Bank Bashing to end?

(1 September 2014 – Australia) Bank of Queensland (BOQ) has posted record advocacy ratings in East & Partners bi-monthly Business Banking Index (BBI) while the Commonwealth Bank of Australia (CBA) – which has been out of favour with its business customers, is making a strong comeback.

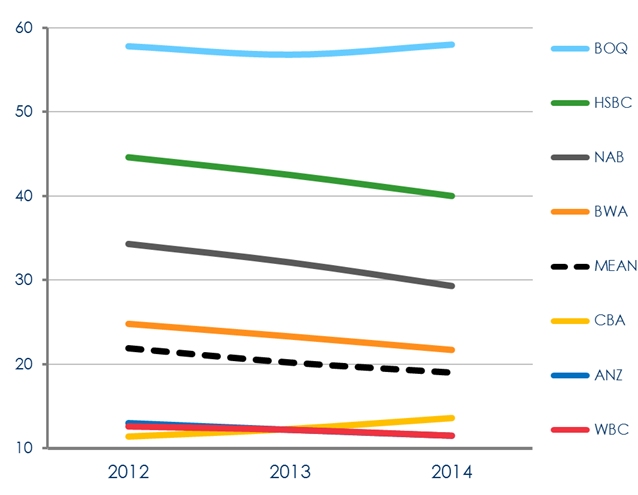

Interviews with 988 enterprises Australia wide as part of East’s Business Banking Index indicates overall advocacy has broadly declined since May 2012 from 21.9 to 18.6 (where 10 indicates would not recommend and 100 indicates would recommend).

However promising gains by CBA but most notably BOQ have broken the recent downtrend.

BOQ rates strongly with a record high advocacy rating of 58.0. CFO’s and treasurers that go out of their way to advocate their bank are more likely to actively engage with their Relationship Manager, offering valuable cross sell opportunities.

BOQ’s Brendan White, Group Executive of Business Banking, Agribusiness and Financial Markets, said he was extremely proud of the survey results which were an outstanding compliment to BOQ’s people and customer-first service proposition.

“BOQ’s point of differentiation is our unique operating model which sees a network of owner-managed and corporate branches who have deep relationships with their customers being closely supported by a fully resourced and national team of business bankers,” he said.

“Australia is a very competitive banking market so banks need to identify their strengths and focus on the market segments and customers that most value their particular service proposition. Our relationship banking model clearly is delivering the service excellence that our business banking customers need and deserve.”

CBA’s rating of 13.9 is considerably lower than the market average of 18.6, yet an outstanding 26.4 percent increase since 2011 from as low as 11.0 is cause for optimism for the bank and the wider industry more broadly.

CBA appears to have begun the long road to redemption in the eyes of CFO’s and treasurers across Australia, seemingly turning a corner by achieving robust per annum growth in all four sentiment indicators including Empathy, Satisfaction, Loyalty and Advocacy.

Advocacy is the number one driver of product engagement and holds a growing significance to business banks, particularly with expected demand for additional banking services trending higher.

Business banking demand for the upcoming month is set to expand by 19.8 percent market wide, approaching the high of 33.6 percent notched in November 2011.

Advocacy by Bank

10 (would not recommend) to 100 (would recommend)

Source: East & Partners Business Banking Index

About the East & Partners Business Banking Index

Released every two months, the Business Banking Index (BBI) explores shifting preferences customers place on mind share, customer advocacy and satisfaction when ranking their overall sentiment towards Australian banks. The research formulates bank index scores from over a thousand interviews with Institutional, Corporate, SME and Micro businesses, effectively spanning the full range of business segments.

The breadth of the BBI analysis delivers market-spanning conclusions on how highly customers regard their bank. Bank index scores monitor key drivers of customer engagement behaviour including business banking advertising recall, mind share, loyalty, satisfaction, proactivity, empathy, detraction and advocacy.

The BBI has proven clear predictive correlations based on customer engagement behaviour and intentions with key bank performance outcomes both in aggregate and by individual bank. The BBI’s leading predictors are strongly connected with measures such as market share, customer retention, wallet share, product cross-sell and bank margins.

Market Segments:

› Micro – A$1-5 million

› SME – A$5-20 million

› Corporate – A$20-725 million

› Institutional – A$725 million plus

For more information or for further interview based insights from East & Partners on the Business Banking Index, please contact:

Jennifer Rondolo

Marketing Executive

East & Partners

t: +61 2 9004 7848

m: +61 411 395 157

e: jennifer.r@eastandpartners.com

Subscribe

Subscribe