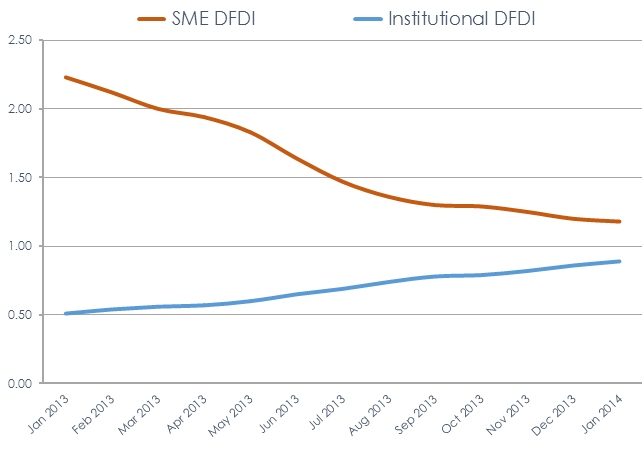

Inverse momentum for Institutional businesses and SMEs

(24 March 2014 – Australia) Australia’s largest institutional businesses could soon deposit more than they borrow from the banking system while small and medium sized enterprises (SMEs) could soon borrow more than they save.

These are the ongoing trends in East & Partners Deposit Funding & Debt Index research, a monthly look at deposits and lending in the banking system based on data from the Australian Prudential Regulatory Authority (APRA).

East’s DFDI research creates a ratio based on deposits and lending. A DFDI ratio of over 1 indicates higher deposits relative to borrowings, while a ratio of less than one denotes higher borrowings. The one year trend has been for the DFDI ratio for the largest institutional businesses – those with more than $725 million a year in annual revenues – to go higher as the segment deleverages.

While the institutional DFDI was at 0.57 in April 2013, it had risen to 0.89 in the most recent February 2014 research round. This means that for every $1 the institutional segment has in deposits, it has 89 cents in borrowings from the bank system.

In contrast, the DFDI ratio for the SME segment – of businesses with annual revenues of $5-25 million – has gone from 1.94 in April 2013 to 1.18 in January 2014. Where SME businesses had $1.94 in deposits for every $1 borrowed in April that has now fallen to $1.18.

If these trends continue, the Institutional DFDI could move higher than 1 in the first half of this year, while the SME ratio could fall below 1. This would represent a significant event in deposit and lending trends as Institutions would – for the first time since East’s DFDI program began in July 2010 – become net depositors. SME’s would become net borrowers – also for the first time.

Lachlan Colquhoun, Head of Market’s Analysis, said the firm had been watching the trend lines closely over the last year.

“We’ve seen for some time that larger businesses have been deleveraging as smaller ones releverage,” said Colquhoun.

“These DFDI ratios are also corroborated by data from our other programs on credit demand, which show a clear change in sentiment between the segments. It shows that that the business segments are travelling at different speeds and have varying dynamics, all of which is adding to business and economic uncertainty.”

Business Deposits / Business Loans

Source: East & Partners Deposit Funding & Debt Index

About the East & Partners Deposit Funding & Debt Index

East & Partners monthly Deposit Funding and Debt Index (DFDI) provides insightful research supporting the implementation of bank funding strategies within a constrained and competitive lending market. The industry benchmarks are based on monthly deposit and lending data released by the Australian Prudential Regulation Authority (ARPA). Capturing trending data across core deposit funding and lending metrics allows unique insights to be derived, including business to retail deposit volume ratios, deposit and lending market share, rate triggers for deposit switching, deposit churn levels and tenure of term deposits.

Business Depositor Segments:

Institutional – A$725 million plus

Corporate – A$20-725 million

SME – A$5-20 million

Micro – A$1-5 million

For more information or for further interview based insights from East & Partners on this DFDI, please contact:

Sian Dowling

Marcomms & Client Services

East & Partners

t: 02 9004 7848

m: 0420 583 553

e: sian.d@eastandpartners.com

Subscribe

Subscribe