Fintechs put incumbent banks under pressure in the Cross-Border business

(14 November 2018 – Asia) Many businesses are becoming more comfortable with employing alternative providers and fintech companies for their cross-border payments services.

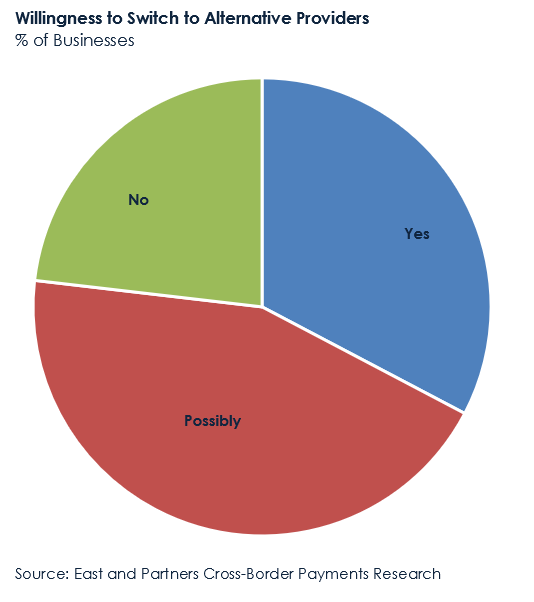

Close to one in three businesses in Asia are willing to do so and another 44.1 percent are already considering it.

The fact that businesses are willing to entrust a part of their core business function to alternative providers speaks volumes about the pressure fintechs are putting on incumbent banks and the hunger for alternative solutions corporate Asia currently has.

Methodology

In total 1,853 enterprises across Hong Kong, Malaysia, the Philippines and Singapore from the Micro, SME and Lower Corporate segments were interviewed directly in August 2019. Interviews were conducted with the Business Owner, CFO, Finance Manager or Corporate Treasurer using a structured questionnaire.

The Micro segment comprises businesses with annual turnover of US$1–5 million, while the turnover band for SME is US$5–20 million and Lower Corporate US$20–100million. The sector distribution in each country market reflects a natural sample of the population distribution.

About East & Partners

East & Partners is a leading specialist business banking market research and analysis firm. The firm’s core expertise is in the provision of analysis and advisory services tailored for the commercial, business and institutional banking markets across Asia Pacific, Australasia, Europe and North America.

Subscribe

Subscribe