East & Partners Corporate Transaction Banking program enables subscription bank clients with valuable industry insights, competitive market positioning statistics and key relationship characteristics within the rapidly growing mid-market segment (A$20-725 million annual turnover).

Market share, wallet share, customer satisfaction and mind share analytics are derived from direct interviews conducted with a representative national sample comprising up to 900 CFOs and group treasurers.

Australian banks understanding of corporate cash management requirements, growth aspirations and emerging product and service advances are evaluated against key segment, state and sector verticals. Corporate enterprises are seeking a relationship manager who better understands both their needs and unique challenges they face in their industry. In order for transaction banks to better tailor their offering to enterprises with increasingly higher service expectations, banks must consider their overall customer engagement rating, a full picture of which is attainable from E&P’s core research program.

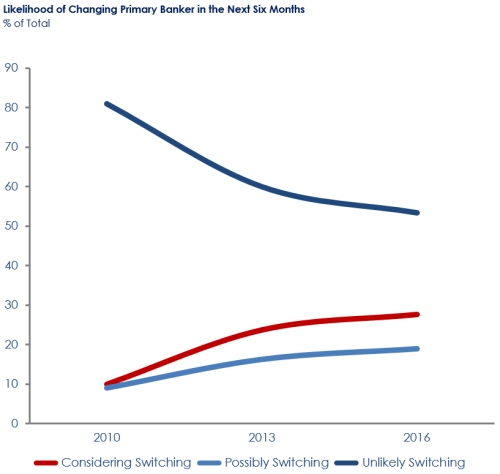

Although product satisfaction ratings for most banks are improving, overall service satisfaction is flat or falling. This provides ample opportunity for banks to instil a competitive advantage into their business model, increasing market share and driving revenue growth from a fundamental product category underpinning further credit and treasury based cross sell opportunities.

Respondents cite an express need for new transaction banking platform capabilities, particularly online, with more specific “solutions based” products that will provide real cost savings and time benefits. Bank’s transactional product offering provides the key platform for banks to deliver these strategies. E&P’s Corporate Transaction Banking research identifies emerging demand trends, allowing banks to be more proactive in their approach to growth strategies.

Corporates respond favourably to business banks acknowledging the importance of the voice of the customer, fulfilling the fundamental customer driver of ‘can my business bank grow with me?’ Today’s corporate enterprise is tomorrow’s institutional organisation.

The twice a year analysis service addresses businesses evolving needs as they grow, effectively preventing customer churn and enabling further cross sell opportunities. Relationship Managers armed with the latest Corporate Transaction Banking program results can confidently address customer concerns of how well their business bank is equipped to cater for their expanding operational requirements.

East’s continually high survey completion rate reflects the importance transaction banking services have to both large and small business banking customers alike. In addition to the core multiclient content of the program, full subscription clients are also invited to include proprietary questions in each six monthly interview sweep, using the vehicle of the ongoing research as a means of both adding valuable supplementary material to their use of the service and in the generation of tactical information solutions as needed.

| Distribution by Interviewee | % of Total |

| Chief Financial Officer | 61 |

| Group / Corporate Treasurer | 19 |

| Finance Manager | 7 |

| Finance Director | 7 |

| Group Accountant | 6 |

Subscribe

Subscribe