Fierce Competition Damages Customer Satisfaction in Business FX

(3 February 2015 – United Kingdom) As business foreign exchange (FX) markets become increasingly competitive in the United Kingdom (UK), satisfaction ratings continue to slide relative to global peers according to newly released findings by research house East & Partners (E&P).

The findings are presented as part of E&P’s latest UK Business Foreign Exchange Markets program, based on direct interviews with 2,201 SME and Lower Corporate enterprises conducted in December 2014.

The latest release supplements E&P’s series of global business FX markets research, examining Spot FX, FX Options and Forward FX product and service engagement across the UK, US, Canadian, Asian and Australian markets.

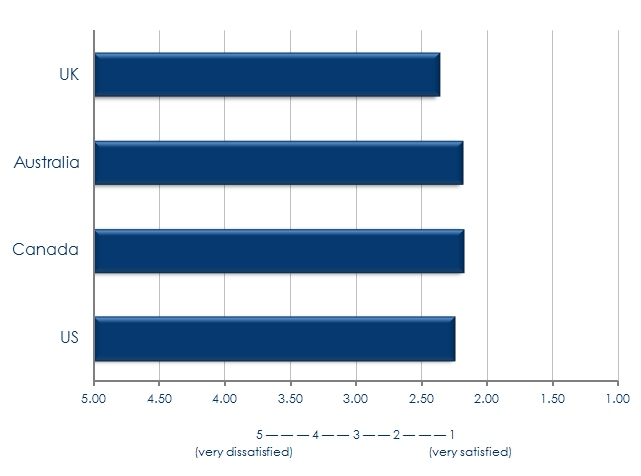

Overall market wide UK business FX satisfaction currently stands at a rating of 2.37, where 1 = satisfied and 5 = dissatisfied. US based business FX customers are considerably more satisfied, rating 2.25, behind Australian businesses (2.19) and Canadian businesses (2.18) in this critical, growth market segment.

Western Union achieved best of breed customer satisfaction, rating at 2.11 - ahead of Deutsche Bank (2.16) and UBS (2.16). Western Union’s strong service satisfaction translates directly into above average wallet share in the UK Spot FX Market with the group effectively securing a higher proportion of Spot FX business per primary customer.

Intense competitive pressure has clearly weighed heavily on UK business FX customer satisfaction levels. British business owners are the most disgruntled FX customers among all surveyed countries. In E&P’s view this also reflects heightened customer expectations with the UK FX markets breeding innovation and exportable FX trading platforms for the retail investor/trader markets.

The UK FX market has a relatively even primary relationship distribution across several FX providers. The three biggest Spot FX service providers in the UK constitute merely 39.9 percent of the total market. This compares to Canada and Australia where the three largest FX providers by market share account for a cumulative, and much higher, 48.9 percent and 58.6 percent of primary Spot FX relationships, respectively.

“The great majority of FX providers in the UK are driven by price differentiation. There is no shortage of FX providers choosing to attract customers through lower transaction costs rather than building sticky and higher value relationships.” said Jessica Gao, Market Analyst at East & Partners.

“There is minimal brand loyalty or identification among FX customers. They’re bargain hunters who are constantly dissatisfied with the level of services they’re receiving, who then hunt for even cheaper alternatives, creating a hyper price competitive environment where few FX providers are successfully penetrating the market effectively.”

Wallet share in the UK is also the lowest among all countries covered in the E&P BFX market programs. Overall market wide wallet share has plummeted to less than 25.0 percent in December.

“UK FX providers can gain stronger market share, wallet share and customer satisfaction if they differentiate themselves on more than simple pricing and start to engage their customers through value building methods. Critical opportunities to do just this lie, for example, in the provision of risk management solutions for middle market UK trading businesses.

“One provider doing just this for example is using the creation of resource centres, small business assistance programs, industry solutions and selected other relationship development factors with their customers in order to create higher value relationships.”

Business FX Customer Service Satisfaction Ratings

Average Rating Reported

Source: East & Partners UK Business Foreign Exchange Markets Program

About the East & Partners UK Business Foreign Exchange Markets Program

East & Partners’ UK Business Foreign Exchange (FX) Markets program delivers demand-side assessments of the Micro, SME and Lower Corporate markets of the United Kingdom.

Designed to monitor competitive performance in these high growth but highly competitive markets, E&P’s Business FX Markets Program supplies industry wide performance measures across pivotal benchmarks every six months:

- Spot FX Market: Market Share, Wallet Share, Share of FX Customer Mind

- FX Options Market: Market Share, Wallet Share, Share of FX Customer Mind

- Forward FX Market: Market Share, Wallet Share, Share of FX Customer Mind

- Product Customer Satisfaction Ratings

- FX Customer Service Satisfaction

For more information on East & Partners’ UK Business FX Markets program, please contact:

Sian Dowling

Head Client Services

East & Partners

t: +61 2 9004 7848

m: +61 420 583 553

e: sian.d@eastandpartners.com

For media enquiries, please contact:

Jennifer Rondolo

Marketing & Communications

East & Partners

t: +61 2 9004 7848

m: +61 411 395 157

e: jennifer.r@eastandpartners.com

Subscribe

Subscribe