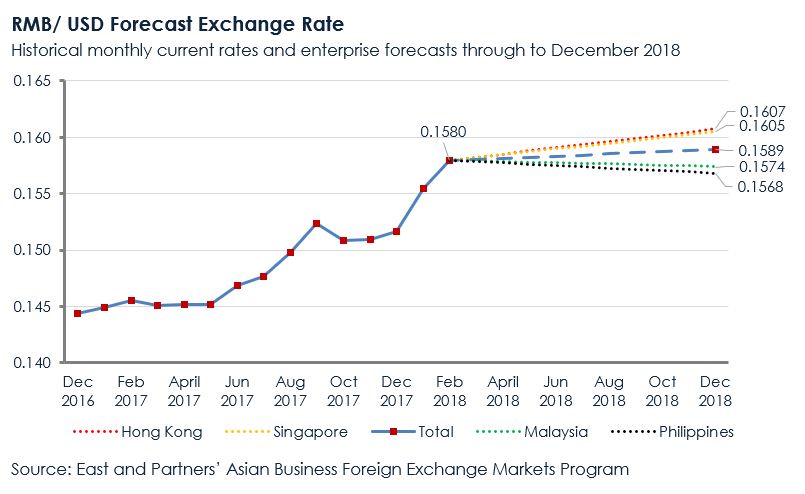

The research directly interviewed around 1,850 importers and exporters with annual turnover of US$1–100 million across Hong Kong, Singapore, Malaysia and the Philippines. It showed that the Chinese currency, which has gained about 3 percent against the dollar so far this year, is now forecast to trade at 0.1589 by year-end – little change from its present level of 0.1580.

“We expect a weaker US dollar and surge in market sentiment, driven mainly by improving economic fundamentals and easing trade tensions between the world’s two largest economic powers, to support a slight appreciation of the RMB over the remainder of 2018 based on this new research”, noted East & Partners Lead Analyst Asia, Sangiita Yoong.

Overall, however, the Yuan is set to weaken broadly against most major currencies traded in Asia. Businesses in the region expect the RMB to lose the most value against the euro, down 11.5 percent to 0.1135, while the Singapore dollar and Australian dollar are projected to fall 1.0 percent and 2.0 percent respectively by end-2018.

Interestingly, businesses in Hong Kong and Singapore, where RMB is the second most traded currency behind the greenback, are notably more bullish on the growth prospects facing the Yuan this year than the Philippines and Malaysia.

The research shows that small businesses in the region are increasingly using RMB instead of the Euro to settle trades. Currently, RMB accounts for close to one-fifth of average enterprise FX volume in Singapore and one-third in Hong Kong, up 27.9 percent and 14.6 percent respectively from three years ago.

Considering the use of Yuan in cross-border payments will continue to rise in the region, the question is now - how prepared are smaller and medium sized businesses in Asia to cope with currency risk?

About East & Partners Asian Business Foreign Exchange Markets Program

This research is from the tenth round of East and Partners Asian Business Foreign Exchange Markets Program, a six-monthly research program. In total 1,849 enterprises across Hong Kong, Malaysia, the Philippines and Singapore from the Micro, SME and Lower Corporate segments were interviewed directly in February 2018. Interviews were conducted with the Business Owner, CFO, Finance Manager or Corporate Treasurer using a structured questionnaire.

The Micro segment comprises businesses with annual turnover of US$1–5 million, while the turnover band for SME is US$5–20 million and Lower Corporate US$20–100million. The sector distribution in each country market reflects a natural sample of the population distribution.

About East & Partners

East & Partners is a leading specialist business banking market research and analysis firm. The firm’s core expertise is in the provision of analysis and advisory services tailored for the commercial, business and institutional banking markets across Asia Pacific, Australasia, Europe and North America

For more information about this report, or East & Partners’ research, please contact:

Regional Insights Manager

Sian Dowling

e: sian.d@eastandpartners.com

t: +61 2 9004 7848

Head of Client Services

In Kai Khor

t: +65 6579 0533

m: +65 9820 3716

inkai.khor@eastandpartners.asia

Subscribe

Subscribe