Global East Analyst Meeting Insights - March 2024

(15 March 2024 – Global) East & Partners analyst meeting summary provides a unique insight into emerging research, analysis and client thought leadership trends based on the "voice of treasurer" for 2024 and beyond.

As fieldwork ramps up in several markets for upcoming Global Insight Report, Trade & Supply Chain Finance, Asset Finance, Cash & Payments and Business FX services, several valuable areas for further exploration and research are emerging based on feedback from the “sell side” (East’s financial services clients) coupled with the “buy side” (CFOs/corporate treasurers/business owners directly interviewed as part of East’s perpetual global research and advisory services).

Exclusive New Commercial Cash & Payments Analysis

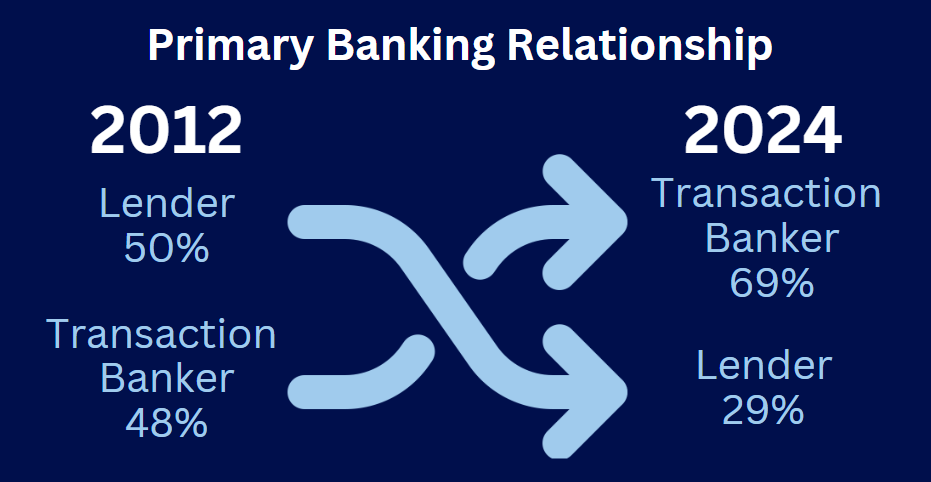

The Transaction Bank retains its place as the “home” bank for 69 percent of Australian commercial enterprises according to newly released East & Partners research.

Representing core infrastructure needs and the most regular touch points for businesses, getting the transaction bank offering right has never been more important.

How important are other factors which determine a treasurer’s perception of their core banking relationship primarily as a cash management and payments based as opposed to lending? Other key factors cited by middle market enterprises include

- Improved liquidity management/cash visibility

- Relationship strength

- Cost efficiencies achievable

- Integration strength

- Regulatory/compliance support

- Positive economic sentiment/expanding bank panel

- Biggest area of innovation, e.g. Payments

For banks focused on their lending business, supporting clients in managing their high interest rate exposure is key while other drivers include

- Managing working capital/cash flow needs

- Negative economic sentiment/consolidating bank panel

- Managing high debt ratios

- Unable to access appropriate debt funding

- Significant credit lines expiring/renewing in the short term

“How are banks leading engagement with clients and the broader market? Are they struggling to effectively differentiate solutions and stand out in a crowded market?”

East & Partners’ newly released February 2024 Australia Cash & Payments service places the customer voice firmly at the centre of your market messaging, value proposition, product development and competitive differentiation.

New Global Insight Report – April Release

While there is a strong focus on the evolving role of the CFO in terms of their core function increasingly incorporating elements of technology and traditionally CIO linked tasks, how much decision making heft does the corporate treasurer carry now and more importantly into the future?

East & Partners latest Global Insight report, based on direct interviews with the Top 100 revenue ranked corporates in each of eight countries, provides a valuable “playbook” for selling effectively to treasurers that are being given more latitude and responsibility in their day-to-day operations.

This fascinating piece of analysis has generated significant interest and attention throughout fieldwork set to conclude in the coming weeks.

Home Bank Effectiveness Matrix

What proportion of Forward FX customers also execute Spot FX with their primary transaction bank?

Which bank are primary cash & payments customers thinking of first for products increasing in demand quickly such as cross border payments and international transaction banking?

What difference is there between perceived capability and overall brand awareness and presence in the market?

East’s upcoming research service releases will provide a detailed breakdown of both which banks are securing the core relationship and associated credit and relationship lines the most effectively and why.

Macro Business Banking Outlook

How much of an impact will China’s sharp economic slowdown have on trade finance and corporate banking lending growth?

Is “China Plus One” actually evolving to “Minus China” as India and ASEAN nations tussle for leadership and FTA ratification lead by aggressive moves from the fastest growing major G20 economy – India?

How are incumbent majors responding to rising competition for business deposits, evidenced by strong competition from Macquarie against the Big Four in Australia in particular?

Previous Analyst Meeting Summary

In February 2024, East’s analysts were closely monitoring private credit markets, the evolving role of the RM, embedded finance and multiple research service enhancements.

Subscribe

Subscribe