Hefty Business Tax Administrative Burden

(7 April 2014 – Australia) Australia’s largest businesses declare monthly Business Activity Statement reporting will have a detrimental impact on cash flow and administrative processes, according to new research from industry analysts East & Partners.

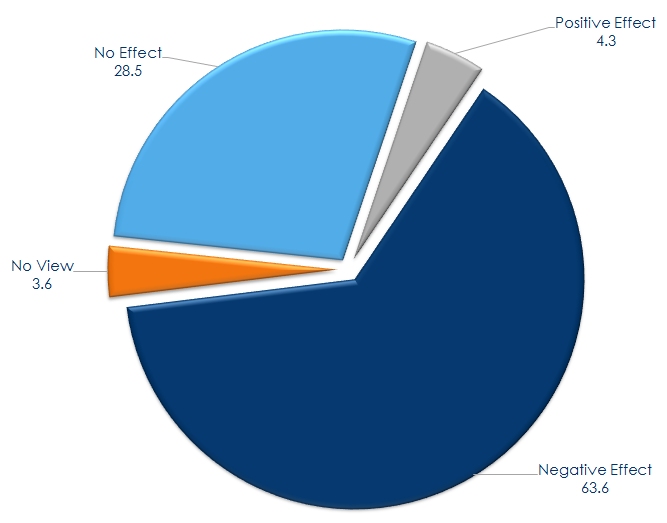

According to East’s research, 63.6 percent of businesses believe the shift to monthly BAS tax reporting will result in a negative impact on their bottom line. Australia’s Top 500 enterprises by revenue are worst affected, with 70.6 percent of institutional businesses suggesting they will encounter adverse cash flow and administrative issues.

The results are presented as part of East’s latest Business Banking Index, released biannually as a leading barometer of Australian business banking sentiment.

The Australian government announced reforms to the timing of pay as you go (PAYG) instalments for corporate tax entities in 2013, intending to be more responsive to economic conditions faced by businesses and improve coordination of PAYG instalment payments with GST payments.

The change to monthly reporting will be introduced over a four year period, with Australia’s largest enterprises affected first. Business Activity Statements (BAS) present income in addition to outgoing and incoming GST (Goods and Services Tax). Enterprises with turnover below $20 million per annum will continue to report GST quarterly by default, but can choose to report monthly.

The BAS process serves as an effective self-assessment tool for businesses keeping track of indirect taxes, yet the constant book-keeping process is not viewed in a positive light by affected larger businesses. The ATO argues closer monitoring of GST payments, operating income and profits improves transparency and reduces the impact of end-of-quarter accounting procedures.

Senior Markets Analyst Martin Smith stated “The shift to monthly reporting clearly shapes as a burden to Australian businesses despite positive trade-offs and ready access to advanced accounting software designed to keep pace with regular reporting”

“44.6 percent of corporates do not intend to opt in to monthly BAS reporting, however a significant 36.3 percent are unsure. As it stands the trade-off between regular reporting and administrative and cash flow concerns will continue to adversely affect Australian businesses”

BAS Tax Reporting Impact - Cash Flow & Administrative Costs

(% of Total Market Businesses Affected by Monthly BAS Tax Reporting)

Source: East & Partners Business Banking Index – March 2014

About the East & Partners Business Banking Index

The bi-monthly Business Banking Index explores the shifting preferences customers place on Mind Share, Customer Advocacy and Satisfaction when ranking their sentiment towards Australian banks. The research formulates Bank index scores from over a thousand interviews with Institutional, Corporate, SME and Micro businesses spanning all Business Depositor segments.

The breadth of the BBI analysis delivers market-spanning conclusions on how highly customers regard their bank. Bank index scores monitor key drivers of customer engagement behaviour including Mind Share, Loyalty, Proactivity, Empathy, Detraction and Advocacy.

For more information or for further interview based insights from East & Partners on the Business Banking Index, please contact:

Sian Dowling

Marcomms & Client Services

East & Partners

t: 02 9004 7848

m: 0420 583 553

e: sian.d@eastandpartners.com

Subscribe

Subscribe