Business Credit Demand Only Tells Half the Story

(20 April 2015 – Australia) Overall business credit demand is heavily dependent on the corporate segment, new research from East & Partner’s Deposit Funding and Debt Index (DFDI) shows.

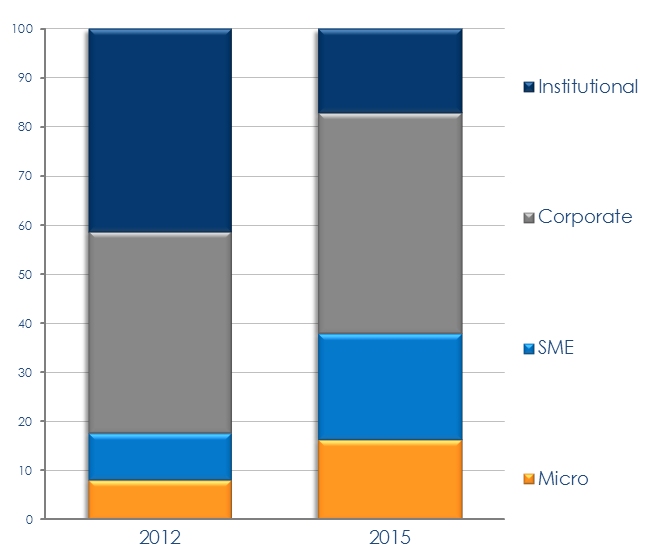

Based on APRA’s monthly banking statistics, the DFDI indicates that lending to corporates has expanded to 44.8 percent of total business loans, up from 41.1 percent in 2012.

“To put this into perspective, business lending to corporates as a proportion of total lending is now two and a half times greater than lending to the Top 500 enterprises by revenue,” said East & Partners analyst Jessica Gao.

“Business loans sourced by the corporate segment have been consistently growing over the past two years against moderate or declining lending demand for the broader market.”

This is a reflection of industry breakdown by segment, in particular the wind down in mining related capital expenditure reflected in aggressive deleveraging by the institutional segment since early 2013.

Corporates stand apart from the Micro, SME and Institutional segments in terms of business lending growth because they represent the business market’s only real growth segment currently. The segment’s total business deposit to lending ratio of 0.40 has been consistently declining from a high of 1.04 reached in July 2010.

This means that for every A$1.00 corporates borrow they deposit A$0.40 cents into the banking system.

The proportion of institutional business deposits has expanded from 20 percent to 30 percent of the entire market since 2012.

This trend is shifting business deposits as a source of funding away from smaller Australian banks. Within the DFDI’s analysis on business deposit and loan balances by bank, the ratios for smaller sized banks contracted. This signifies lower deposits relative to lending.

BOQ’s total business deposit to lending ratio decreased from 1.59 to 1.30 in the last year, Bendigo Adelaide Bank’s ratio dropped from 1.30 to 1.18 and Rural Bank’s ratio contracted marginally from 0.45 to 0.41.

“In March 2014 the Top 500 were net borrowers at a DFDI ratio of 0.97. A year later and the institutional DFDI ratio has soared to 1.67. The Top 500 now deposits a staggering A$1.67 per dollar borrowed compared to A$0.97 cents per dollar borrowed as recently as last year.”

Business Lending Volumes by Segment

% of Total Market

Source: East & Partners Deposit Funding & Debt Index, February 2015

About the East & Partners Deposit Funding & Debt Index

East & Partners monthly Deposit Funding and Debt Index (DFDI) provides insightful research supporting the implementation of bank funding strategies within a highly competitive business and retail credit market. The industry benchmarks are based on monthly deposit taking and lending data released by the Australian Prudential Regulation Authority (ARPA).

Capturing trending data across core deposit funding and lending metrics allows unique insights to be derived by bank and segment, including business to retail deposit volume ratios, deposit and lending market share, rate triggers for deposit switching, deposit churn levels and tenure of term deposits.

Business Depositor Segments:

› Institutional – A$725 million plus

› Corporate – A$20-725 million

› SME – A$5-20 million

› Micro – A$1-5 million

For more information or for further interview based insights from East & Partners on this DFDI, please contact:

Nehad Kenanie

Marketing Communications

East & Partners

t: 02 9004 7848

m: 0402 271 142

e: nehad.k@eastandpartners.com

Sian Dowling

Client Services and Development

East & Partners

t: 02 9004 7848

m: 0420 583 553

e: sian.d@eastandpartners.com

To keep up with East & Partners please follow our Twitter and LinkedIn pages

Subscribe

Subscribe