Impact of FTAs clear as mud for Aussie businesses

(3 November 2015 – Australia) One in two small businesses are unsure how newly ratified Free Trade Agreements (FTAs) will impact their international growth prospects, East & Partners (E&P) trade finance research shows.

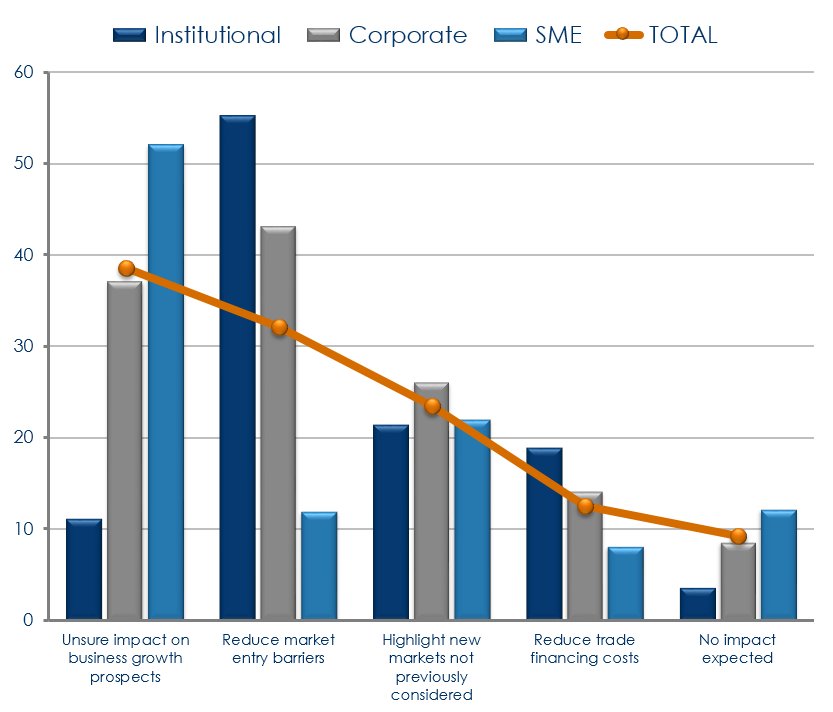

Of 1,862 importers and exporters interviewed biannually for E&P’s Trade Finance program, 39 percent are not fully aware how bilateral free trade agreements will benefit their business.“Small business owners arguably have the most to gain from reduced trading barriers brought about by the Trans-Pacific Partnership, ChAFTA and even a purported FTA with the European Union,” said Martin Smith, E&P Head of Markets Analysis.

“Despite the federal government’s A$10 million push to promote the benefits of FTAs signed with China, Japan and Korea, the great majority of SMEs are unaware how they can harness the benefits or indeed what the benefits specifically are.”

“The results indicate that for every Australian business that agrees FTAs will highlight new market opportunities, a further two do not know if they will be better or worse off,” he said.

Only 11 percent of Australia’s top 500 businesses are unsure how FTAs will affect them. This figure jumps to 52 percent for SMEs.

Fifty-five percent of the institutional segment acknowledge ‘freer trade’ will reduce tariffs and offshore market entry barriers. In contrast only 12 percent of SMEs share their sentiment.

“Relatively well capitalised and experienced institutional enterprises exhibit a strong understanding of the benefits associated with FTAs and are well prepared to take advantage,” said Smith.

While China remains a key focus for over half of importers and exporters, India’s importance as a trade destination is growing at the fastest rate.

To successfully penetrate new markets, CFOs are increasingly searching for a trade finance provider that offers innovative supply chain management initiatives and greater liquidity support.

Competition between trade finance providers has reached fever pitch in the last year, headed by market share leaders ANZ and HSBC. CBA, Citi and Westpac have also achieved strong market share growth in key sectors and across multiple segments.

Customer churn, both current and forecasted, has climbed steeply in conjunction with a sharp rise in competitive pitching, reaching their highest levels since the inaugural February 2004 round of the E&P trade finance program.

The proportion of institutional enterprises that reported they were likely to change their primary trade finance provider has almost doubled to 32 percent since February 2012, accelerating rapidly as pricing competitiveness and digital e-Trade solutions continue to reshape the market. Middle market churn intentions remained steady at 34 percent, while one in four SMEs are considering switching banks, reflecting higher wallet share and a lower willingness to ‘multibank’.

“Interestingly twice as many large corporates expect their trade finance costs to fall as a result of bilateral free trade agreements in comparison to small businesses. Despite higher volumes, revenues will remain under pressure as long as importers and exporters remain less price sensitive,” Smith said.

“There is a clear incentive for Australian, international and non-bank trade finance providers to explicitly communicate and support FTA benefits, address key service factors and implement effective eTrade solutions.”

Free Trade Agreements Impact on International Growth Aspirations

% of Total

Source: E&P Trade Finance Program – August 2015

About the East & Partners Trade Finance Program

East & Partners Trade Finance Markets program is the only comprehensive research program providing data and insights across Institutional, Corporate and SME business segments.

Trade Finance presents an increasingly competitive and important product area. Satisfied trade finance customers are traditionally more loyal to their banking relationships, and trade is often the cornerstone of cross sell for a range of other products across transaction and corporate banking. Strong trade finance relationships underpin wallet share development and product penetration across the full suite of business banking products.

Released in February and August each year since 2004, survey results are generated from direct interviews with a national, structured sample of +/-1,850 exporters and importers presenting Bank Market Share, Competitive Positioning, Wallet Share, Mind Share, Market Drivers and Futures, Customer Satisfaction and Service Factor Importance.

Business Segments:

› Institutional – A$725 million plus

› Corporate – A$20-725 million

› SME – A$5-20 million

For more information or for further interview based insights from East & Partners, please contact:

Media RelationsNehad Kenaniet: 02 9004 7848 m: 0402 271 142 e: nehad.k@eastandpartners.com |

Client Services and DevelopmentSian Dowlingt: 02 9004 7848 m: 0420 583 553 e: sian.d@eastandpartners.com |

|

|

www.eastandpartners.com |

|||

Subscribe

Subscribe