CFOs Lament Lack of Vital Blockchain Adoption Guidance

(8 November 2022 – Global) CFOs are ready and willing to integrate distributed ledger technology (DLT) yet struggle with deficient bank guidance, a lack of scale and inhibitive onboarding costs new research from East & Partners and PCM reveals.

“The Great Switch: Major Corporates are Ready for Blockchain – but can Banks Deliver?” analysis is based on direct interviews with 850 CFOs and treasurers of the top revenue ranked corporates in nine markets across Europe, North America, the Middle East and Asia. The research presents detailed needs and expectations for integration of blockchain, DLT, central bank digital currencies (CBDCs) and stablecoins into their treasury function seeking greater treasury efficiency and cost benefits

Improved communication and regulation could help to address a lack of understanding and cybersecurity concerns.

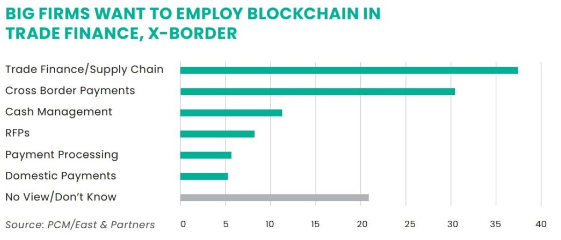

In particular, corporate treasurers are interested in the application of distributed ledger technology (DLT) for trade finance, cross-border payments and cash management, due to its promise of greater transaction security, faster settlement times and lower costs.

But information about available DLT solutions and their stated benefits remain unclear to the key stakeholders involved in driving forward blockchain adoption. Hence, improved communication on these issues would increase the number of connected partners. This issue was cited as a concern by 45 percent of interview respondents, Martin Smith, global head of markets analysis at East & Partners, told CorporateTreasurer.

The responses differed greatly across regions, reflecting a disparity in understanding and progress on treasurers’ “payments journeys”, Smith added.

Treasurers in Hong Kong and Germany, being in more advanced stage of their payments journey, were less concerned about a lack of connected partners than their counterparts in the UK or UAE, for example, and respondents in Singapore and the US – unlike in the UAE – had clear opinions around where regulators should focus their attention when it comes to enabling blockchain payments.

One group treasurer cited in the report said that his company, a US$10 billion German manufacturer, had been studying DLT and blockchain “for some time” but was struggling to get traction or clarity on how to move forward and was receiving little help or information from his banking partners.

“Tangible benefits expressed in the form of real use cases and case studies would be an excellent first step for improving comprehension to reduce the current high level of unwillingness to connect to DLT systems and reach a requisite ‘critical mass’ for broader scale adoption by connected partners,” said Smith.

Those who have participated in pilot schemes are more receptive to the adoption of cryptocurrency payments, the report also suggested.

“There’s a lot of upside in DLT for our supply chain funding and payments, especially. We participated in a trial with our trade bank using blockchain to complete a $7 million trade transaction that worked really well. [We’re] keen to be doing more,” said the treasurer of a Singapore-based, $4.5 billion logistics and shipping company.

“There is quite an implementation hurdle into DLT; the banks seem to be making it up as they go along somewhat, which doesn’t make it easier. The benefits, especially around transaction speed, counter-party security and cost, are pretty compelling for us,” said the CFO of a UK-based $11 billion wholesale distributor.

Treasurers also expressed apprehension about the potential downsides of DLT adoption, including increased vulnerability to cyberattacks. They highlighted exchange hacking as the area of crypto compliance that they believe regulators should be most focussed on addressing.

Regulation around transparency, central bank digital currency (CBDC)-backed solutions, or the introduction of a universal crypto exchange or broker licensing system, would be effective in prompting corporates to encourage their clients to accept and pay using cryptocurrencies or stablecoins, Smith shared.

In contrast, regulation around cross-border tax harmonisation was not cited as a priority, except in Germany and the UK.

Application uncertainty

While treasurers and CFOs are excited about the potential of CBDCs to unlock emerging payments solutions and address cyber fraud concerns, 45 percent of respondents were unsure exactly how they would go about implementing CBDC technology.

Those who were sure, cited cross border payments and trade and supply chain finance as key areas for CBDC application.

“Trade is definitely where we see big benefits and efficiencies in DLT payment solutions. We have a pilot planned with our trade bank for early 2023 to use as a learning experience – actually for both parties,” said the treasurer of a $3.5 billion import-distribution firm in Hong Kong.

Interestingly, treasury teams appear to have a much greater level of understanding on the application of stablecoins (fiat currency-backed cryptocurrencies), with only 19 percent unsure about how they would implement them across treasury processes. What is clear however, is that banks need to do more to support their corporates clients both in terms of advisory and on executional capacities for blockchain, the report concluded.

Subscribe

Subscribe