Global East Analyst Meeting Insights - May 2024

(24 May 2024 – Global) East & Partners global analyst meeting insights provides a valuable insight into emerging business banking research and advisory trends at the crucial intersection where strategic bank planning meets the “voice of the treasurer”.

What mission critical factors are East & Partners analysts, financial services clients and Corporate Treasurer research base focusing on for H2 2024 and beyond?

Running the Magnifying Glass Over Bullish Business Lending Growth

The Big Four collectively predicted in recent half year/quarterly earnings results exceptionally strong business credit demand that is only set to surge higher over the next six months. Importantly the question must be asked, how broad based is business lending growth at a time of rising insolvencies and cost of living pressures biting hard on balance sheets across the country?

East & Partners demand side analysis overlaid on APRA’s Monthly Banking Statistics for the Deposit Funding and Debt Index service reveals a deeper level of insights into deposit and lending growth by segment, with enhanced analysis set to expand on this valuable lens through the addition of state, sector and international trade profile breakdowns across Big Four, non-Big Four and international banks.

How much are SMEs borrowing from banks relative to deposits compared to large corporates? And is this trend forecast to continue higher or lose momentum?

Manufacturing and energy sector verticals in particular are in the box seat to benefit directly from elevated fiscal support despite criticism from the Reserve Bank of Australia (RBA) that rising government stimulus measures are thwarting efforts to stifle stubbornly high inflation. Economists continue to warn that strong business investment could push up prices for labour and equipment in the near term.

ANZ reported the largest loan growth ever in its commercial division, up seven percent year-on-year. “Business credit growth has run seven percent higher year-on-year, the fastest growth in recent memory” commented ANZ CEO Shayne Elliott. “If you asked me six months ago, as the previous head of the business and private bank, if I would have printed nearly nine percent business credit growth, I would have said there is no chance” stated NAB CEO Andrew Irvine after the bank delivered H1 business credit growth of nine percent.

CBA reported business lending increased by A$2.7 billion in Q1 2024, outpacing the average of Big Four rivals and more than in home loans. “The strong job market is driving robust demand for corporate loans. We are seeing continuing resilience. Demand for business credit has remained robust, and we see that strength as a positive” stated CommBank CEO Matt Comyn.

NAB reported eight percent annual business lending growth. “The level of activity in business banking is astonishing and surprising on the upside. It is proof that the economy is actually holding up much better than the doom and gloom in the media might have you believe” commented newly appointed NAB CEO Andrew Irvine.

“There is a real appetite to grow businesses, and owners are looking to get financing to grow their business. It is quite broad-based across agribusiness; property, particularly property development; professional services and healthcare, that is where there is a really positive pipeline” commented Westpac Executive Anthony Miller.

“The market for business lending is no more or less competitive than it ever has been even as all big four lenders fight harder for business borrowers. Westpac is not focused on outgrowing our peers but growth with specific customers we want as customers. I don’t fall into the idea that growth must be relative to system. SMEs are thinking about long-term investments in their business and will not baulk at gearing up if interest rates remain high for longer. Notwithstanding the noise and uncertainty we might see in the next 12 months, they are clear about their longer-term plans” Miller added.

Global Business FX Market Comparisons

As American Express exits international FX, are non-bank providers such as OFX, Convera, World First, Monex and Wise stepping into the sizeable gap left behind or are banks winning back importers and exporters valuable business?

East’s latest Global Business FX analysis across Australia, New Zealand, Hong Kong, Singapore, France, United Kingdom, Canada and the United States provides a timely finger on the pulse of evolving customer behaviour at a time when declining wallet share appears to be turning a corner.

What FX providers provide best practice examples of how to retain more turnover per primary customer for Spot FX, FX Options and Forward FX?

Selling Banks to the Corporate Treasurer - New Global Insight Report Release

East & Partners' latest Global Insights Report, "Selling Banks to the Corporate Treasurer," uncovers a significant shift in transaction banking dynamics based on direct interviews with the Top 100 revenue ranked corporates in each of eight countries (N = 755) including Australia, Canada, China, Germany, Hong Kong, Singapore, United Kingdom and the USA.

The research emphasises the escalating role of corporate treasurers, who are stepping up to take the helm of decision-making responsibilities traditionally held by CFOs. The study reveals that corporate treasurers are not just ensuring operational resilience and adjusting the company's balance sheet to fund growth but are also keeping in step with developments in environmental, social, and governance matters, as well as new business investment priorities like artificial intelligence.

The readiness to switch banking provider varies significantly by region. The research found large corporates based in Hong Kong (81 percent) and Australia (78 percent) much more willing to move their business to a new transaction bank relative to Singapore corporates (62 percent). Similarly, US corporates are more willing to jump ship than their Canadian counterparts at 78 percent and 55 percent, respectively. While British treasurers are clearly standing on a “burning platform”, ready to transfer almost the entirety (90 percent) of their transaction banking wallet to a new provider compared to relatively content German corporates that display a significantly lower interest in banking away from their current provider (45 percent).

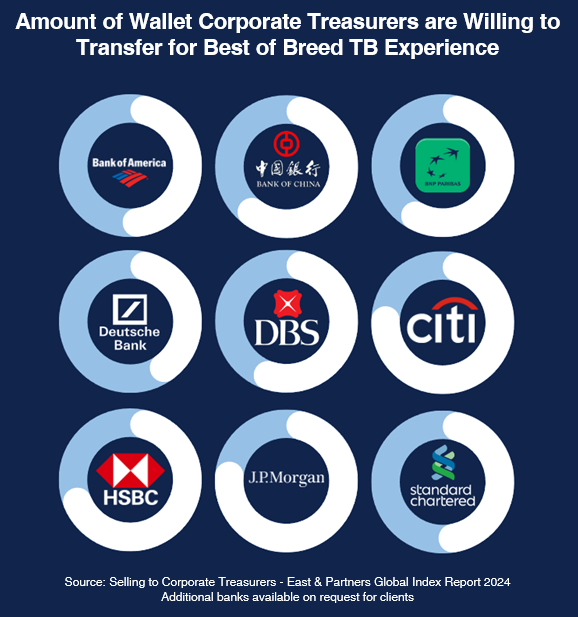

A key early gauge of customer churn is the percentage of transaction banking wallet that treasurers are willing to shift to a new provider for a best of breed experience. JPMorgan, Citi and HSBC clients are prepared to switch three quarters of their business to a new provider that makes a compelling proposition to them and can then actually deliver on that proposition. Conversely, Deutsche (44 percent), Standard Chartered (51 percent) and BofA (52 percent) clients are the most hesitant to relinquish transaction banking business to a new provider, reflecting a stronger customer retention imperative by these banks. Winning transaction banking business away from DB, SCB and BofA is infinitely more difficult than JPMorgan, Citi and HSBC who are clearly “stretched thin”.

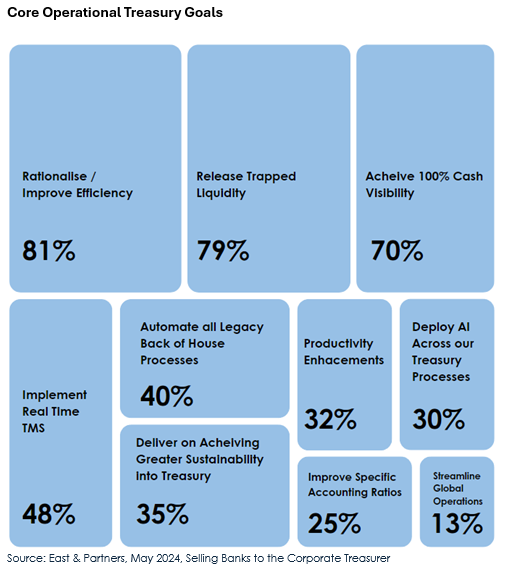

East & Partners’ Global Head of Market Analysis, Martin Smith emphasised “It always helps to align solutions with key goals and deliverables that the Corporate Treasurer has been tasked with. With this in mind, advice and offerings that work to rationalise and improve supply chain efficiencies, release trapped liquidity and achieve 100 percent cash visibility will go a long way in engaging and providing value on areas close to a corporate treasurers’ heart.”

Corporate Treasurers, emerging as the new overall owner of the banking relationships, are willing to transition a staggering 69 percent on average of their transaction banking wallet to new providers for a top-tier experience.

East & Partners’ Global Head of Market Analysis, Martin Smith, emphasised, “When a Top 100 corporate looks to make a move from their incumbent, the percent of their wallet moving lies within a tight band when looked at either by market or incumbent primary bank.”

Contact East & Partners to access the full report.

Previous Analyst Meeting Summary

In April 2024, East’s analysts were exploring exclusive new corporate decision-making behaviour based on China’s economic slowdown, RMB depreciation impacts and East’s upcoming Global Insight Report Selling Banks Effectively to the Corporate Treasurer building on popular Onboarding and RFP focused releases.

Subscribe

Subscribe