Cross Border Payments Demand Surging

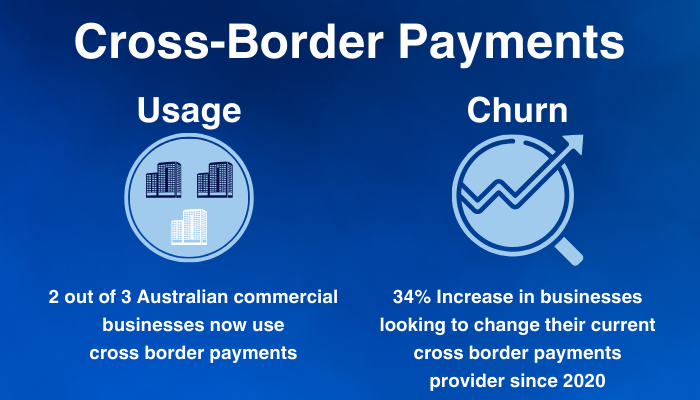

(26 January 2024 – Australia) International payments usage has doubled in the last decade amongst Australia’s commercial enterprises as incumbent major transaction banks struggle to retain clients.

New research from East & Partners reveals rising cross border payments usage has been offset by increasing intent to switch current primary provider.

Transaction Banks are facing customer retention “jaws” as record high churn compounds sharp wallet share declines.

“East’s long running voice-of-the-CFO research raises the important question of why these businesses are seeking to change transaction bank more than ever before. The analysis outlines which Banks are outperforming for international payments and why, linking with powerful global comparisons illustrating emerging trends in other global cash and payments markets” stated East & Partners Global Head of Markets Analysis, Martin Smith.

Subscribe

Subscribe