Banking Corporates Growth Path – Key Challenges Identified

(31 August 2015 – Sydney) Three key factors are preventing Australian Corporates from evolving into institutional enterprises according to East & Partners (E&P) mid-market business banking research.

Barriers to growth in Trade Finance, Asset Finance and Transaction Banking markets are recognised at a time when business leaders in the Corporate segment, classified as enterprises with annual turnover of A$20 – 725 million, are tasked with boosting productivity.

Trade Finance is a crucial focus area for mid-market enterprises increasingly turning to overseas markets to take advantage of the rapidly depreciating Australian Dollar and fuel growth. Margins achieved offshore by exporters exceed domestic margins by up to 25 percent, yet perceived value for money and satisfaction of e-Trade solutions remains low.

Although competitive pitching for the Big Four’s trade business, particularly by international banks, has increased proportionately to the importance of trade finance products, one in two mid-market enterprises demand improved open account financing facilities in order to win their trade business.

NAB’s significant transactional presence is no longer converting to market share leadership in trade as ANZ, HSBC and CBA successfully build their mid-market trade customer base.

Mid-market enterprises continue to use secondary trade finance providers, signified by average trade finance wallet share sitting at a low 61.4 percent. CFOs and treasurers using multiple trade finance providers report a need for greater liquidity support and innovative supply chain management initiatives.

Equipment finance currently represents 16.9 percent of corporates total borrowings. Similarly to trade finance, the corporate segment is the most highly competitive in terms of pitching for new equipment financing business, evidenced by the absence of a stand out market leader. CBA, Westpac, St George and NAB are competing fiercely for new asset and equipment finance business.

Broker sourced equipment finance volumes continue to expand, with businesses citing considerably better pricing and less time shopping around as major advantages of using the broker channel. The number of corporates intending to change their equipment finance provider in the next six months jumped from 24.8 to 27.0 percent predominantly driven by price or the need for a simpler credit process.

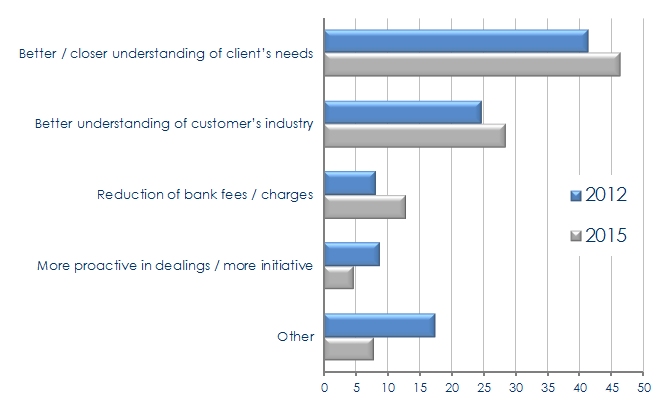

“Arguably the most important business segment, Corporates cite the need for closer understanding of their needs and industry itself as the single most important improvements desired in transaction banking,” said East & Partners Head of Markets Analysis, Martin Smith.

“Coupled with a requirement for a simpler credit process in equipment finance markets and improved open account financing in trade, the product and service focus the banks currently hold towards the mid-market segment requires recalibration.

“Until these elements are addressed in earnest, tomorrow’s institutional enterprises will remain frustratingly constricted from realising their growth aspirations” said Smith.

Single Most Important Improvement Wanted in Transaction Banking

(% of Total)

Source: East & Partners Corporate Transaction Banking Program

About East & Partners Corporate Business Banking Research

Corporate business banking market share, wallet share, customer satisfaction, mind share and customer churn performance ratings of Australian Corporate sized enterprises in the A$1–20 million turnover segment are represented in the Trade Finance, Equipment Finance and Corporate Transaction Banking programs. Based on direct interviews with 900 middle market CFO’s and treasurers, product and service characteristics are examined in detail, providing detailed customer dynamics, behaviour and analysis.

For more information or for further interview based insights from East & Partners, please contact:

| Media Relations Nehad Kenanie t: 02 9004 7848 m: 0402 271 142 e: nehad.k@eastandpartners.com |

Client Services and Development Sian Dowling t: 02 9004 7848 m: 0420 583 553 e: sian.d@eastandpartners.com |

|

|

| www.eastandpartners.com | |||

Subscribe

Subscribe