Bottom-Up Equipment Finance Engagement

(3 June 2015 – Australia) Small businesses have increased their engagement with equipment finance providers according to new research by East & Partners.

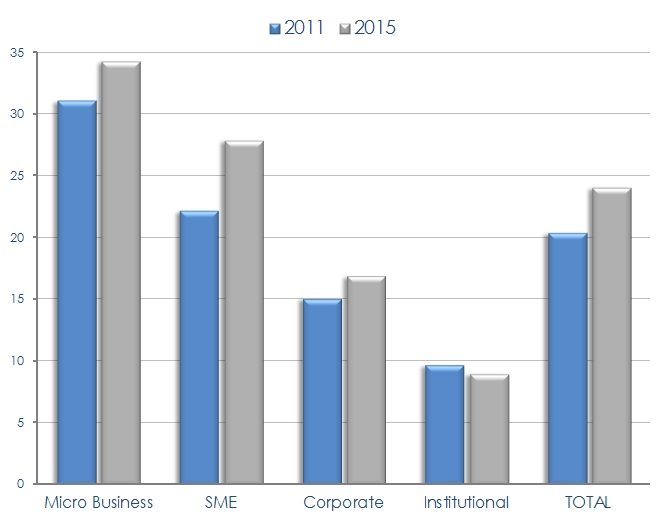

The annual Asset & Equipment Finance Report, based on direct interviews with 1300 Australian businesses with current equipment and asset financing arrangements in place, found that equipment financing as a proportion of total borrowing increased to 34.3 percent for Micro businesses and 27.9 percent for SMEs since June 2014.

In comparison, equipment financing within the institutional segment accounted for less than 10 percent of total borrowings. Corporates usage of novated leasing, finance and operating leases, chattel mortgage and commercial hire purchase products sits at 16.9 percent of total borrowings, over half that of Micro businesses.

“As Micro businesses and SMEs manage working capital constraints, they are increasingly seeking out equipment financing providers to acquire or replace plant and equipment vital to running their business or lifting productive capacity.” said East & Partners Head of Markets Analysis Martin Smith.

Asset and equipment markets have experienced significant rationalisation among providers as the shift to a new phase of growth and funding requirements takes place.

The report found that the two largest equipment finance providers by market share, NAB and GE, struggled to maintain long running growth trends. In contrast, Westpac and CBA achieved significant primary market share growth in the 2014/15 financial year.

While many small business owners continue to consider the broker channel based on a perception of better pricing, the banks increasingly view equipment finance as a product which can be effectively sold into existing primary lending and transaction banking relationships. 61.2 percent of respondents nominated their relationship bank as a preferred source for equipment finance solutions however a growing 35.5 percent of businesses reported ‘no preference’.

The corporate segment is the most competitive given the absence of a clear standout market leader. Westpac and NAB are competing closely for primary market share leadership while CBA and Macquarie both gained ground. GE and captive financiers lost market share over the last year with fully one in four corporates signalling an intent to change their primary financier in the next six months.

At the institutional level, bank providers are focusing on innovative bespoke solutions for their existing clients as a way of adding value to the relationship and winning a greater share of the customer’s wallet. Although the Big Four remain the dominant providers to the segment, their cumulative market share decreased from 89.5 to 86.8 percent since June 2014.

Macquarie has notably doubled market share among the Top 500 enterprises by turnover since 2011 while BOQ has also achieved considerable success in expanding the bank’s institutional equipment finance customer base.

“The equipment financing market is positioned for a mixed year on two fronts,” said Smith.

“Firstly, extensive structural and management changes with providers such as Capital Finance, Esanda, Macquarie and GE will impact the lending landscape.”

“Furthermore, the introduction of the Federal Government’s A$20,000 accelerated depreciation provision will undoubtedly impact asset classes differently as the need to stimulate non-mining business investment intensifies.”

“For example, 45.4 percent of enterprises currently finance their car fleet and 29.5 percent of enterprises use equipment financing for trucks. Allowing Micro businesses to immediately deduct each asset that costs less than A$20,000 is expected to result in greater product engagement for these asset classes in particular.”

Equipment Finance as Proportion of Total Borrowings

Average % of Asset Finance over Total Borrowings

About the East & Partners Asset & Equipment Finance Markets Program

East & Partners Australian Asset and Equipment Finance program delivers insights on forecast demand for equipment finance and related products across Australia’s Micro business, SME, Corporate and Institutional segments annually.

Released in June, detailed data analysis includes:

| ■ | Equipment finance customer demographics and relationship positioning |

| ■ | Banks market share and competitive positioning |

| ■ | Service factor importance in Equipment Finance |

| ■ | Customer Satisfaction in Equipment Finance |

| ■ | Market drivers and futures |

Customer Segments:

› Micro – $A1 – 5 million

› SME – A$5 - 20 million

› Corporate – A$20 - 725 million

› Institutional – A$725 million plus

For more information or for further interview based insights from East & Partners, please contact:

| Media Relations Nehad Kenanie t: 02 9004 7848 m: 0402 271 142 e: nehad.k@eastandpartners.com |

Client Services and Development Sian Dowling t: 02 9004 7848 m: 0420 583 553 e: sian.d@eastandpartners.com |

|

|

| www.eastandpartners.com | |||

Subscribe

Subscribe