FX Risk Front and Centre for NZ Exporters/Importers

(17 August 2015 – New Zealand) New Zealand based businesses are implementing greater FX risk protection according to East & Partners’ (E&P) New Zealand Business FX (NZ BFX) program.

The NZ BFX report, based on direct interviews with 413 business owners and treasurers across New Zealand, presents FX views and hedging intentions for the Micro, SME and Lower Corporate business segments.

The program has found that since Round One, an additional 10.5 percent of importers and exporters are engaging with FX providers to hedge against a volatile Kiwi Dollar and an uncertain economic outlook.

“Despite Auckland real estate bubble concerns, the Reserve Bank of New Zealand has signalled further rate cutting intent in order to address depressed dairy prices, sluggish inflation and uneven economic growth,” said East & Partners Head of Markets Analysis, Martin Smith.

“Market participants are reacting by formalising appropriate risk management measures. It is important to note however that in many instances Micro businesses and SMEs are in fact establishing a defined treasury policy for the first time.” he said.

The percentage of businesses incorporating Forwards into their treasury policy increased from 23 percent to 27 percent in the last six months, led by a concerted lift in ‘regular’ and ‘occasional’ SME users in particular.

Lower Corporates’ higher turnover and FX volumes result in Forwards usage that is more than three times higher than small businesses. Demand for Options remains largely limited to larger sized enterprises however small businesses who are both importing and exporting are displaying considerably higher demand for Options, reflecting the need to apply tailored FX solutions to their business.

Although the major banks including ANZ, ASB, BNZ and Westpac represent an aggregate Spot FX market share of 82.1 percent, standalone FX providers such as American Express and Western Union are quickly developing a substantial customer base among Micro and SME segments in particular.

10.7 percent of importers and exporters nominate non-bank FX providers such as American Express, Western Union and other boutique brokers as their primary provider of Spot FX.

Western Union has now surpassed HSBC and Citi for Spot FX primary relationship share and seeks further growth among corporates by replicating market leading customer satisfaction ratings among Micro business.

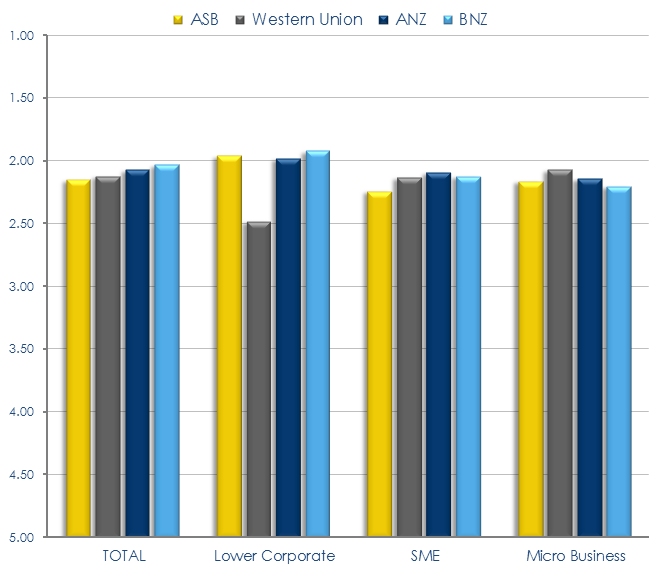

ANZ tops customer satisfaction ratings within the SME segment while BNZ is the number one ranked provider of Spot FX to Lower Corporates.

“A high proportion of small businesses react to invoices when they’re due or cover shortfalls with unsecured personal debt lines. This is clearly unsustainable in the long term, very costly and emerges as a key opportunity for both the banks and challenger brands alike in terms of dedicated service and better FX risk management education.” said Smith.

Spot FX Customer Satisfaction Ratings

Average Rating Reported by Primary Customer

(5= very dissatisfied | 1 = very satisfied)

Source: New Zealand Business FX Program – May 2015

About East & Partners NZ Business Foreign Exchange Program

Designed to monitor competitive performance in this high growth but highly competitive market, the analysis delivers industry wide performance measures across pivotal benchmarks. The biannual program provides a short form monitor of market share, wallet share and customer satisfaction experiences in Spot FX together with penetration analyses in FX Options and FX Forwards markets.

Business Segments:

| › | Micro Business (N = 154) – NZ$1-30 million |

| › | SME (N = 145) – NZ$20-725 million |

| › | Lower Corporate (N = 114) – NZ$5-20 million |

For more information or for further interview based insights from East & Partners, please contact:

| Media Relations Nehad Kenanie t: 02 9004 7848 m: 0402 271 142 e: nehad.k@eastandpartners.com |

Client Services and Development Sian Dowling t: 02 9004 7848 m: 0420 583 553 e: sian.d@eastandpartners.com |

|

|

| www.eastandpartners.com | |||

Subscribe

Subscribe