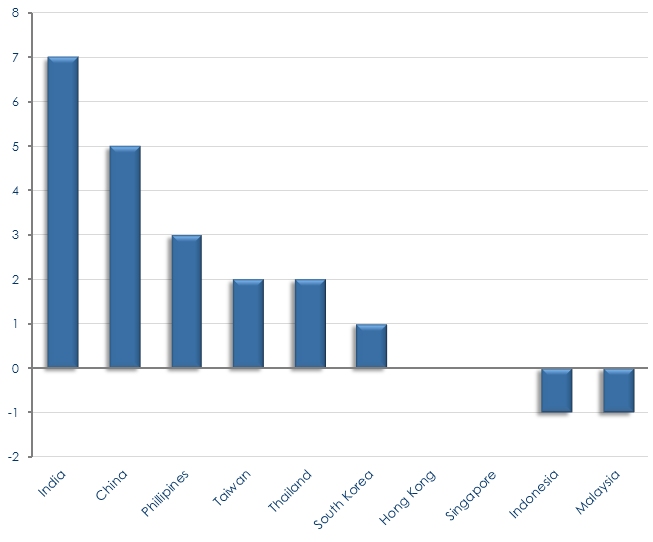

T&E budgets for Indian Corporates grew by 7 percent in Q2

(18 August 2015 – Hong Kong) The travel and entertainment (T&E) budgets of Indian corporates are accelerating rapidly as they expand their export markets and international trade, according to new research from East and Partners (E&P Asia).

E&P Asia’s Corporate Travel and Entertainment report, created from interviews with the region’s top 1,000 corporates by revenue across 10 markets (ex-Japan), provides a unique view on corporate T&E spend behavior and forward sentiment in the market.

The report shows that the Indian T&E market is likely to become the next significant market of opportunity for T&E providers in the region, as the growth in T&E budgets has now outpaced that of Chinese corporates.

Indian corporates increased their T&E budgets by 7 percent in the second quarter of 2015, against a 4 percent growth in the previous quarter. In comparison, Chinese T&E budgets have maintained a steady growth rate of 5 percent over the last two quarters.

The bullish growth in T&E budgets by Indian and Chinese corporates is in stark contrast to the rest of Asia, where T&E budgets grew by a more conservative 3.7 percent. Corporates in Indonesia and Malaysia have begun cutting back on their T&E budgets.

Evolving T&E Spending

This comes amidst a shift in T&E spend behavior, with a majority of corporates facing increasing pressure on budgets.

The report also shows further shifts in how and where T&E is allocated, with the proportion of spend being allocated to conferences and events versus “normal business travel”, as large corporates across the region continue their hunt for return on these investments.

At the same time, the report has also uncovered corporates actively developing deeper involvement with intermediaries in managing their T&E spending, moving away from in-house management.

Darryl Ye, Head of Market Analysis for East & Partners Asia, commented that the change in T&E spend is presenting new opportunities for both hospitality providers and event organizers in the region.

“T&E spending typically follows the flow of trade. Intra-Asia trade volumes have been growing consistently over the last few year, and East certainly expects T&E spending within Asia to grow concurrently with these trade flows” Ye said.

“As these corporates continue to shift their focus within Asia, providers with a keen Asian flavor in their offering will stand to benefit the most from this developing trend by corporates.”

Corporate T&E Budget in Asia

Percentage change in T&E Budgets for Q2/Q2 2015

Source: East & Partners Asia - Corporate T&E Market Insights Program

About the East & Partners Asia ‘Asia Corporate T&E Market Insight Program’

The Asia Corporate T&E Market Insight Program directly interviews the Top 1,000 revenue ranked corporates across ten countries in Asia. The analysis includes a detailed view of market share, corporate satisfaction with individual brands and corporate T&E buying behavior and repeats every quarter.

The report provides accurate evaluation and insight around the following key issues using the window of the corporate CFO and reflecting this role’s increasingly close management of corporate T&E spending:

| › | Market size and growth |

| › | Market share |

| › | Corporate buying behavior, especially in regard to channel/intermediary use and term contracting for room nights |

| › | Dollar volume allocations between business travel and events/entertainment |

| › | Corporate satisfaction with hotel brand performance |

| › | Brand recognition and mind share amongst large corporates |

| › | The use of formal expense management tools |

For more information or for further interview based insights from East & Partners, please contact:

| Perpetua Ngo Hong Kong Office 23/F, The Centrium 60 Wyndham Street Central, Hong Kong t: +852 3175 1966 e: perpetua.n@eastandpartners.com |

Darryl Ye Singapore Office #05-05 Infinite Studios Singapore 138 56 t: +65 6579 0116 e: darryl.y@eastandpartners.com |

|

|

| www.eastandpartners.com | |||

Subscribe

Subscribe