Business Deposit Volumes in Focus

(28 April 2014 – Australia) Business deposit volumes are reacting to the active reweighting of capital allocation priorities by Australian enterprises.

East & Partner’s Deposit Funding and Debt Index (DFDI), sourcing newly released APRA data, indicates the Top 500 continues to deleverage while SME’s have shifted in the opposite direction.

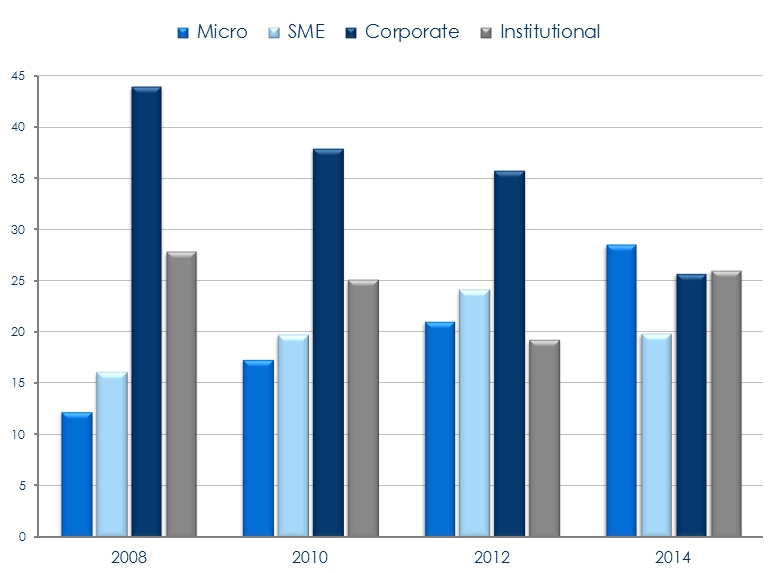

The relative importance of businesses in the sub A$20 million turnover bracket has increased considerably. Corporate and Institutional business deposit volumes have declined significantly since 2008, yet deposit volumes for Micro businesses edge further higher. SME deposit volumes have ceased trending higher as preferable lending conditions prevail.

Business lending and term deposit demand is clearly being driven from the ‘bottom up’, in a distinct about-face since the GFC when larger businesses predominantly underpinned demand. This change suggests banks that concentrate on small business deposit taking are in a stronger position to outperform the market.

Relative to current lending balances, changing deposit volumes have created a significant imbalance for Australian banks within the last 18 months. The Deposit Funding and Debt Ratio (DFDI) for the SME segment has plunged as borrowing increases relative to deposits, from 2.62 in June 2012 to a new low of 1.13.

In comparison the Top 500 are depositing more per dollar borrowed than at any other time. The Institutional DFDI has risen to a new high of 0.93, suggesting Australia’s largest enterprises could deposit more than what they borrow from the banking system by the end of 2014.

East & Partners Senior Markets Analyst Martin Smith ascribes several key motivators for the ongoing adjustment in business depositor behaviour.

“The shift back to more attractively priced Term Deposits from On Call Deposits continues to gather pace. Reducing interest rate differentials have triggered an increase in customer churn, with current and forecasted customer switching frequency rising further.”

“Key drivers of business deposit growth include the renewed focus upon cash flow and retention of cash holdings, sustained deleveraging of the balance sheet by larger enterprises and greater cross selling into existing customer lending relationships.”

Business Deposit Volumes by Segment

% of Total Business Deposits

Source: East & Partners Deposit Funding & Debt Index – March 2014

About the East & Partners Deposit Funding & Debt Index Program

East & Partners’ monthly Deposit Funding and Debt Index (DFDI) provides insightful research supporting the implementation of bank funding strategies within a constrained and competitive lending market. The industry benchmarks are based on monthly deposit and lending data released by the Australian Prudential Regulation Authority (ARPA). Capturing trending data across core deposit funding and lending metrics allows unique insights to be derived, including Business to Retail deposit volume ratios, Deposit and Lending Market Share, Rate triggers for deposit switching, Deposit churn levels and tenure of Term Deposits.

For more information or for further interview based insights from East & Partners on this Deposit Funding & Debt Index report, please contact:

Sian Dowling

Marcomms & Client Services

East & Partners

t: 02 9004 7848

m: 0420 583 553

e: sian.d@eastandpartners.com

Subscribe

Subscribe