East & Partners’ Big Business Banking Predictions for 2015

(17 March 2015 – Australia) Sub three percent business credit growth, resurgent SME export demand with a falling Aussie Dollar, wider proliferation of online payments and the continued advance of foreign banks’ transaction banking presence emerged as key 2015 business banking predictions from East & Partners’ Annual Outlook.

Presenting the firm’s latest research and analysis in Sydney, East & Partners (E&P)’s predictions extended to improving customer engagement by generating greater ‘mind share’ in addition to disruptive FX providers offering alternative technology intensive, innovative service and re-priced offerings.

Non-bank specialist FX providers are forecasted to achieve up to a 12 percent greater share of the Spot FX market by the end of 2015.

Transaction banking firmly remains in the realm of the Big Four, illustrated by results from E&P’s Corporate Transaction Banking program. Direct interviews with 897 CFO’s and treasurers of Corporate sized enterprises (turning over A$25 - $725 million per annum) Australia-wide highlighted aggregate primary market share for the majors has jumped from 76.2 percent to 82.2 percent since 2009.

Combined with improving wallet share, foreign banks face a difficult task prising away core business banking relationships functions such as Cash Management and Payment Processing. The trend towards greater Big Four primary transactional relationships is suggested to be running out of steam however as international banks step up their offering.

Leading with competitive trade finance product and service propositions backed by market leading mind share, international banks such as Citi and HSBC are building on their strong Cross Border Payments pedigree by targeting further core transactional relationship growth.

SME export participation was forecasted to jump by at least 20 percent as the Australian Dollar flat lines. Margins achieved offshore by exporting small businesses are forecasted to exceed domestic margins by up to 25 percent.

Research from E&P’s Equipment Finance program reveals liquidity and working capital constraints remain one of the largest inhibitors to further SME business activity, paving the way for a comeback by the broker channel offering perceived better pricing.

E&P’s SME Transaction Banking program indicated engagement with Product Specialists (29.3 percent) is fast becoming the main preference for time poor business owners, arguably overtaking RM interaction by the end of this year (32.1 percent). 5.2 percent of 1,497 SME’s surveyed exhibit no interest towards interacting with their bank while a mere 0.8 percent would visit a branch.

“Our research provides unrivalled insight into the perception business owners have of their bank, providing a great deal more than market wide monitors of business banking performance in terms of market share or customer satisfaction rankings,” commented Martin Smith, East & Partners’ Head of Markets Analysis.

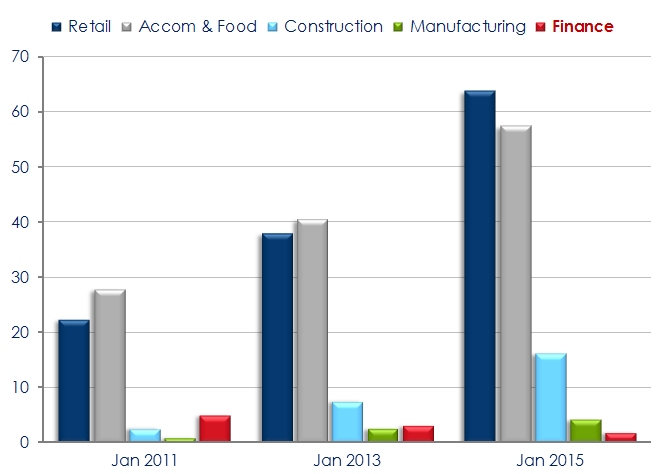

“For example, the Business Banking Index asked up to a thousand CFO’s and treasurers across Australia: ‘What industry sectors have you advocated companies from?’” Almost two thirds of all respondents happily advocated a company in the retail or food industry following a positive experience. After all, how often do you book a restaurant without reading a review?

“Advocacy rates for the Finance sector have more than halved since 2011, from 5.1 percent to 2.0 percent. It is clear that banking and finance is really suffering in terms of customer sentiment and there is clearly a worrying disconnect forming between business owners and the banks in terms of expectations not meeting reality” said Smith.

Which industry sectors have you advocated companies from?

% of Enterprises

Source: East & Partners Business Banking Index

About East & Partners’ Annual Outlook

East & Partners presents key themes and forecasts of what is set to shape the year ahead in Australian business banking. Held in Sydney and attended by senior representatives from domestic and international banks, financial services providers and media, the evening provides an excellent setting for sharing the analyst group’s unrivalled insight into challenges and opportunities facing the banking sector coupled with proposed strategic responses.

Business Depositor Segments:

› Institutional – A$725 million plus

› Corporate – A$20-725 million

› SME – A$5-20 million

› Micro – A$1-5 million

For more information from East & Partners, please contact:

Sian Dowling

Head Client Services

East & Partners

t: +61 2 9004 7848

m: +61 420 583 553

e: sian.d@eastandpartners.com

For media enquiries, please contact:

Jennifer Rondolo

Marketing & Communications

East & Partners

t: +61 2 9004 7848

m: +61 411 395 157

e: jennifer.r@eastandpartners.com

Subscribe

Subscribe