Australian Institutional Banking Markets Program

East & Partners Institutional Banking Markets program delivers leading research and analysis of strategic product and service objectives across Australia's Top 500 enterprises, turning over more than A$725 million per annum.

The relative success institutional banking teams are having in delivering service excellence to their clients is measured across Market Share, Wallet Share, Customer Satisfaction and Mind Share ratings. The report’s in-depth findings provide detailed analytics of Individual Relationship Manager Performance, Borrowing Intentions, Panel Positioning and Customer Churn.

Tighter margins and a declining need for refinancing has had a detrimental effect on borrowing markets at the top end of town. Capital management needs (38.3 percent) have surpassed working capital to fund growth (35.9 percent) as the most pressing reasons for new planned borrowing. New business acquisition is cited as the next most important reason for new borrowing by 28.2 percent of the Top 500.

The changing institutional banking environment poses significant challenges to Australian Banks, driving a need for closer understanding and connection with the constantly evolving Top 500 segment.

Released every April and October, the detailed data analysis includes:

- Primary and Secondary Market Share

- Wallet Share and Mind Share rankings

- Product, Service and Relationship Satisfaction and Importance

- Churn Levels and Intentions

For more information on this report, or to request a full report profile please contact:

Sian Dowling

Client Services & Development

t: +61 2 9004 7848

e: sian.d@eastandpartners.com

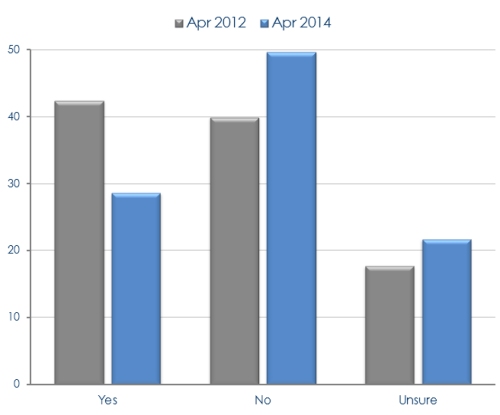

Planned Borrowing in Next Six Months

% of Total

Subscribe

Subscribe