Macroprudential Fails to Sting Banks

(19 January 2015 – Australia) Australian banks are conforming successfully to higher minimum liquidity ratios, research from East & Partners’ (East) Deposit Funding & Debt Index (DFDI) shows.

The Australian Prudential Regulation Authority’s (APRA) latest quarterly authorised deposit-taking institution (ADI) performance statistics indicates the average Common Equity Tier 1 ratio (CET1) currently sits at 9.2 percent.

This is well above the current capital holding requirement and positions Australian banks strongly against international peers given it allows organic capital growth over a longer timeframe should the current capital adequacy requirement increase.

Although this is a crucial, transitional period in terms of pricing, risk management and regulatory compliance, Australian banks appear to be complying well. According to East’s DFDI, banks in Australia have gradually derived more of their funding requirements from domestic customer deposits, rather than costlier offshore wholesale capital markets.

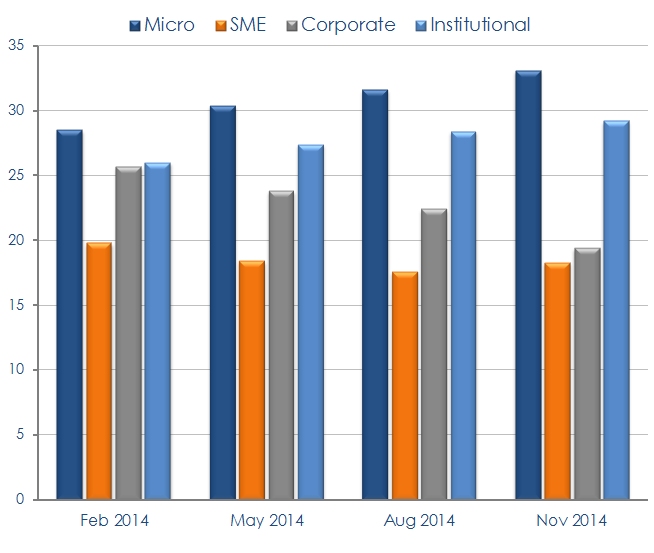

The business deposit market is distinctly segmented into savers – Micro businesses and the Top 500, and borrowers – SMEs and Corporates. Combined, Micro business and Institutional segments constitute more than 60.0 percent of total deposits, growing 8.0 percent in 2014.

Australian banks’ deposit to lending ratio in East’s latest DFDI remained stable, confirming their aversion towards curtailing risky assets. However, the luxury of superior deposit pools may fall short if APRA adopts David Murray’s recommended CET1 ratio, currently set between 10.0 to 11.6 percent.

In this scenario the banks will have little alternative other than tapering loans to underperforming sectors. If Australian banks can successfully manage regulatory compliance without severely damaging revenue growth, they may continue to expect a jump in business banking credit demand underpinned in particular by the Corporate segment.

“We have been closely tracking lending and deposit behaviour of Australian banks in response to higher capital adequacy requirements. The results are well within our expectations,” commented Jessica Gao, Market Analyst at East & Partners.

“Access to quality liquid assets takes priority over tapering high risk mortgages. It is less likely to affect revenue and investor confidence, despite continuous speculation of official RBA cash rate movements in 2015.

“The strong domestic savings trend has played an important role in the current outcome. However, with declining retail savings, if the banks want to consolidate their position, they will need to improve their deposit quality by targeting the correct business segment,” added Gao.

“Even if the rate is low enough to reduce the overall risk profile, the declining income effect will sustain the current outstanding debt level. Banks will need to consider actively reducing risky credit commitment and issuance if this is an area of focus for them."

Business Deposit Volumes by Segment

% of Total Market

Source: East & Partners Deposit Funding & Debt Index

About the East & Partners Deposit Funding & Debt Index

East & Partners’ monthly Deposit Funding and Debt Index (DFDI) provides insightful research supporting the implementation of bank funding strategies within a competitive business credit environment. The industry benchmarks are based upon monthly deposit and lending data released by the Australian Prudential Regulation Authority (ARPA). Capturing trending data across core deposit funding and lending metrics allows unique insights to be derived, including business to retail deposit volume ratios, deposit and lending market share, rate triggers for deposit switching, deposit churn levels and term deposit tenors.

Business Depositor Segments:

› Institutional – A$725 million plus

› Corporate – A$20-725 million

› SME – A$5-20 million

› Micro – A$1-5 million

For more information or further interview based insights from East & Partners please contact:

Sian Dowling

Head Client Services

East & Partners

t: +61 2 9004 7848

m: +61 420 583 553

e: sian.d@eastandpartners.com

Subscribe

Subscribe