East & Partners SME Transaction Banking examines and forecasts demand for transaction banking product lines and service offerings within Australia’s Small to Medium Enterprise (SME) segment (A$1 – 20 million turnover per annum). The SME segment remains numerically the largest battleground for revenue and profit growth among Australian banks at a time when both the majors and non-Big Four providers seek to leverage growing volume and margins in business banking markets overall.

- Cumulative “Big Four” market share is at 76 percent

- The highly competitive middle market exhibiting greater demand for cross border payment functionality, multi-currency and international transaction banking support

- Record high proportion of CFOs and treasurers considering switching their primary transaction bank in first half of 2016

- 1 in 4 SMEs intend to switch their primary transaction bank in the next six months

Significant effort is being invested in building service propositions to the historically under-banked SME segment. Although close to half of SMEs primarily engage with their business bank for transaction banking needs, the low interest rate environment has driven many SMEs away from large commercial banks towards highly competitive “disrupters”. The shift to digital is a major attraction for small business owners that have traditionally struggled to overcome failed credit assessments based on cash flow, security or financial data constraints, a major hurdle for smaller sized start-ups and Micro businesses in particular.

Key Features

In addition to the core multi-client content of the program, clients have the opportunity to add exclusive proprietary questions to each six-monthly interview sweep, using the ongoing research as a means of both adding valuable supplementary material to their use of the service and in guiding the generation of timely tactical information solutions.

Benefits

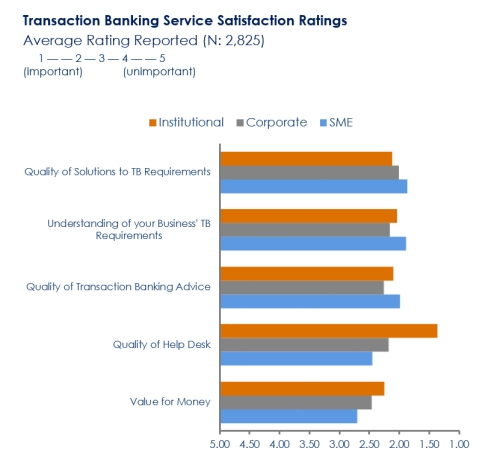

Program subscribers cite a deeper understanding of underlying shifts in product and service experiences, expectations and forecasted demand as a major advantage. The demand-side research effectively compliments internal risk management and performance procedures by accurately determining what specifically is driving CFO’s and treasurers changing preferences and transaction banking relationship characteristics.

| Distribution by Interviewee | % of Total |

| Finance Director | 30 |

| Chief Financial Officer | 21 |

| Finance Manager | 20 |

| Group / Corporate Treasurer | 18 |

| Group Accountant | 11 |

Subscribe

Subscribe