Credit cards come back as UK moves towards a cashless society

(23 May 2016 – United Kingdom) There has been significant growth in the acceptance of credit cards and contactless card payments by small and medium enterprises (SMEs), new research from East & Partners Europe shows.

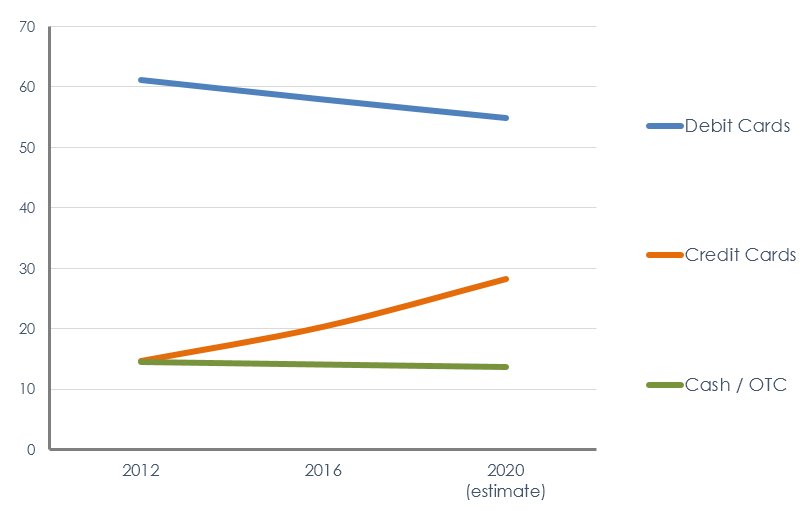

Since 2012, the acceptance of credit card payments has entered something of a resurgence, growing its share of merchant payment volumes by a relative 39 per cent from 14.6 per cent to 20.3 per cent today.

Over the same period, debit card payments have remained the most widely accepted form of payment by SME merchants, however it has seen a slight decrease from 61.2 per cent to 57.9 per cent of all payments received as credit’s share has grown.

Virtually all of this growth in credit card payments has been in acceptance of payment online, growing from 2.7 per cent in 2012 to 8.9 per cent in 2016. In the same period the acceptance of debit card payments online has only grown 0.3 per cent to 1.4 per cent, resulting in credit dwarfing debit in this channel by more than 6 times in size.

“It’s clear from our research with SME merchants in the UK that they are very willing to accept credit card payments online”, said Simon Kleine, Head of Client Services, East and Partners Europe.

“This growing willingness to accept credit payments for online purchases is driven by the increasingly competitive environment, and a recognition by online retailers of the need to compete by meeting their customers’ payment preference for paying by credit card.”

While credit has been experiencing this major growth in its acceptance by SMEs online, a new means of payment has established itself from almost nowhere in the form of contactless payments at terminal point of sale with High Street merchants.

East’s research shows that 8.2 per cent of card transactions at the terminal are now contactless transactions, and forecast that this is on a trajectory to grow to 15 per cent by the end of 2017.

The continued dominant acceptance of debit cards, upward trend of contactless payments and credit cards’ popularity online, have accompanied decline of both cash payments and cheque acceptance which now account for only 14 per cent and 6.8 per cent of all transactions respectively.

“As the convenience of cards increases, so too does their domination of the payments market, whether it be online or at point of sale. As such, it’s inevitable that the use of cash in the UK economy will continue to decline year-on-year,” said Kleine.

Receivables Transaction Behaviour – SME Merchants

Average % of Total Annual Receivables

Source: East & Partners Europe’s UK Merchant Acquiring Markets Program

About the research

The latest round of the UK Merchant Acquiring Markets Program interviewed 1293 SME card accepting merchants nationally during April, 2016. To ensure that all enterprises interviewed are card accepting merchants, East & Partners executes interviews only with those enterprises which confirm they have card based receivables. The sample is drawn from the natural population of relevant enterprises, structured by turnover, industry and geography based on detailed UK enterprise population demographics.

The fieldwork for the UK Merchant Acquiring Markets program takes place with a sample of 1,293 merchants turning over between £1 million and £50 million per annum. This represents a substantial 2.2 percent of the total enterprise population in this market segment.

All merchants are interviewed on a direct basis using a structured Interview Questionnaire. In each case, the interview takes place with the individual holding primary responsibility for decision making over the organisation’s merchant and acquiring relationship.

About East & Partners

Established in 1987, East & Partners is a leading specialist business banking market research and analysis firm. The firm’s core expertise is in the provision of independent analysis and advisory services tailored for the commercial, business and institutional banking markets across Asia Pacific, Australasia and Europe.

For more information or for further interview based insights from East & Partners, please contact:

| Head Client Services Simon Kleine t: +44 7455 169 469 e: simon.k@eastandpartners.com |

|

||

| www.eastandpartners.com | |||

Subscribe

Subscribe