Building Resilience as the New Definition of “Global” Emerges

(22 January 2024 – United States) Global supply chains have been on a rollercoaster over the last few years and while pressures have normalised, debates around effective supply chain management strategies are still important to avoid disruption.

Last year Citi published a comprehensive Citi GPS report examining global supply chains. Many of those elements, especially those focused on geopolitical and macroeconomic challenges, still ring true today. The geopolitical and macroeconomic shocks of late have upended this approach and the global economy is now reaching a critical tipping point.

While there is a broad consensus that inflation has peaked in many markets, the timing of rate cuts remains a topic of feverish market speculation as reported in Citi’s latest GPS report.

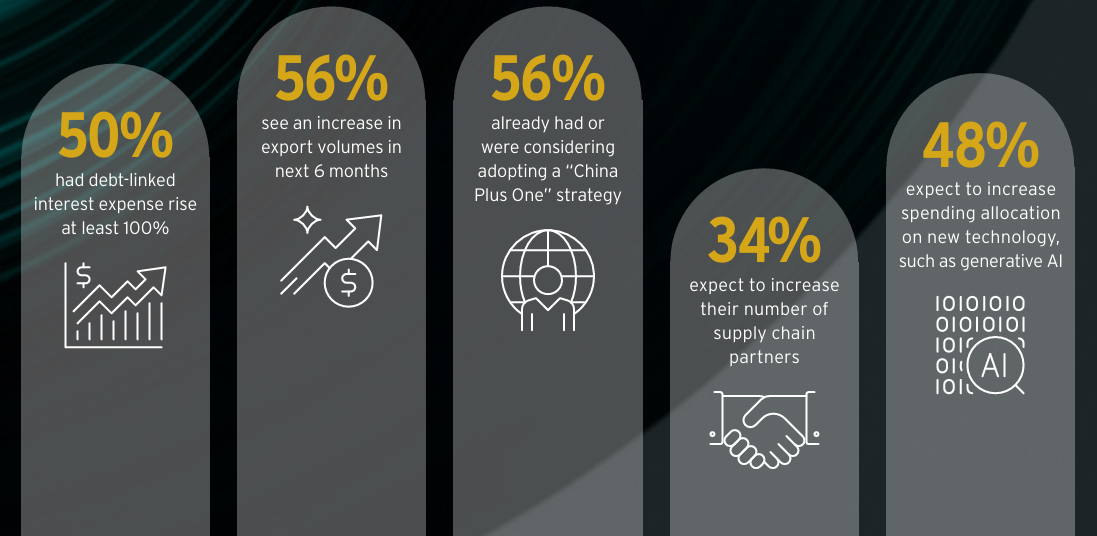

Citi partnered with East & Partners to conduct primary, voice-of-the-corporate research on supply chain challenges, resiliency, and the future of supply chains for the world’s largest and most complex organisations:

“Today, amidst the backdrop of transformative technological innovations, increasing resilience is the clear and resounding call. We see nearly every country and company focused on security. This heightened focus on resilience has given birth to a new era of diversification, and as businesses and countries adapt to this era, we’re starting to see clear benefits in economic growth” said Citigroup CEO Jane Fraser commenting on the latest Citi GPS: Global Perspectives & Solutions January 2024 release.

The full GPS report can be read here: Supply Chain Financing - Building Resilience as the New Definition of "Global" Emerges

Subscribe

Subscribe