Banking the Big End of Town – Exclusive CFO Insight

(23 September 2015 – Australia) How Australia’s largest companies rate their business bank for innovation and value for money has profoundly changed in the last two years, East & Partners (E&P) institutional research shows.

E&P regularly interviews Australia’s Top 500 enterprises by revenue (A$725 million plus annual turnover) for a number of subscription research programs, providing comprehensive analysis of the way in which CFOs engage with their business bank on critically important treasury functions, financial products and service expectations through key banking relationships.

“E&P has for some time reported the growing presence of international banks targeting greater market share in transaction banking, debt capital markets, project finance and trade. What is not fully understood is the underlying shift in product and service experiences, expectations and forecasted demand, or what is fundamentally driving these preferences,” said E&P Head of Markets Analysis, Martin Smith.

“We see a direct impact on the bottom line of both incumbent Australian Big Four offerings and global banks alike as well informed treasurers seek out solutions that align with their need to streamline costs and incorporate new regulatory requirements more closely.”

The Institutional Banking program reveals that CBA and NAB are rated by businesses with turnover greater than $725 million per annum as the best value for money, well above the market average of 2.83 (where 1 = high value and 5 = low value). They are followed by HSBC and Citi with a gap to ANZ and Westpac, falling close to the market average.

Innovative solutions performance ratings display significantly more variance. The Big Four are rated below the market average of 1.96 and slowly making up ground on highly rated competitors such as Macquarie and Citi.

Although equipment financing for the institutional segment represents a relatively smaller proportion of total borrowings at nine percent compared to SMEs’ proportion over 25 percent, innovation is a key proponent of greater product uptake of finance leases, operating leases, novated leasing and chattel mortgage products. Macquarie currently tops equipment finance innovation satisfaction market wide with a rating of 2.09, outperforming outgoing GE (2.20) and upwardly mobile BOQ (2.35).

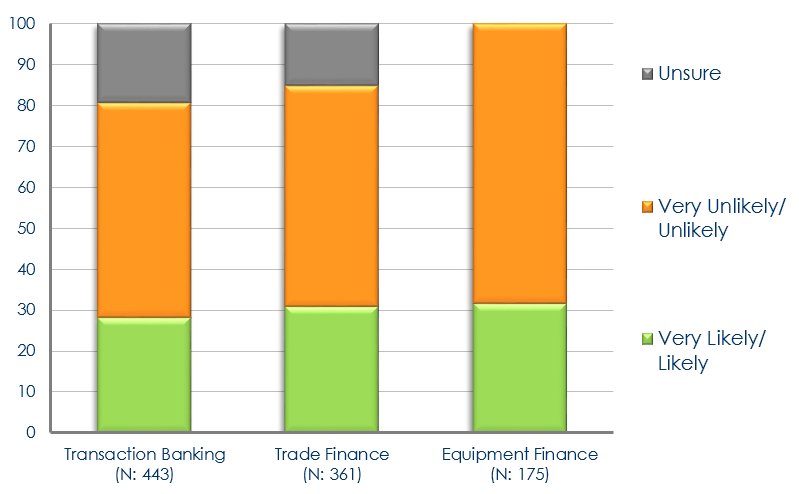

The firm’s analysis of the Top 500 enterprises also finds that significant customer churn is occurring across key banking products. E&P finds that up to 28 percent of CFOs and treasurers are considering switching their primary transaction bank in the next six months.

In addition, E&P’s Trade Finance research reveals that over 30 percent of institutional importers and exporters are either ‘Very likely’ or ‘Likely’ changing their primary trade finance provider in 2015. 31 percent of institutional enterprises are also likely to churn for equipment fiancé in the next six months.

“Customer churn in the institutional segment has historically been relatively low compared to mid-market and small businesses, but we are seeing heightened competitive pitching on more than just lower rates and better pricing,” said Smith.

“This is impacting relationship share across a number of key panel banking products. Clearly what previously passed as innovative and value for money will no longer apply into 2016 and beyond, requiring a close focus on the voice of the customer and peer benchmarking”

Institutional Customer Churn

% Changing Primary Provider Next Six Months

Source: E&P Institutional Research Programs

About East & Partners Institutional Business Banking Research

Institutional, business banking market share, wallet share, customer satisfaction, mind share and customer churn performance ratings of the Top 500 Australian enterprises by turnover (A$725 million plus revenue per annum) are represented in the Institutional Transaction Banking, Institutional Banking, Trade Finance and Equipment Finance programs. Based on direct interviews with over 400 institutional CFO’s and treasurers each round every six months, product and service characteristics are examined in detail, providing detailed customer dynamics, behaviour and analysis.

For more information or for further interview based insights from East & Partners, please contact:

| Media Relations Nehad Kenanie t: 02 9004 7848 m: 0402 271 142 e: nehad.k@eastandpartners.com |

Client Services and Development Sian Dowling t: 02 9004 7848 m: 0420 583 553 e: sian.d@eastandpartners.com |

|

|

| www.eastandpartners.com | |||

Subscribe

Subscribe