Responsible Credit Card Surcharging?

(30 March 2015 – Australia) Submission of comments on the Financial System Inquiry led by David Murray is set to close on the 31st of March, but a new set of data on credit card surcharging activities may inundate the Treasurer’s inbox right before the door shuts.

As part of a broader Inquiry, the Reserve Bank of Australia (RBA) and Mr Murray proposed a “cap” on surcharges posed by merchants.

Newly released findings from East & Partners’ (E&P) research on merchant payments shows that over 40 percent of large (Institutional segment) card accepting merchants with turnovers over A$725 million are applying 1.5 – 2.0 percent in credit card surcharge, when 99.3 percent incur 1.5 percent or less in merchant service fees (MSF).

“Hearing the sentence ‘we charge extra for accepting your credit card’ in restaurants should be the least of consumers’ worries when it comes to credit card surcharging,” said E&P Analyst Jessica Gao, “Your local merchant incurs a much higher MSF than institutional enterprises.”

By contrast, only 13.3 percent of merchants with turnovers below A$5 million are applying a 1.5 – 2.0 percent range in credit card surcharge, yet 87.1 percent of them incur a MSF of up to 1.5 percent.

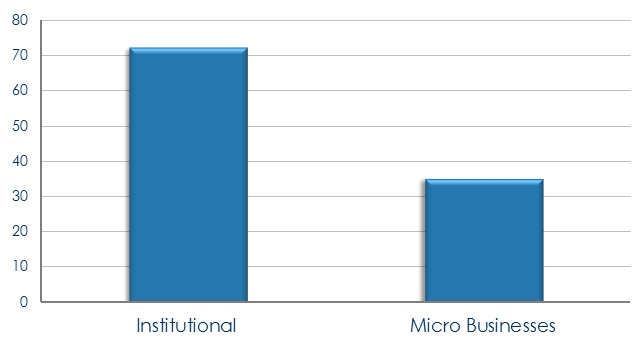

Larger merchants not only tend to apply higher surcharges, they do so more commonly. Over 72 percent of institutional businesses are currently applying a surcharge to their credit card transactions, more than double that of micro businesses.

Taxis and airlines are very common card surchargers, with these fees having long been a crucial part of their revenue mix. Cabcharge, for example, accounts nearly 10 percent of its taxi fare revenue from non-cash surcharges and is set to lose an estimated A$14 million pa as the NSW and Victorian governments’ taxi surcharge cap comes into effect in 2015.

“Don’t believe merchants applying aggressive surcharges when they refer to their card acceptance cost of facilities going up to justify surcharges on card payments. They’ve actually decreased over recent times,” said Gao.

The average merchant service fee of all credit cards for merchants in Australia regardless of their size was 1.62 percent in 2010. That figure has since dropped to 0.95 percent as at the end of December 2014.

“Following pressure from the RBA, average surcharge levels have gone down from 2.60 percent to 1.60 percent across all merchant segments over the same period.”

Credit and debit cards account for three quarters of the Australian merchants’ total annual receivables and now represent the only payment methods that are growing. The Inquiry’s proposed changes are set to provide much needed guidance on prudence, accountability and a level playing field in Australian payments.

Incidence of Credit Card surcharging

% of Merchants

Source: East & Partners Australian Merchants Payments – January 2015

About the East & Partners’ Merchant Payments Report

East & Partners Merchant Payments Report aims to provide accurate intelligence on the merchant acquiring market. The report incorporates full analysis alongside direct interviews with a large scale natural sample of Australian merchants and key RBA statistics.

The Merchant Payments report is published annually to provide deep and unique insights into key drivers of Australian merchants’ current behaviour and payment practices. It is set to monitor a range of merchant behaviour metrics by drawing on East & Partners’ rich data on the payments market, supplemented by further analysis and additional primary data gathering executed directly with merchants.

For more information or for further interview based insights from East & Partners on this please contact:

Sian Dowling

Client Services & Development

East & Partners

t: +61 2 9004 7848

m: +61 420 583 553

e: sian.d@eastandpartners.com

Subscribe

Subscribe